During a recession, financial planners will tell you to invest above the inflation rate. But what does that mean?

According to the International Monetary Fund (IMF), inflation is the “rate of increase in prices over a given period of time.” This estimation includes broad measurements such as the cost of living in a country, but it also calculates more specific goods such as food, or services, such as a haircut.

In layman’s terms, a person’s buying power becomes less with the same amount of money. Say a bowl of Nasi Lemak costs you RM5 in 2005; that same piece of Nasi Lemak, a famous Malaysian dish—the exact same serving and ingredients—will cost you RM10 in 2020 or even double the original price, despite, in essence, offering the same value.

Rising inflation across countries

In Malaysia, inflation jumped 4.4% to 127.9 in July 2022, the highest in more than a year, following the rising cost of food, according to The Star. The increase in the consumer price index (CPI) was the highest since April 2021.

The same sentiment can be seen across the pond. In Singapore, the key consumer price gauge rose in July at its fastest pace in more than 13 years, mainly driven by higher inflation for food, electricity, and gas, official data according to CNBC. The core inflation rate— Singapore’s central bank’s favoured price measure—rose to 4.8% in July this year on a year-on-year basis.

Both increases in Malaysia and Singapore were in line with the median forecast in a Reuters poll of economists. In the United States, inflation has accelerated at its fastest pace in about 13 years as the country’s economic recovery continues to gain steam, its Labor Department said. Year over year, prices increased 5.3%.

So if you’ve noticed a spike in prices for simple purchases like a cup of coffee, don’t be too surprised. It’s the result of rising inflation.

Related: Top 4 Money Mistakes to Avoid in a Bear Market

Why is inflation problematic?

To a degree, inflation is good. According to Investopedia, inflation is useful when the economy is not running at capacity, and there’s unused labour or resources. Here inflation helps increase production. Inflation also helps debtors repay loans with money that is less valuable than the money they borrowed.

However, it’s clear that inflation clearly cuts through the value of your money, rendering it less valuable than what it was before, and persistently high inflation could affect the standards of living of a country.

One could argue against this if people are also getting salary increases that are in line with or higher than inflation because, in theory, if someone’s income grows faster than prices, their standard of living improves.

But unfortunately, salary hikes are not standardised across sectors, or rarely do they get adjusted to factor in inflation; even if it does, they may also be lesser than the rate of inflation. This also doesn’t factor in seniors workers or those living on fixed or static income like those living on minimum wage.

Can governments stop inflation?

Unfortunately, there is no real wage to stop inflation. Sure, the government can increase interest rates to manage it, but stopping it isn’t likely. So the best thing one can do to manage inflation is to understand the effects of inflation, so he or she can better strategise and manage their finances for the long-term. After all, a little loss in the short-term is okay to compensate for longer wins.

You are not powerless against the effects of inflation. But to understand how it affects your purchasing power, you need to have a better grasp of your own finances, your expenses, and your income so you can start building effective strategies to protect your finances.

Related: Guide 2022: Planning for your retirement in Malaysia

How to prepare for inflation?

1. Start investing if you haven’t already

The best way to hedge against inflation is to invest your money. Of course, this also depends heavily on the type of investment you choose.

For example, putting your money into fixed deposits may no longer be as competitive, as the rates are now usually below the rate of inflation (2.50% was the highest we found when searching for Islamic FDs in Malaysia).

But parking your money in a mixed portfolio of high-risk and conservative assets (like stocks and bonds) may see a different growth that will allow you to grow your personal worth more quickly than if your money was sitting idly in a savings account.

Related: How to Earn Halal Money? The Money Mindset

Investment options on Ethis Group

If you have more cash to spare, such as a minimum of SG$10,000, you could consider investing in deals on Ethis Indonesia. A recent campaign, Hafizh PP, has an ROI of 7%.

Be sure to check out the latest financial news and trends to know where to look for smart investments. And if you haven’t started, it’s better to start earlier so that you can have a longer time horizon (aka: duration to invest) to benefit from investing because the returns compound over time. If you are looking to invest in highly profitable long-term investments, you may want to check out the deals on Ethis Malaysia, an equity crowdfunding platform that caters to long-term, highly profitable businesses.

Other investments like gold and bitcoin and real estate investments are also seen as inflation hedge investments because the value of these assets is expected to maintain or increase over a period of time. For example, traditionally, real estate is a great hedge because, almost always, the value will appreciate, and there is room to earn additional income if you rent out your own place.

If you have already started investing, consider diversifying your investments to protect them from market crashes during a bear market.

