Editor’s Note: This post was originally published in Nov 2017 and has been edited and updated for relevancy and comprehensiveness.

Over time, the Islamic financial system has positively evolved and is now regarded as one of the fastest growing segments of the global financial system. Currently, the system offers a comprehensive financial system of its own: ranging from banking, capital market to takaful sectors. As at end 2016, total Islamic banking assets has reached USD 1.8 tln and is projected to surpass USD 3 tln mark by 2020.

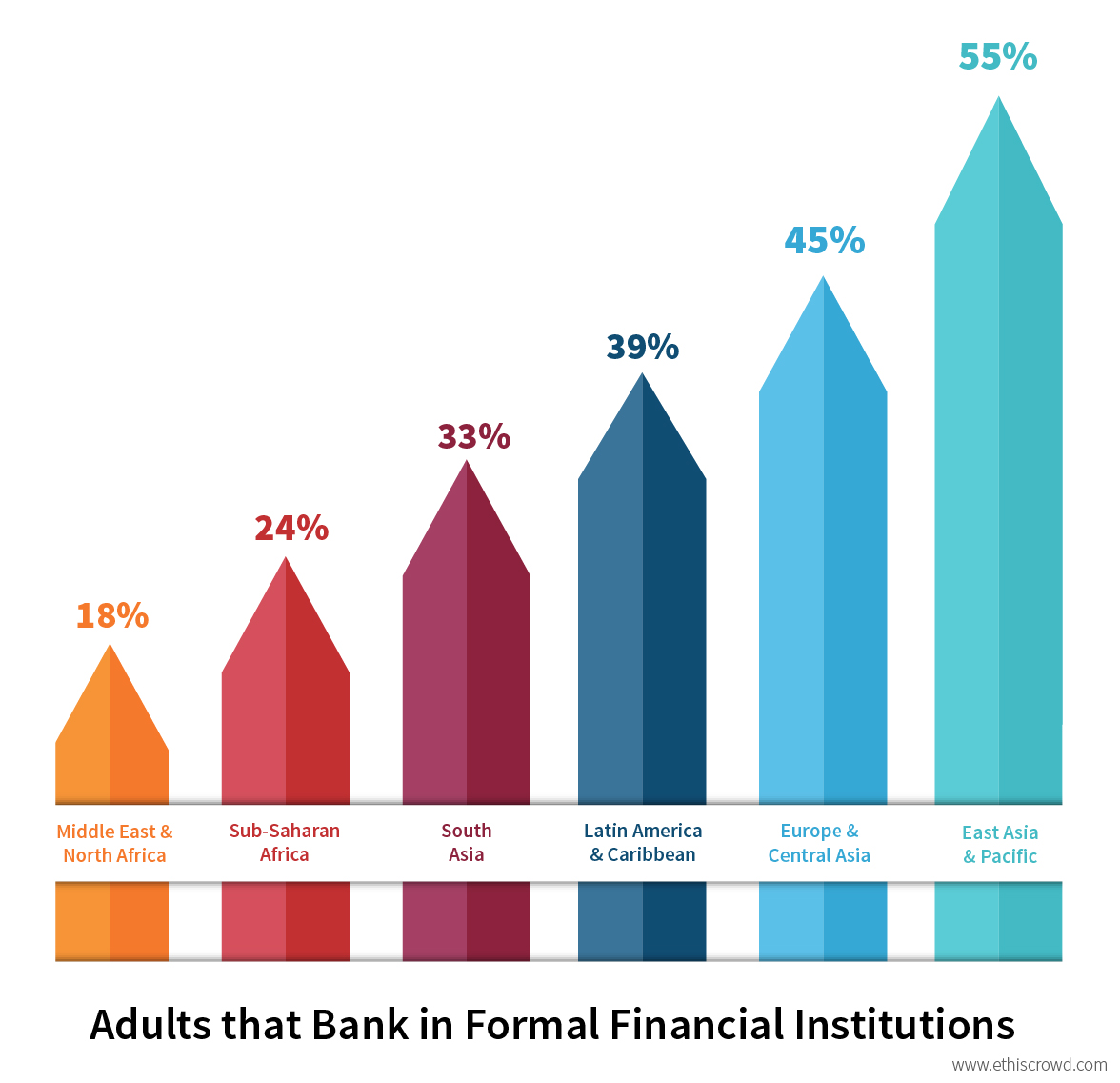

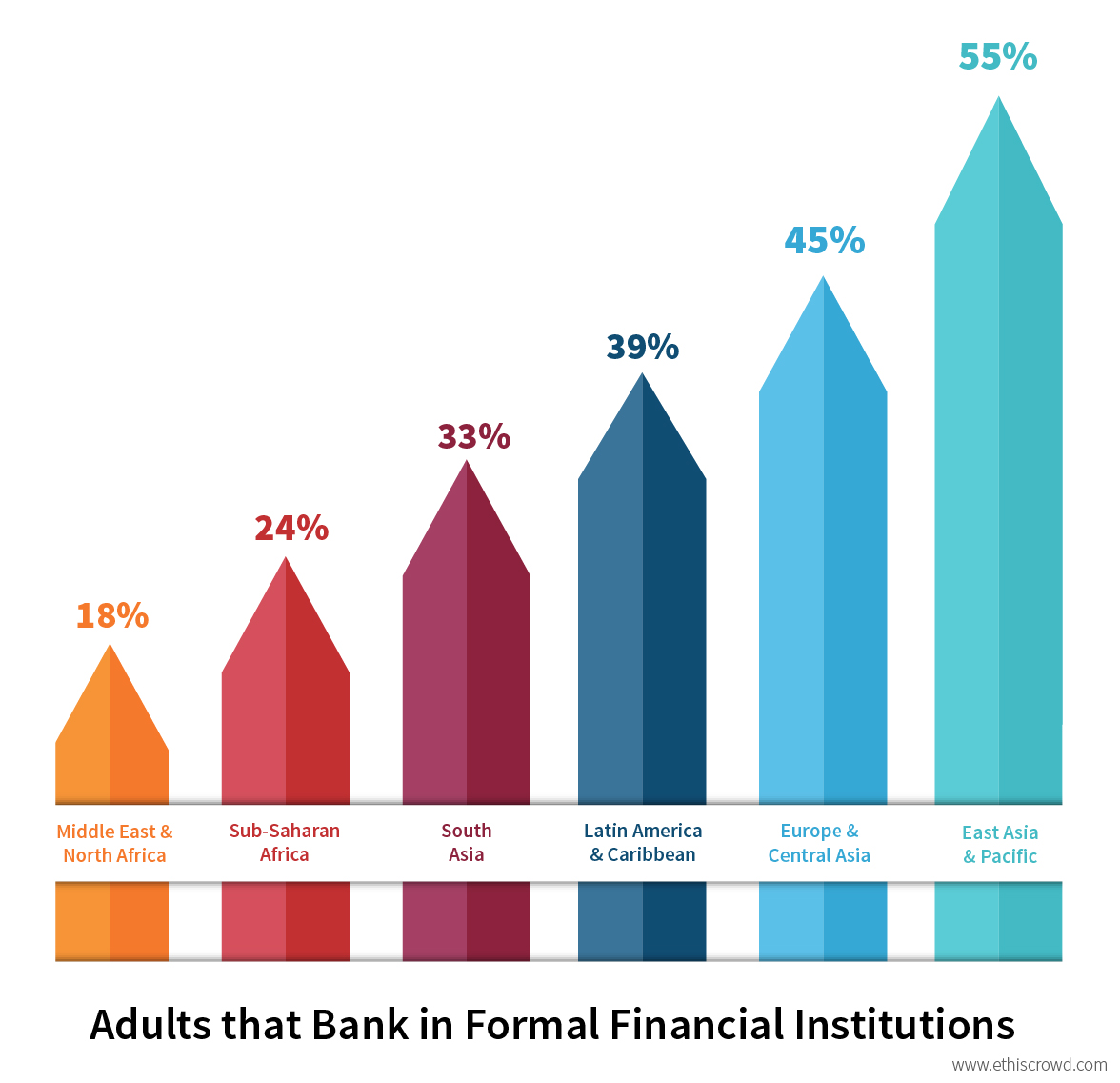

Unfortunately, although Islamic finance is growing and has inherent characteristics and principles that promote financial inclusion, there is uneven access to financial services and instruments that are compliant with Shariah, or Islamic law. The key countries that offer Islamic banking and finance have one of the highest percentages of adults that do not bank in formal