How does a Muslim go about balancing their deen (religion) and the dunya (worldly) matters from a financial perspective? Here are six tips on how to approach halal money matters as a Muslim.

Get rich or die trying? Nah.

While a big house and fancy cars are nice to have—and there’s nothing wrong with having nice things—material abundance should not be one’s ultimate goal.

As Muslims, we all know that Allah ﺳﺒﺤﺎﻧﻪ ﻭ ﺗﻌﺎﻟﻰ put us on this earth to worship Him. Therefore, its Muslim aim in life should not be limited to working to death in pursuit of a higher status and a bigger net worth. After all, this life is only temporary.

The fact remains, however, that one does need to pursue a halal income to provide for oneself and one’s family. Allah ﺳﺒﺤﺎﻧﻪ ﻭ ﺗﻌﺎﻟﻰ is ar-Razzaq, the Provider, but we still need to do our part as the bills aren’t going to pay themselves, and food won’t magically appear on our tables.

There’s no money or wealth like halal money and wealth

For starters, we should only pursue income strictly from halal means. Be wary of engaging in jobs or businesses that sell haram products, such as alcohol or interest-based securities.

It is also pertinent that you, as a Muslim, ensure the transparency and fairness of all your dealings; never cheat or defraud anyone (Muslim or not) for the sake of selfish or short-term gains. There is indeed no barakah in haram earnings.

In addition, extra income should always be put to productive use, as hoarding is frowned upon in Islam. Don’t be a miser or get too attached to money and worldly possessions. Plus, as you know, keeping money under your mattress or in the bank will only be detrimental as it will lose value over time thanks to inflation. Inflation refers to the ever-increasing cost of living, which results in the loss of value of money.

What are some examples of halal investments to produce halal money?

One way to avoid the peril of inflation is by investing to earn a profit to counter this inflationary loss. Thankfully, in many countries today, there are Islamic finance institutions and products for you to invest in.

Furthermore, the advancement of fintech has brought forth new online platforms and services that allow investors from almost anywhere in the world to invest.

