By Aneesa Ismail Rahman

From scaling up to gaining access to more resources, there are many reasons why a company needs to raise funds, and its goals play an important role in determining the best way for it to raise funds.

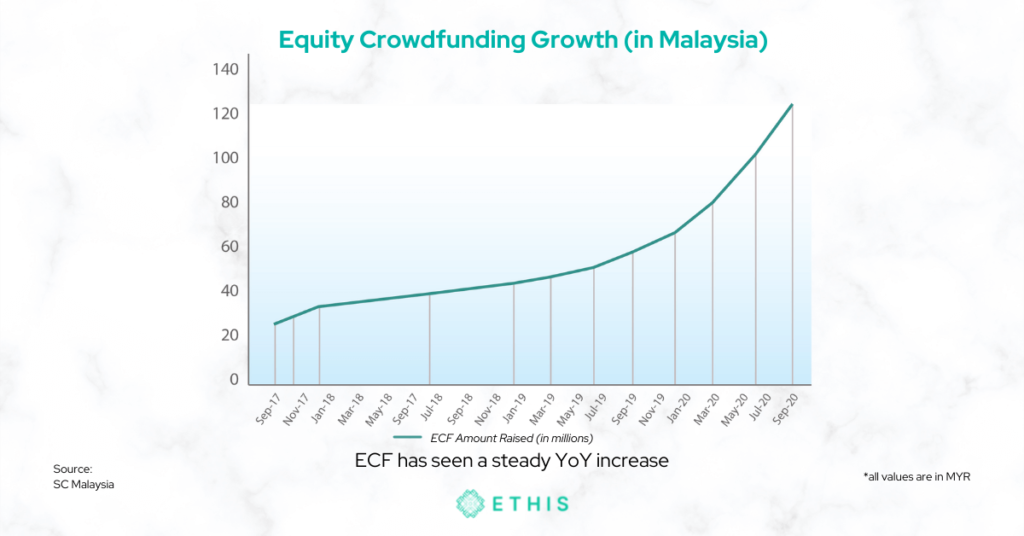

Two of the most common methods for firms to raise financing are through Equity Crowdfunding (ECF) and Venture Capital (VC). Traditional types of funding methods, such as Venture Capital, provide big sums of money from a few sources, but ECF provides many modest sums of money from a large number of people. In recent years, Equity Crowdfunding has also gained popularity in Malaysia according to the Securities Commission.

Let’s compare these two methods to see how cautiously ECF and VC should be pursued. In this article, experts provide their insight and weigh in on the best type of finance for your company.

Identifying the differences between ECF and VC

When comparing traditional VC investment with crowdsourcing, there are some key distinctions to consider:

a) Level of control

Funding via ECF is generally more entrepreneur-friendly than VC funding. Many founders dislike giving up board seats and majority control. Raising funds via ECF allows the entrepreneur to keep a significant level of control while raising capital via VC usually involves accepting the investor’s terms and valuation.

b) Social Impact

For businesses that want to create significant social impact rather than just generate money, ECF may be quite beneficial. Many crowdfunding investors want to use their money to help expedite a change they believe in or wish to see happen, and then it’s just a question of finding the perfect firm to help them achieve their goals. This is fantastic news for businesses that can rewrite their ideas and solutions to have a significant social or environmental impact. Ethis.co is an excellent example of an award-winning impact investment platform that can be utilised to fund your startup.

c) Strict or flexible criteria?

The criteria used by venture capital firms to identify investment targets are generally stricter than those used by ECF platforms. Crowdfunding remains a more flexible investment vehicle than venture capitalists. Therefore, if your firm is scalable and has a compelling story, the choice to invest will be made by a number of people, as in the case of ECF, rather than just a few, as in the case with VCs.

d) The Network Effect

The term “network effect” refers to any situation in which the value of a product, service, or platform depends on the number of buyers, sellers, or users who leverage it. Typically, the greater the number of buyers, sellers, or users, the greater the network effect—and the greater the value created by the offering.

ECF platforms benefit from economies of scale. This is because when another user joins a network, the value of an individual’s participation grows because network effects produce positive feedback loops and increasing returns to scale.