financial institutions. For instance, in the MENA region, only 18% of adults have accounts in the formal financial institutions, whilst in the South Asian region, 33% adults have accounts in the formal financial institutions.

Furthermore globally, 2 bln adults do not have a bank account and it is estimated that approximately 200 mln micro to medium enterprises (MMEs) in developing economies lack access to affordable financial services and credit. Therefore, to achieve financial inclusion and provide benefits to a broader group of consumers excluded from certain segments of the financial system, innovative delivery models must be explored and implemented, and one such model is crowdfunding. Crowdfunding is known as a quick way of raising funds with potentially fewer regulatory requirements.

Types of Crowdfunding

At a glance, crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and individual investors (or donors). This approach taps into the collective efforts of a large pool of individuals—primarily online via social media and forums—and leverages their networks for greater reach and exposure. It is noteworthy to point out that crowdfunding is an especially useful tool for start-ups that usually have practical money-making and job-creating ideas to create new businesses and eventually help to create a better community. In the past, to apply for a loan in formal financial institutions, start-ups and MMEs will need to have a strong business plan and financial history. These applications will typically be rejected as they are deemed to be too risky when viewed through the lens of the banks’ credit and risk assessment. Fortunately, through innovative delivery models such as online crowdfunding platforms, they can now have access to hundreds and thousands of investors. When these same startups are featured on crowdfunding platforms, thousands of micro and large investors and supporters may decide to rally behind the startups and support the idea.