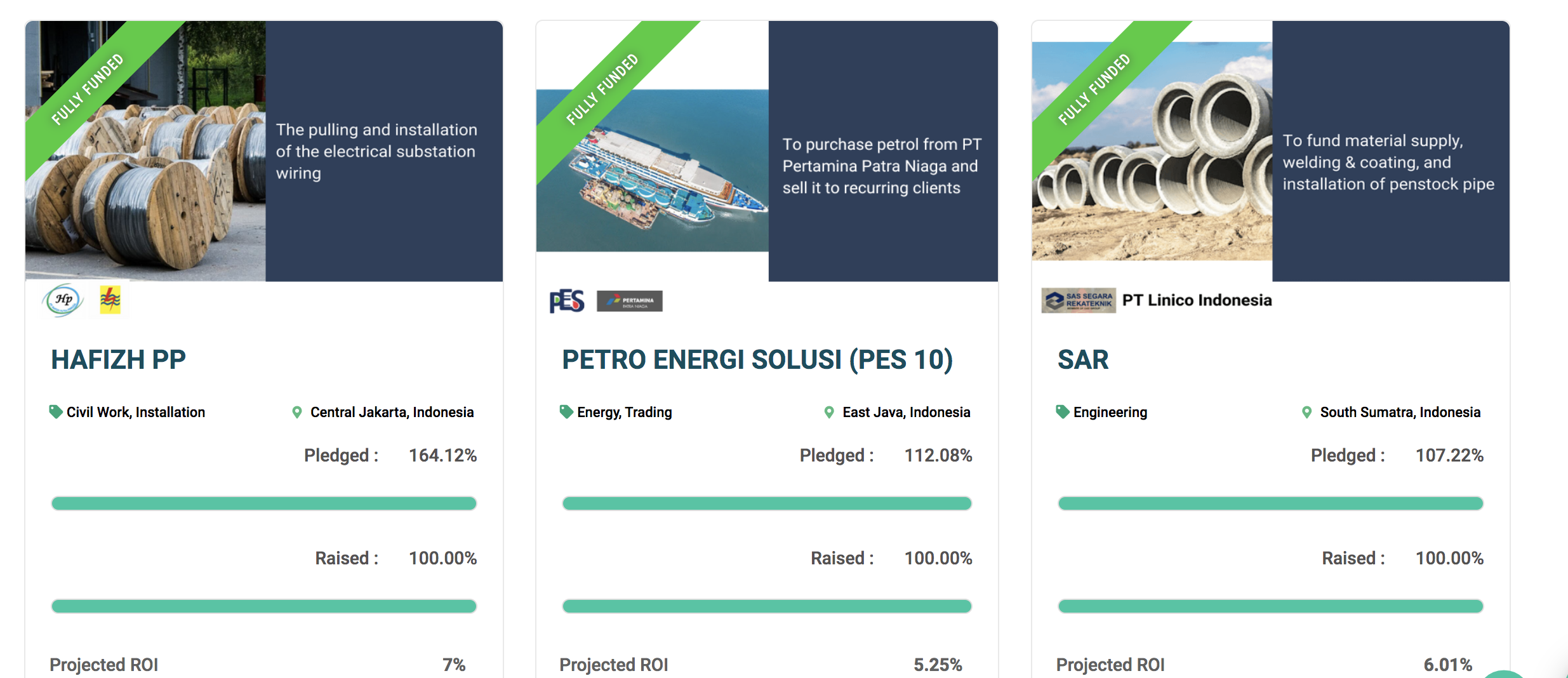

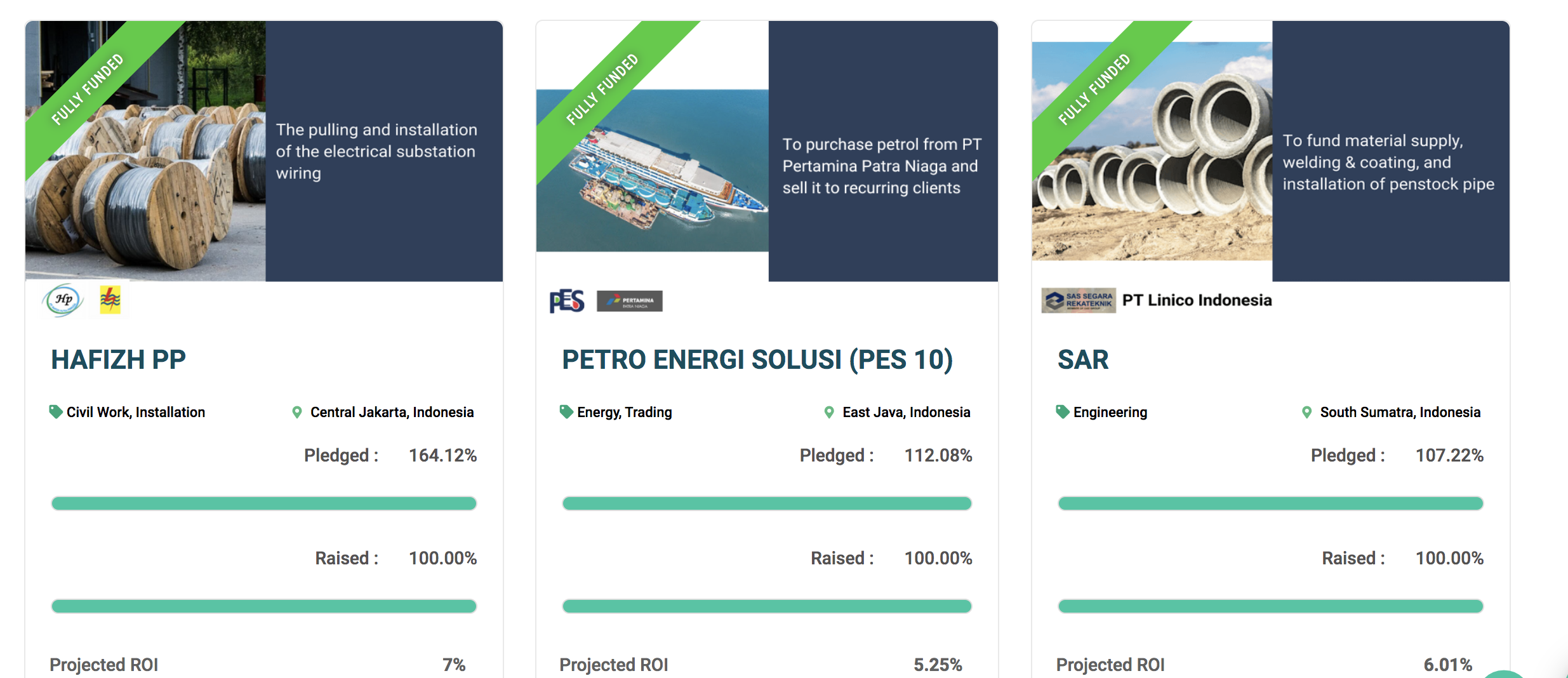

Islamic investment through crowdfunding is one such platform and service that is fast gaining in popularity, especially so for investment crowdfunding where you can either invest in a company or a project.

