Although not much has changed when it comes to planning for retirement, the challenges that today’s savers face may not be the same as the previous generations.

One, life expectancy is on the rise. In 1960, the earliest year the United Nations began keeping global data, the average person could expect to live to 52.5 years of age. Today, the average is 72—and potentially longer, which also means, you’ll need your money to last longer.

Compounding matters, higher-than-expected inflation, especially in the United States and major European economies, is taking a toll on the global economy and financial conditions.

All things considered, how can one still attain the retirement they’ve always wanted—whether that’s travelling around the world, living a luxurious life, or just spending more time with family and friends—without having to stress about money?

In this retirement guide, we’ll break down some of the steps that we think may be useful, from basic budgeting tips to figuring out goals that could set you on your way to financial freedom.

Related: Halal Investment: A Beginner’s Guide

When can you retire?

This question depends on the answer to this other big question: will you have enough income after you retire? It also depends on your personal needs and circumstances—do you still need to spend on your children, how’s your debt situation, and are you trying to live a certain lifestyle?

There isn’t a hard fast rule to refer to, but according to the Employees Provident Fund (EPF), those who reside in Malaysia will need to save at least RM240,000 by the time they retire at 55 years old to cover basic needs such as food and everyday costs. This savings plan is based on an RM1,000 minimum pension for public-sector employees and assumes you live to be 75, which is the average life expectancy of Malaysians.

Unfortunately, EPF also recently said that 73% of its members will not likely be able to meet this requirement this year. And if we were honest, RM1,000 may not be sufficient due to other potential rising expenditures such as medical costs, your family, and leisure to enjoy a good retirement.

The age at which you can retire, and when you officially withdraw your social benefits (EPF in Malaysia), as well as the age at which you must retire, aren’t all equal.

In Malaysia, you may make a full withdrawal or flexible withdrawal by the age of 55. But that doesn’t mean you should hit the brakes and withdraw most of your cash at that age, especially if you don’t plan on retiring until 60.

How much savings do you need when planning for retirement?

To safely cover your monthly expenses for 15 years from the point of retirement, which, let’s say is 75—the average life expectancy in Malaysia—you need at least RM 486,000 by the age of 60 as a single retiree. That money can include anything and everything from your EPF, Private Retirement Scehems, cash, rental income etc.

As a guideline, you need two-thirds of your final drawn income to sustain your pre-retirement standard of living. For example, if you make RM12,000 monthly in your final year of work, expect to need RM8,000 a month when you retire. Alternatively, you could downgrade your lifestyle. Other retirement planners say you need 80% of your pre-retirement income to sustain the same quality of life after you retire.

Knowing how fast your “burn rate” allows you to estimate how long your nest could last. You could reasonably expect to withdraw 4% of your savings in your first year of retirement, and increase this amount to factor in inflation and cost-of-living adjustments in subsequent years.

Though these rules aren’t perfect, it is a good estimate of one’s retirement readiness and ensures you don’t run out of retirement savings.

