What comes to mind when you think about investing online? Cryptocurrency? Share trading?

You might have heard of Investment Crowdfunding – a smart investment choice?

What about investment in general? What types of investment are available to you, and which ones are the best for your needs?

Savvy investors and the wealthy will always want to explore real estate investing. Investing in solid land is the cliche that many firmly believe is the way to go.

Does this mean that only the rich can invest in real estate?

Let us give you the answer with 3 reasons why Investment Crowdfunding is the smarter choice.

Smart Reason 1: Investment crowdfunding empowers you to make your own decisions

Investment crowdfunding is a booming trend.

Crowdfunding basically allows large or small investors to pool funds for specific projects, campaigns or issuers. Your money is matched directly to the project or company, not through any fund or financial intermediary.

What’s so smart about this then?

- Well, with crowdfunding, you can make your own investment decisions without having to depend on managers and analysts who may not be aligned with your preferences and interest.

- Now you get to invest in what you want and like. Some of you may enjoy the thrill of investing in startups along with its associated risks.

- A number of you may feel the smarter choice is to invest in healthy SMEs.

- I’m sure most of you would also feel that property is a smart and relatively more stable investment.

Smart Reason 2: Crowdfunding allows you to invest small or large amounts

As exciting as it may be to start investing in real-world projects directly, it is smart to exercise some prudence.

Since investment crowdfunding allows small investments, and since there is also typically a continuous stream of new campaigns launched every so often, you can take it slow and start from low.

- If your investment funds are not too high, you can be smart by investing a small amount and diversifying by spreading your investment into multiple campaigns.

- If you have a higher risk appetite, and are confident of the campaign you like, then you can also be smart and go big in one or a few campaigns.

- You can be even smarter by mixing strategies – invest small amounts routinely, and then when you come across the campaign you really like, or if you get a large windfall or bonus, then you can jump in with a larger investment.

Smart Reason 3: Invest in the best property markets

Property crowdfunding is growing rapidly in many countries, especially during period of strong property market growth.

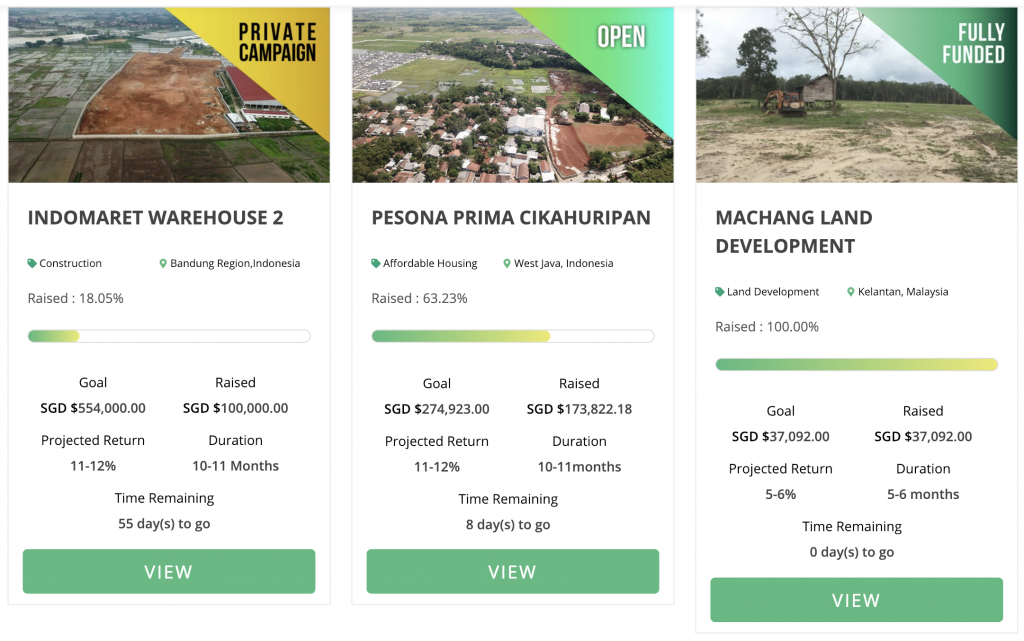

For example, Indonesia’s huge and emerging population and economy has brought about amazing opportunities for property investment, which had been taken up mainly by local investors and large investment funds or conglomerates. (Read on: 7 Reasons Why You Should Invest in Indonesia)

With crowdfunding, you can enter and invest in Indonesia all-online.

Other countries that have solid property crowdfunding platforms include the UK, US, Australia and now even parts of Africa!

Ethiscrowd.com is the smart choice which allows you to profit like a property developer

At EthisCrowd, we’re excited to combine the concept of Investment Crowdfunding with Property Development.

With just a few hundred dollars, you can invest with our crowd in truly unique property developments projects – social housing for low-income families.

From our base in Singapore, we’ve helped investors from more than 30 countries to invest in Indonesia, most of them for the first time.

This is impact investing – making money while doing good. You will also be investing in the most exciting economy in the emerging world!

Our campaigns have brought profits of between 10 to 15% on an annualised calculation.

The best part about property is that there is also asset-backing so you know that even if there are problems on the ground, that the result will be delays, or in the worst case scenario the asset is liquidated and some capital will be recouped for investors. (Read on: How Ethis Manage the Risks involved in Property Investing)

Of course, the beauty of Crowdfunding is that you can invest from almost anywhere in the world, directly into projects from your personal device.

We’re not claiming to give you smart investment advice.

In fact, what we do is the opposite – we match you with credible property developers so you get the information you need to make your own smart investment decision.

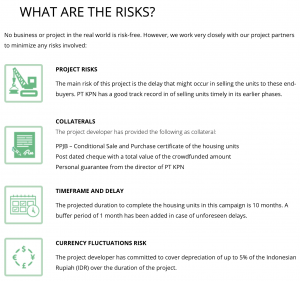

Do note though that for all real-world or ‘alternative’ investments like crowdfunding, there are real risks to your capital.

The important thing is to make sure you invest only what you can afford, and to make sure you understand the risks before you decide to invest.

Once you decide you want to make your first investment, we make it easy for you!

Click here to reach out to us if you want to discuss more

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

Islamic Crowdfunding Platforms: A Possible Tool for Financial Inclusion