You have probably heard of the maxim “don’t put all your eggs in one basket”. It is applicable in many different facets of life, including investing. To put all your eggs in one basket means to invest all of your money in just one portfolio and risk losing all of your capital should the investment go south. When you diversify, you spread out the risk across multiple investment portfolios. That’s the basic premise behind diversification. Let’s dive deeper into this.

Diversification risk management strategy

Savvy investors diversify their investments by spreading out their capital across multiple portfolios. It is an investing strategy used to manage risk. The risk refers to unsystematic risks such as business risk and financial risk. Unlike systematic risk that affects the market in its entirety regardless of investment vehicle, industry, or country, unsystematic risk is specific to a company, industry, market, economy, or country. It is, therefore, diversifiable and the risk exposure can be reduced via diversification.

Related: New to Investing? Here’s a Guide for Beginners

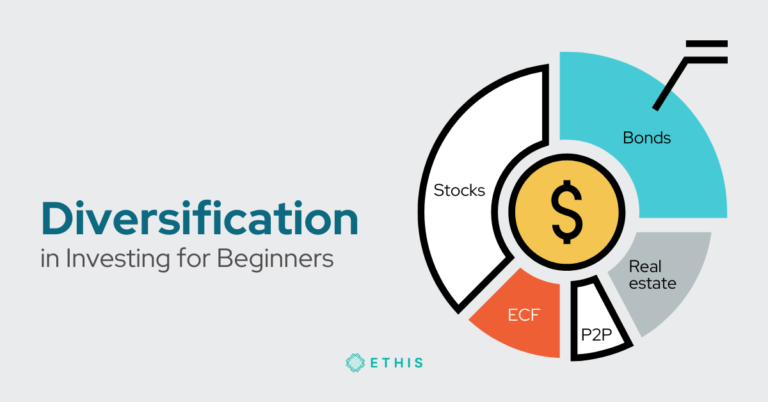

You can diversify your investments across different companies, industries, sectors, geographical locations, asset classes, and financial instruments.

By choosing not to put all of your eggs in one basket, you minimise the risk of losing all of your capital on a single portfolio as your investments are now varied and not concentrated on just one portfolio. So the risk is correspondently spread out across the diversified portfolios that you invest in.

Diversification example

Diversification plays a role in counterbalancing the negative performance of some of your investments by averaging the positive performance of others. To illustrate, let’s say you only invest in airline stocks. During the pandemic, airlines stocks underperformed following a major lockdown across the globe causing you to take a massive loss.

Had you diversified your fund into other stocks such as e-commerce, only part of your portfolio would be affected. In fact, it may yield even better returns as the e-commerce industry was booming amid the lockdown.

Related: Diversify Your Investment via Equity Crowdfunding

You can diversify even further by dividing your funds into other asset classes and financial instruments beyond stocks. The goal is to reduce your portfolio’s sensitivity to market swings as negative movements in one may be offset by positive returns in another.

Diversification does not eliminate investment risk

While diversification serves as a risk management strategy, it does not eliminate the investment risk completely. This is because investing is inherently risky.

Therefore, it’s crucial for an investor to do their own thorough due diligence before investing in any investment vehicle. Be informed and do your homework. There are risks that are diversifiable but certain risks are just unavoidable. Inflation rates, political instability, and war are some of the common inevitable events that cause the market to crash. Not even Warren Buffet, one of the most successful investors, can escape these market risks. In fact, he lost about $23 billion in the financial crisis of 2008.

Nonetheless, don’t go into an investment with the mindset that you will lose money. Instead, use diversification to hedge your portfolio against investment risks. That way, you can counterbalance or minimise your losses in an investment downturn.

Does diversification yield better returns?

Diversification does not necessarily correlate with better returns. It’s not designed to maximise returns.

As a matter of fact, the returns from a diversified portfolio tend to be lower than what you might earn if you are able to pick a single winning investment. So don’t over diversify. Focus on variety instead of quantity. Diversification works best when assets are uncorrelated or negatively correlated with one another. In other words, you are investing in completely different asset classes such as gold and unit trusts.

Diversify your investment with crowd-investing!

There are many asset classes and financial instruments you can choose to diversify your investments. One of them is crowd-investing. At Ethis, we make it easy for you to invest in profitable projects and exciting high-growth companies across the globe via equity crowdfunding and P2P lending. Learn more at ethis.co.

Related: Equity Crowdfunding vs P2P Lending

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You