In today’s modern world, the two obvious ways of making an income are either by having a job or starting your own business. But there is a third way that requires substantially less effort: start investing in assets that increase in value over time.

Though it may seem daunting, investing is essential to building wealth, especially as inflation continues to rise.

But investing isn’t a get-rich scheme—you shouldn’t be expecting instant wealth but instead slow and steady progressive gains over a period of time. Your rate of return depends heavily on the investment type and time horizon. Some asset classes will have stronger rates of return compared to others, but those also tend to be riskier. Smaller gains are better than missing out on the opportunity to build your wealth.

That said, you still have the potential to lose money while investing—but if done carefully and wisely, you have the potential to gain more money than what you initially invested.

In this article, we will go over the top reasons why you should start investing today.

Grow your money when you start investing

There’s absolutely nothing wrong with having more money. Though wealth could mean different things for different people—whether it’s living a certain lifestyle or having a certain amount of money in your bank account. Investing is one of the ways to build wealth.

Investing can help you reach your financial goals faster than just accumulating money in your bank account because investing builds wealth and increases the value of your assets as opposed to letting them sit in your bank account, which though useful, may not be enough to counter inflation.

Related: New to Investing? Here’s a Guide for Beginners

Start investing to beat inflation

Inflation is an increase in the price level of goods and services over time. With a recession over the horizon, inflation is clearly on the rise, too.

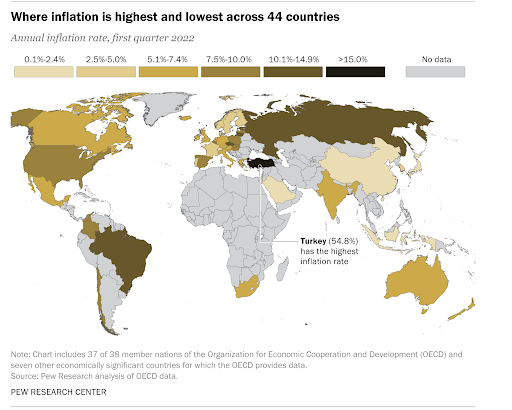

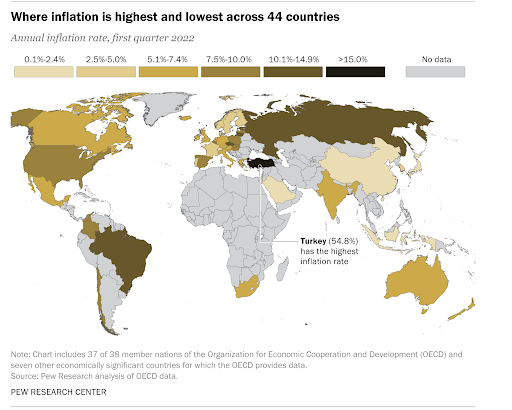

In the United States, the annual inflation rate of 8.6% is higher than it’s been since the early 1980s, as measured by the consumer price index, according to the latest report from the Bureau of Labor Statistics. The Pew Research Center analysis of data from 44 advanced economies finds that, in nearly all of them, consumer prices have risen substantially since pre-pandemic times.

The ripple effect of inflation can be seen through many aspects of the economy, particularly within consumer spending and the investment cycle. Because of inflation, the money you have today buys you less than it did months before. It curtails your spending power and eats into real returns. Your money will be worth considerably less 20 years from now after factoring in inflation.

Related: The Rise of the Halal industry and Tech Innovations in 2022

Some forms of investments, particularly low-risk and conservative investments like fixed deposits are particularly affected because the rate of inflation is higher than the returns of these instruments. Ideally, your investment should be earning more than the inflation rate, so as inflation spokes, so should your rate of investment returns.

Achieve financial goals and spend on those you love

Many people work hard, not just for themselves, but to support their families and loved ones. Investing lets you secure your family’s finances—whether that’s buying a new home, buying a car, putting your children through college or living a more comfortable life.

You may have your own personal financial aspirations that you’d like to achieve, be it over the long term or within the next few months. Maybe you have a dream of starting your own business, travelling the world or making an expensive purchase; the additional money gained from your investments will get you one step closer to your ambitions.

Thanks to the power of compounding, and depending on the rate of return, you could be doubling your initial investment.

For example, if you invested RM100 a month for 10 years, after an initial RM100 investment, your total contribution over that period would be RM12,000. Assuming a 5% rate of return, that RM12,000 would grow to over RM15,526 in that period thanks to compound interest.

Related: Halal Stock Investing – What You Need to Know

Achieve financial independence and retire comfortably

With more wealth, you may be able to pursue the lifestyle you want, including having more choices and possibilities rather than being stuck on limitations. By investing, you’ll be able to create your nest egg and maybe even achieve retirement earlier.

The ideal retirement life is one where you can fund your many expenses such as mortgage, transport, food and medication without depending on a home salary but relying almost entirely on your savings or returns from investments.

Another big push to save up for retirement is to curb the effects of inflation which will indefinitely shrink the value of your money over time.

Investing is a necessary

It is important simply because it is an effective way to make your money grow for you and potentially build wealth. And no one starts investing necessarily knowing the basics or what they are doing so it’s completely fine to take the time to learn the basics of investing.

The real key is having the discipline to stay invested so you can get one step closer to achieving your goals.

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You