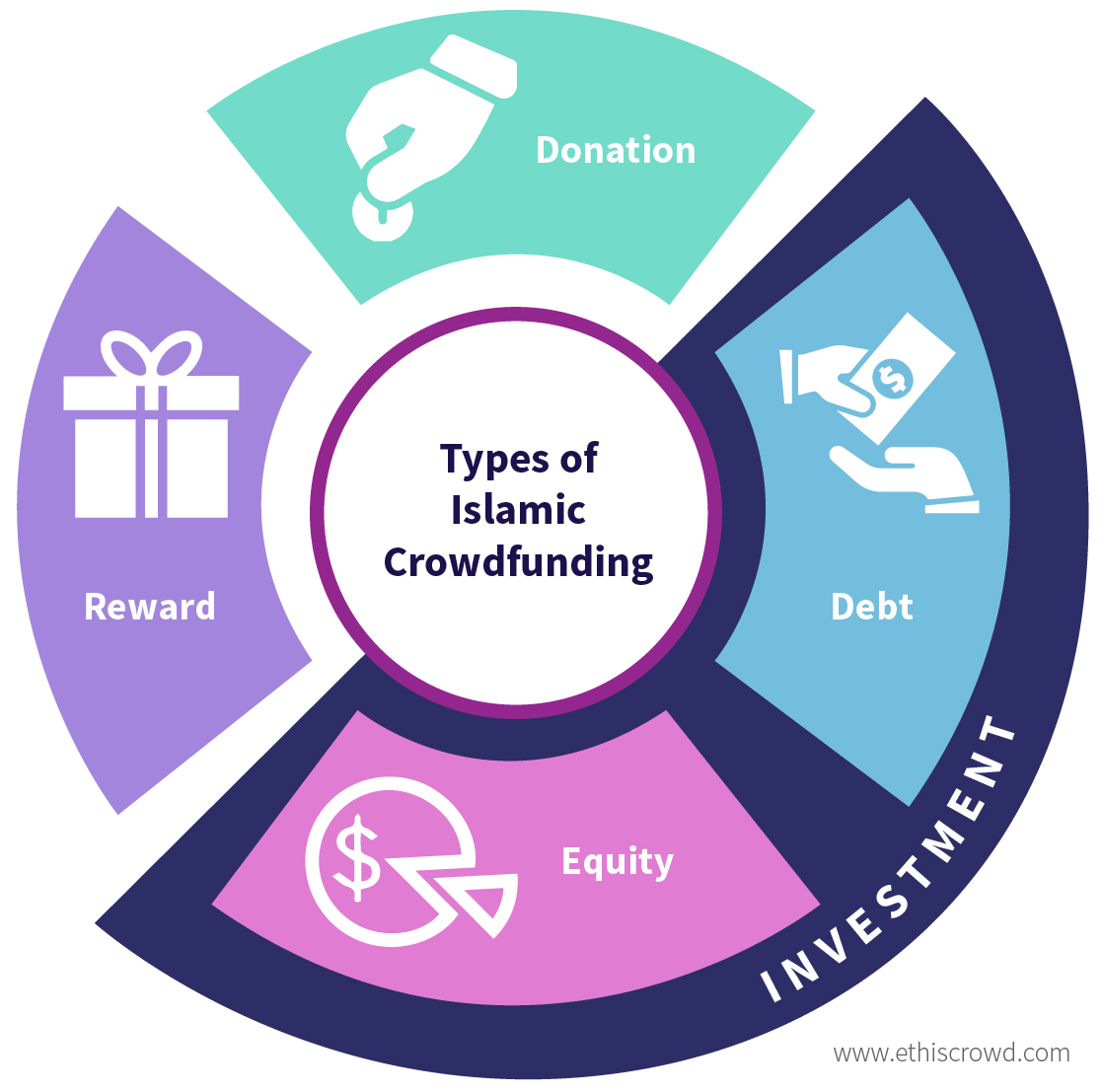

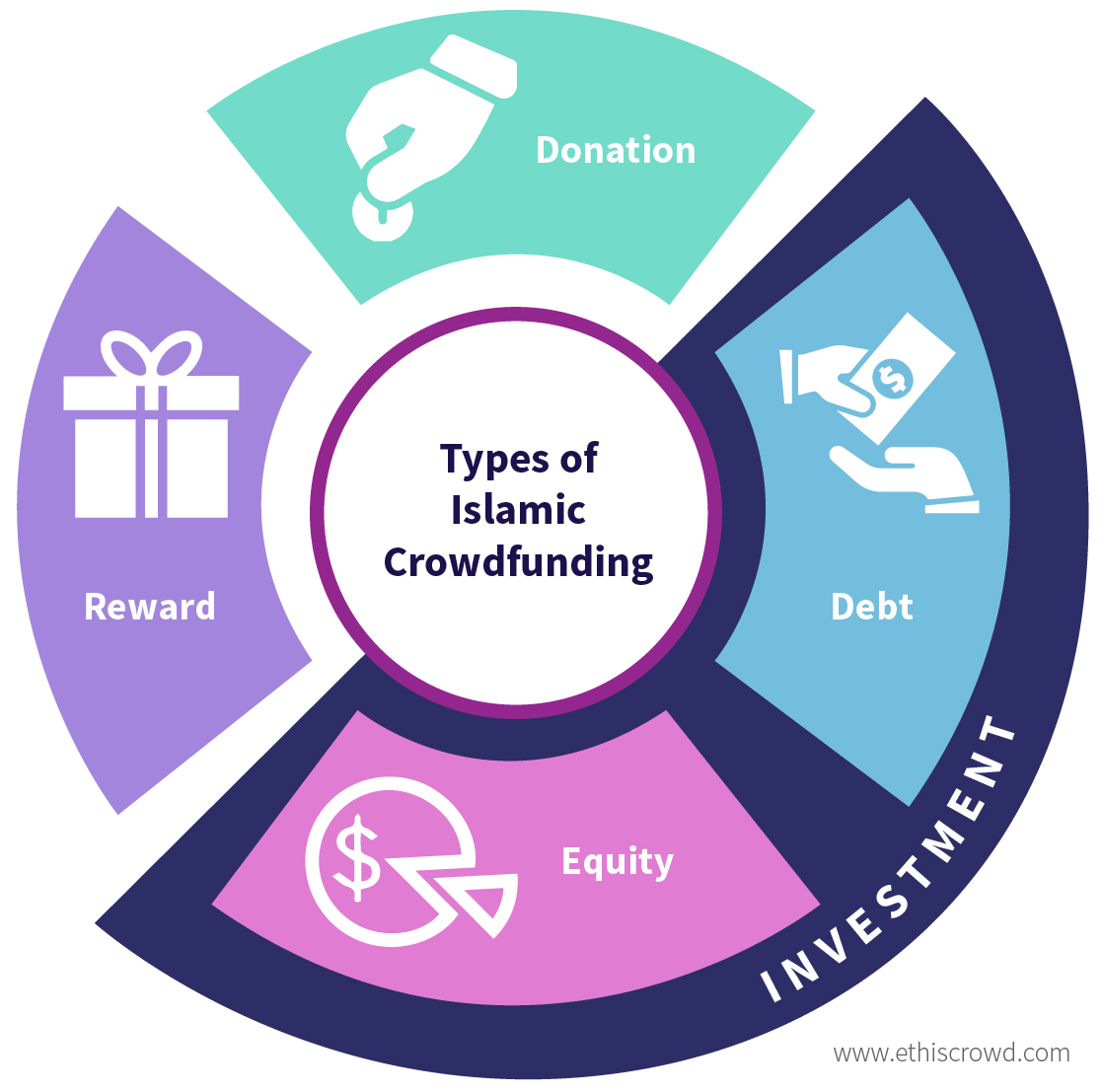

Notably, there are 4 types of crowdfunding namely donation crowdfunding, reward crowdfunding, equity crowdfunding and debt crowdfunding.

In donation crowdfunding, donors donate to Shariah-compliant non-profit projects, social-development initiatives etc. While in reward crowdfunding, donors contribute money against a reward after project completion. It is noteworthy to point out for both equity and debt crowdfunding, they may be placed under a wider category of ‘investment crowdfunding’ since Islamic finance investment models may be hybrids of what is typically categorized as debt or equity. In equity crowdfunding, investors contribute a substantial amount of cash and will become shareholders of the crowdfunding, sharing both profit and loss. Finally, in debt crowdfunding, lenders will expect in return principal repayment and profit.

Financial Inclusion through Crowdfunding

It is noteworthy to point out that crowdfunding could be helpful to raise both financial-based resources for startups and produce social-outcomes to benefit all interested communities. For example, crowdfunding will help to improve access to finance for the excluded and underserved individuals, startups, MMEs, etc. who might have limited or no credit history. According to World Bank study, there is an opportunity for approximately 344 mln people in developing economies to participate in crowdfunding. Secondly, through crowdfunding, there will be innovations of existing models to serve BoP (Bottom of Pyramid) customers, such as microfinance and mobile financial services. Crowdfunding represents a novel fundraising tool embedded in the current financial innovation which operates in order to produce convergent innovations that produce both economic and social outcomes. Finally, crowdfunding opens access to new asset classes that are currently largely unavailable to BoP customers. All of the above will contribute towards the efforts of financial inclusion.