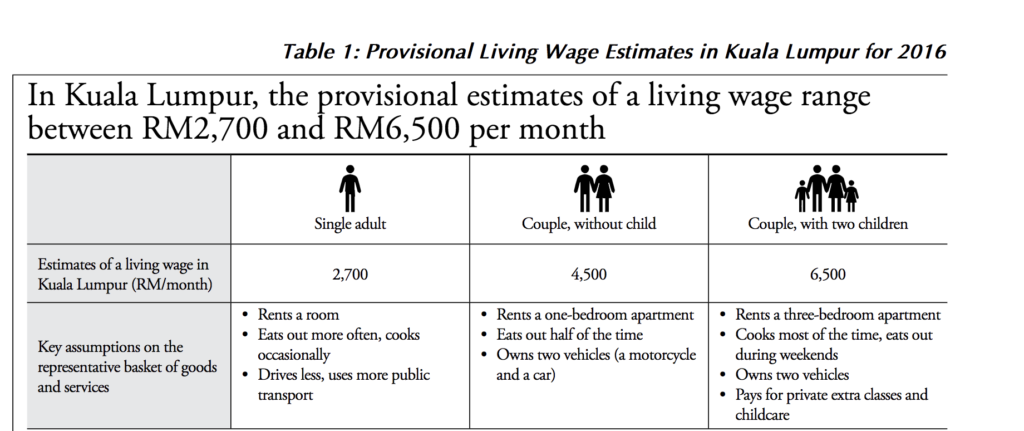

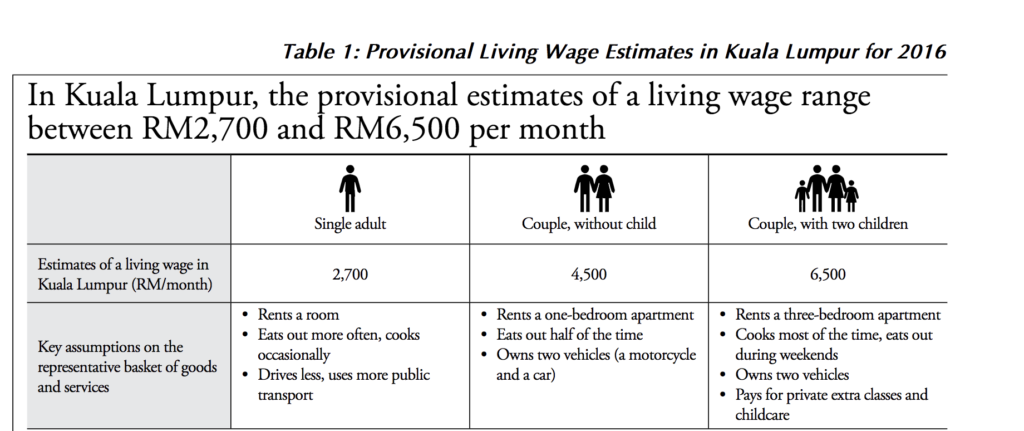

Below are the provisional living wage estimates in Kuala Lumpur, according to a Bank Negara Malaysia report:

This is a simplified amount, but you may adjust it higher or lower according to your retirement ambitions like travelling the world after you retire or pursuing an expensive hobby.

Related: New to Investing? Here’s a Guide for Beginners

Set a goal when planning for retirement

What do you hope to save up for retirement? A good place to start is to think about what your life might look like in retirement. Take a pen and paper and write down your retirement goals.

Retirement planning is necessary to allow you to establish financial security while you’re still working so that you are financially comfortable once you retire.

Plus, people aren’t aware of the importance of having a solid retirement plan. According to a recent report, only 12% of Malaysians are on track for early retirement, with 55% of them unsure of how to achieve financial independence to retire early.

The survey found the most common strategy for early retirement among Malaysians is saving regularly (71%), followed by “doing financial planning” (63%) and “investing” (66%), indicating that Malaysians are still largely hands-on and are at least trying to learn more about it.

Factor in all the different costs

Next, consider how much everything will cost. Evidently, inflation is on the rise. According to RAM Ratings, Malaysia’s full-year inflation forecast for 2022 is 3.0%, taking into account subsidies and price ceilings for key price-controlled food items as well as stronger than expected cost passthrough to consumers so far this year. For context, the average inflation rate in the U.S. over the past century (1913-2013) was 3.22%.

To save yourself the trouble of tomorrow, expect higher prices in the decades ahead when running the numbers. These include factoring in day-to-day expenses, like housing costs, food and health care.

As much as you need to expect higher costs in both value and quantity, you can also expect that some expenses may no longer exist, such as a mortgage or childcare costs, which could result in a decrease in your overall expenses as you near retirement.

After that, add up all the income you might earn in your post-working years. This could be from a pension, retirement fund, investments, rental income, extra cash, business income and so on.

By matching up revenue and expenses, you’ll get a good idea of what you’ll need to set aside for every year of your retirement.

Related: Investing Strategies for Muslims in 2022

All things considered

There isn’t one set way of planning for retirement, especially because it evolves over time depending on circumstances.

But the gist is clear—to have a secure and comfortable retirement, you need to start planning early despite it being stressful and even sometimes—boring.

Next time, we’ll dive into the types of retirement funds and investments you could look into to raise the money to fund your future. Though saving money is great, you’ll need to invest it to enable it to grow.

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You