One example is Ethis, which through its P2P platform, allows investors to dip their hand into impact-driven halal investments in the supply chain industry, among other projects. Crowdfunding breaks the wealth barrier by allowing a group of investors to come together online to each contribute different amounts to the campaign. Ethis has facilitated investors from more than 84 countries to invest directly in projects in Indonesia to share in the profits of local projects.

Another prominent platform is Yielders from the UK, which focuses on buying rent-yielding properties in the UK. In 2014, such investment would only be for the rich, and now it’s open and accessible to even small or first-time investors.

There is even a robo-advisor called Wahed that will identify permissible stocks, and a personalised service called Sharia Portfolio in which a professional will help you build a portfolio of investments based on time horizon, risk tolerance, etc.

Conventional banking products—such as savings accounts, certificates of deposit (CDs), and money market accounts—are interest-based and should be avoided. But you could open an Islamic savings account. Corporate and Treasury bonds are also interest-based, although there is something called sukuk that is essentially the Islamic version of a bond.

The return on investment for sukuk is not very high, but this is a less volatile investment option for those who want a relatively safe place to save money while also enjoying some gain.

Swap the haram for the halal—clean house starting right now

If you happen to have money invested in impermissible investments such as bonds or CDs, or stocks in companies that sell haram products, then the best course of action is to dispose of those investments and give the earnings away as sadaqah.

However, if doing so results in losses that may be a heavy burden for you or your family, some scholars have opined that it is sufficient to make a clear intention to dispose of these haram investments as soon as it is more practical or less punitive to do so.

If you have credit card debt, which tends to have exorbitant interest rates, it’s best to adjust your budget to make it your top priority and pay it off as quickly as possible. Then make the intention to avoid credit card debt in the future.

We can also take this one step further and consider mortgages, as well. Since conventional mortgages are based on making principal with interest payments for many years, they are not Islamically permissible due to the prohibition on riba.

Again, if disposing of your property is a difficult option, then make the intention to clear this debt as soon as possible. It is also possible to refinance a mortgage with an Islamic home financing company like Guidance Residential or UIF Corporation. First-time homebuyers should be prudent and avoid buying more expensive properties to live in.

On building halal money, focus on the end goal—keep your eyes on the prize

While tracking finances is about as fun as watching rice cook, it’s necessary to track one’s income and expenses. Otherwise, more money may be going out than coming in.

There are many tools and apps that make this task relatively easy. One such app is Kestrl, a money management app that allows Muslims to budget, save and invest in line with their values.

It helps you to aim and think of your long-term goals. Instant gratification is fun for a while, but the novelty soon wears off when you are always broke and buried in bills. There truly is greater satisfaction in striving towards a juicy goal and accomplishing it through hard work and persistence.

Let’s live in moderate—waste not, want not

Have you ever heard the old saying, “We should strive to do everything in moderation,” well the same should also apply to spending habits and material possessions?

While enjoying Allah’s ﺳﺒﺤﺎﻧﻪ ﻭ ﺗﻌﺎﻟﻰ blessings, it’s best to avoid excessiveness. And of course also avoid waste, as it is a form of ingratitude.

Reflect on your blessings; there’s a lot to be thankful for

Take some time every day to reflect on everything you are blessed with. Sure, life may not be perfect and you might be facing some difficulties, but things could always be worse.

Besides, having gratitude can result in gaining even more blessings.

Increase your real wealth by giving back

Lastly, give from what you have been given. This doesn’t have to be just monetary donations; volunteering your time and talents is also a form of sadaqah.

Remember, charity does not decrease one’s wealth.

The important thing is to have a clean heart and good intentions.

This article was first published in January 2019 and has been edited and updated for accuracy and clarity. Edited by Anis Shakirah Mohd Muslimin.

Read more about Islamic P2P Crowdfunding

2 Replies to “How to Earn Halal Money? The Money Mindset”

Hey, Thank you for taking the time to write this. I have to start blogging again soon ugh.

Thank you I have made big halal money

Top Posts

Islamic P2P Crowdfunding Explained

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You

Islamic Crowdfunding Platforms: A Possible Tool for Financial Inclusion