Selected Shariah-Compliant Crowdfunding Platforms

It is noteworthy to point out that over time; Shariah-compliant crowdfunding platforms have evolved to become an essential part of the overall Islamic finance activities mainly to facilitate implementation of projects for borrowers who are facing difficulties to raise money through classical lending channels.

In key Islamic finance jurisdiction such Malaysia, a successful education-based crowdfunding platform is established by the name of Skolafund. Skolafund is an online web platform for students, especially the ones in need, to crowdfund their scholarships for higher education. The mission of the platform is to make higher education affordable and accessible to those who qualify, and no one should be deprived of quality education just because they cannot afford it. It first went online in April 2015 for four months. Throughout this four months, it raised almost RM25,000 for 6 students, funded by 125 members of the community. Moving forward, it also intends to help young Singaporeans pursue internships and exchange programme overseas. In addition, Malaysia is also home to world’s first licensed Shariah-compliant operator, Ethis Kapital Sdn Bhd which operates NusaKapital.com. The crowdfunding platform has recently been awarded the license as a recognised market operator to operate P2P financing platform by Securities Commission (SC) Malaysia.

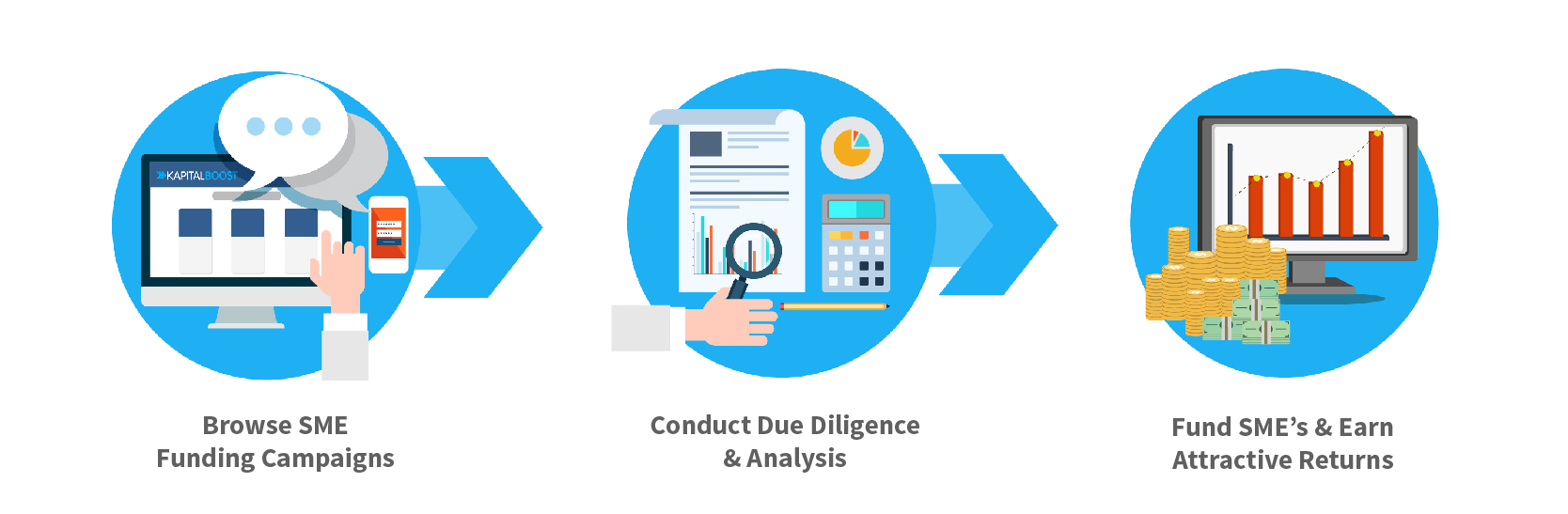

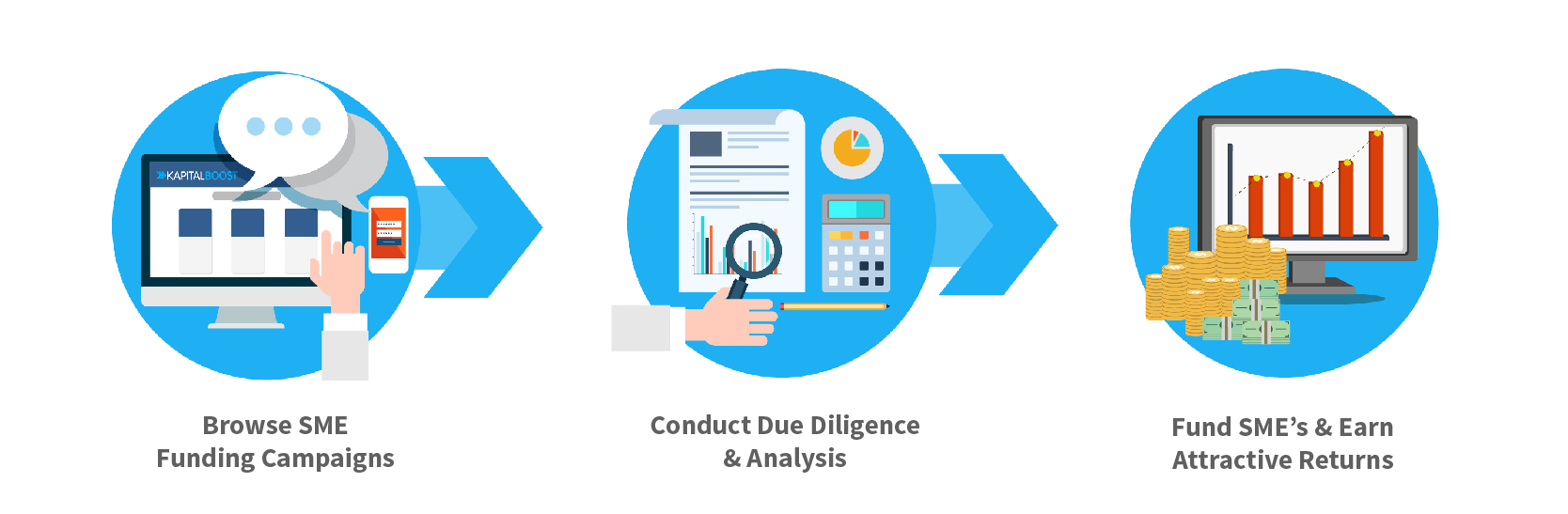