Related: 9 Tips On How To Protect Your Investments During A Recession

2. Look for fixed rates

Time is your biggest enemy when dealing with inflation because, with time, the value of your money decreases while general prices of services and products increase, so expect regular fees like your car loan and mortgage to be affected too.

If you need to pick up a loan, make sure you choose loans with fixed interest rates to manage your regular payments.

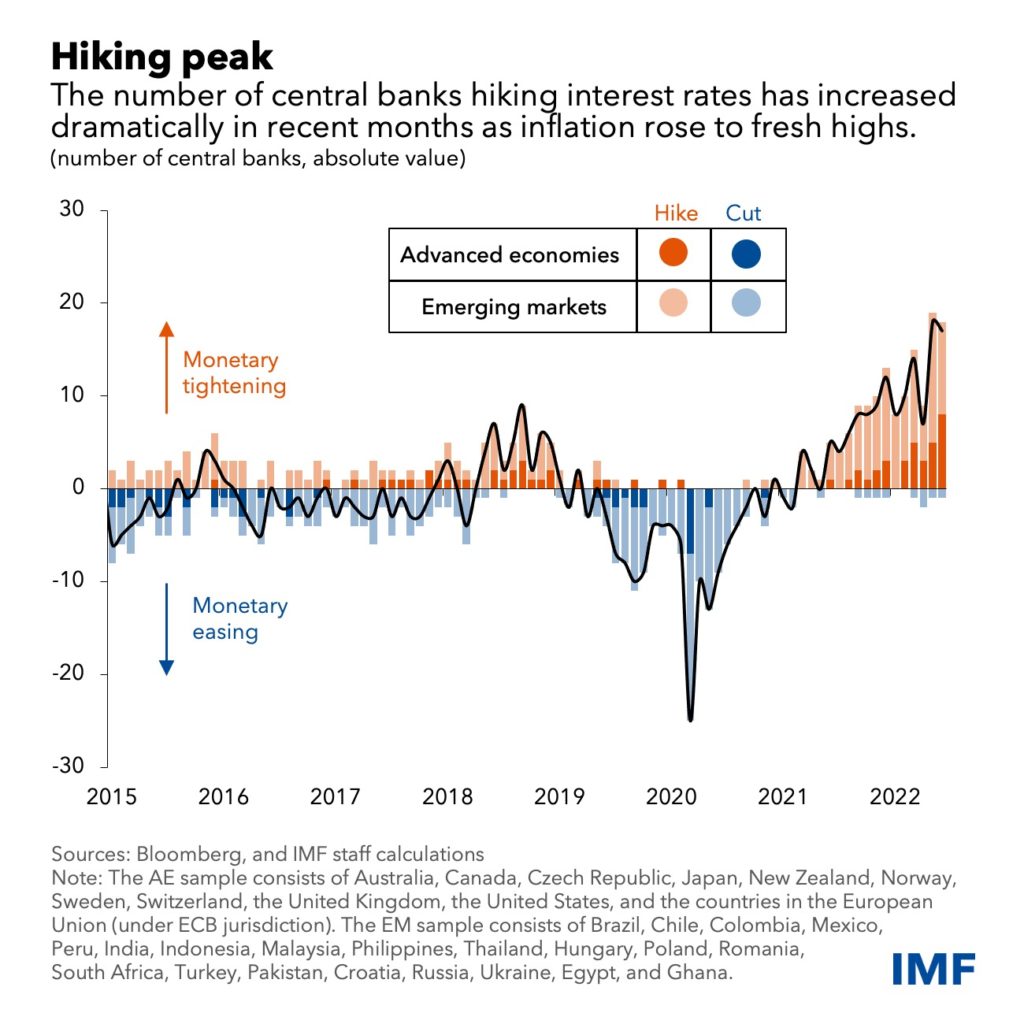

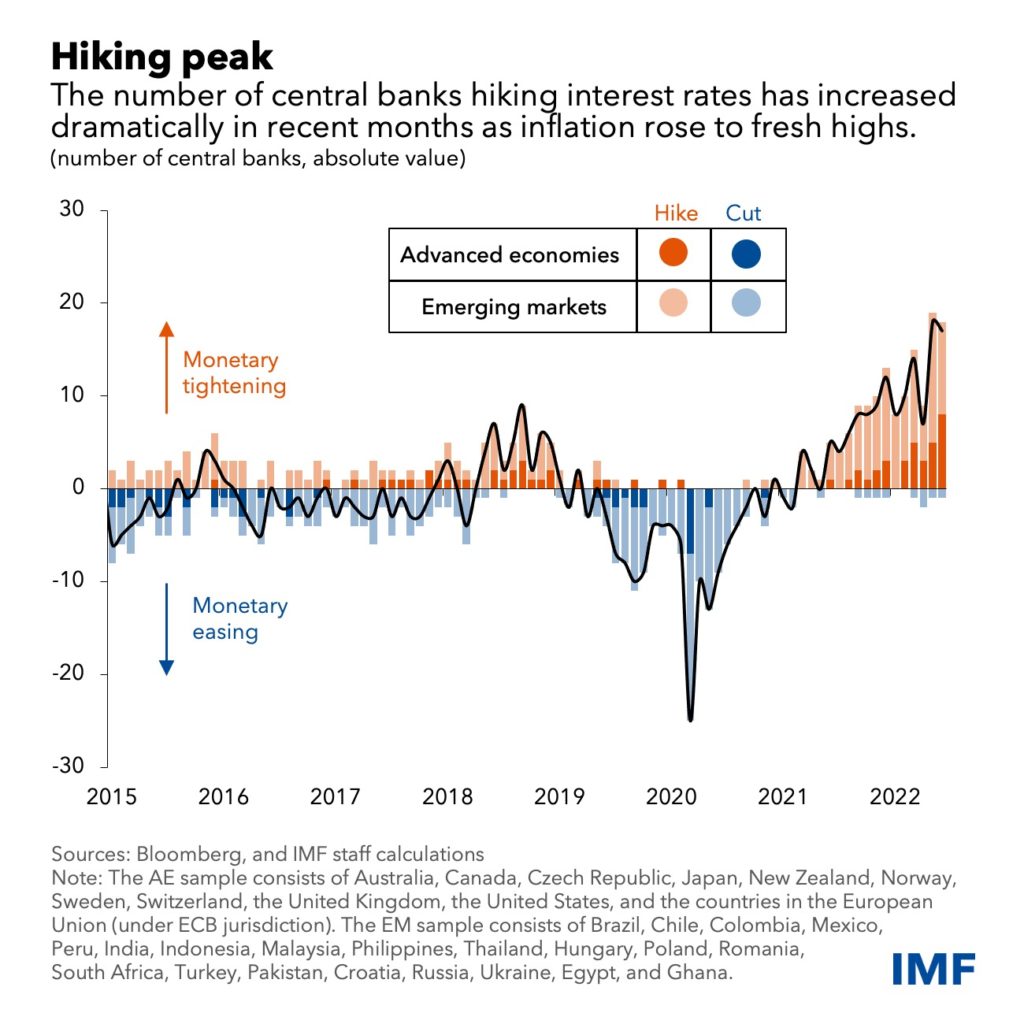

To tame inflation, central banks in many emerging markets proactively started to hike rates (like OPR in Malaysia) earlier last year, followed by their counterparts in advanced economies in the final months of 2021, according to International Monetary Fund.

In the United States, the Federal Reserve System maintains low inflation and unemployment rates by controlling interest rates, or the federal funds rate. By adjusting the rates, banks, and consequently consumers and businesses, find it harder and more expensive to borrow money. Higher interest rates mean it’s more expensive for consumers to buy big-ticket items.

Related: 4 Reasons Why You Should Start Investing

3. Postpone big-ticket purchases and live thriftily

Though beating inflation, price hikes may be temporary, and, in some cases, some items may not see such price hikes. Sometimes it may be worth holding out on some items until their prices start slipping in the future, especially if demand cools off.

In addition, it’s good to stay away from high-ticket items until the prices stabilise at least. This will protect you from relying on credit cards or other high-interest debt.

Another solution is to simply minimise your spending. Not saying you should go full-on frugal, but keeping frivolous spending to a minimum, at least until next year.

Other ways to be more thrifty are to save on gas by carpooling, taking public transport, or working from home. Be on the lookout for discounts, coupons, and other rewards programs, to maximise your returns from existing purchases.

Verdict: No stopping inflation, but you can manage it better

The cold hard truth is that there’s no stopping inflation. It’s on the rise and will only continue rising from here on. But, the good news is you can learn to protect them your cash and reserves against the rise of inflation.

Most importantly is understanding how to manage your finances and ensuring you constantly up your financial literacy game to ensure you are well equipped to know the dos and dont’s during a bear market.

For more useful financial tips, keep exploring our blog for all kinds of timely money-saving and investing articles.

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You