Moving to non-key Islamic finance jurisdiction such as Singapore, the city is home to Asia’s first Shariah-compliant hybrid crowdfunding platform for SMEs named KapitalBoost.com. Kapital Boost provides members with the opportunity to invest and earn attractive returns by funding small businesses. Concurrently, it helps to address the problems of small businesses by offering short-term financing alternatives with a fast and friendly approval process and at competitive rates. Crowdfunding is done through Shariah-compliant arrangements such as Murabaha (trading), Wakalah (agency) and Qard (donations). Finally, it is noteworthy to point out that EthisCrowd, Kapital Boost, Skolafund and Nusa Kapital are all family of crowdfunding platforms under the flag of Ethis Ventures.

Investment Structure for Kapital Boost Members

Conclusion and Moving Forward

Overall, Shariah-compliant crowdfunding platforms can be deemed as an integral component of the present Islamic financial industry as it helps to fulfil the inherent characteristics and principles of Islamic finance that is currently missing – financial inclusion. In addition, through crowdfunding, a larger segment of the community who were initially excluded from certain segments of the financial system now have financial access. More importantly, all interested communities will benefit with the presence of crowdfunding.

Finally moving forward, it is essential for a sound and enabling legal and regulatory framework to be in place for crowdfunding to achieve its market-building potential and deliver on its promise to promote financial inclusion.

Read more about Equity Crowdfunding

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You