In other words, according to Umar Munshi, Group MD and Co-Founder of Ethis, the more people use a platform, the more it compounds in terms of interest and influence i.e. “network attracts network.” The network effect is currently achieved only through equity crowdfunding and not through venture capital.

e) Deal Flow

According to a well-known ECF platform, Startengine, while the total number of ECF campaigns is significantly smaller than the number of VC investments, this is to be expected given that equity crowdfunding has only been operating for a few years compared to venture capital’s decades of existence. They expect that gap to decrease in the coming years as equity crowdfunding grows. According to StartEngine, ECF is expanding rapidly and the company itself has already tripled its growth in the year 2020.

Advantages & Disadvantages of Equity Crowdfunding vs. Venture Capital

The following are some of the most important factors to consider when deciding whether to raise funds through ECF or traditional VC funding.:

Venture Capital Advantages

Deep Pockets: With hundreds of millions (if not billions) of dollars to invest, VCs may swiftly provide a huge sum of money to companies.

Experience: VCs have years of expertise leading high-growth firms as a more established type of capital investment.

Network: VCs have access to strategic contacts and significant resources through their network.

Validation: Businesses that obtain funding from a recognised business receive instant credibility and recognition.

Venture Capital Disadvantages

Exclusivity: Only a small percentage of businesses receive VC investment.

Valuation: VCs apply substantial downward pressure on startup valuations in order to enhance their upside potential.

Control: VCs use favourable conditions (such as board seats, preferred shares, and anti-dilution provisions, among other things) to obtain control at the expense of founders, which can result in situations where founders are driven out against their will.

Equity Crowdfunding Advantages

Control: Most companies use ECF to issue non-voting common shares, allowing founders to keep control of the firm.

Brand Ambassadors: ECF helps businesses to develop armies of hundreds (if not thousands) of investors who subsequently turn into consumers and brand champions.

Exposure: Companies gain new audiences by promoting their ECF campaigns.

Sales: Companies may boost sales by providing incentives to investors, such as discounts.

Steady capital: ECF allows businesses to raise cash on a continuous basis rather than intermittently.

Equity Crowdfunding Disadvantages

No guarantees: It is impossible to predict whether or not a firm will reach its ECF target.

Disclosures: Companies must be upfront with financials and reporting since ECF offerings are accessible to the public.

Costs: ECF initiatives include legal, accounting, platform, and marketing expenses.

What do the experts say when it comes to choosing between the two types of funding for your business?

In an exclusive interview with Ethis, Dr Amr Hussein, CEO from Gainwells said, “if you have two choices, VC would be better. Because the money they are giving is very smart money. They are going to support you much more than anything.”

According to Dr Amr, “if you are running your startup alone, without VCs backing you, this means you are doing everything from scratch, but when you invite the VC on board, they have a lot of connections and a lot of experience.”

However, a major tradeoff of raising money via VC to consider is that “businesses who raise using equity crowdfunding instead of Venture Capital are trading off fewer, higher-dollar value investors like VCs and traditional angels for a larger number of smaller investors in equity crowdfunding,” said Brian Belley, who is the founder of Crowdwise.

Some pertinent points and guidance from Shariah compliant crowdfunding company, Ethis Group MD and Co-Founder Umar Munshi is that, ”ECF is like a mini IPO and they will provide you with goodwill in the market. However, with VC’s it is private funding and in general, the VC has the most power because of the money provided.”

On a technical issue, Umar also comments: “Depending on the nature of the investor, the startup may want investors who actively help out or may want no disturbance. So, if you’re an issuer who is certain about what you are doing, go for VC, otherwise choose ECF.” He also adds that “both VC and ECF have started to converge in recent years.”

“Equity crowdfunding gives entrepreneurs access to a new group of investors who might be great assets to their business. I welcome investing in crowdfunded companies. It means that a company has a large number of promoters before I even invest,” according to Tim Draper (DFJ. Investor in Baidu, Tesla, Skype, and more).

According to medium.com and in the opinion of Naval Ravikant (CEO of AngelList), “…VCs bring expertise but the crowd brings customers and fans.”

Final thoughts

Both ECF and VC fundraising are effective strategies to raise funds for your firm. Make your decision based on where you are in the lifecycle of your company, considering the key distinctions that each of these methods of crowdfunding have to offer.

Learn how to raise capital for your business through Ethis and bring your aspiring business to life!

Ethis Group operates a Shariah compliant investment platform which is approved by regulators in Indonesia, Malaysia, and Dubai, together with a charity platform named Global Sadaqah.

At Ethis, we believe that Equity Crowdfunding is the future of the Islamic Capital Markets. Ethis Malaysia offers access to investment opportunities in distinctive and promising companies while also serving as a platform for entrepreneurs to showcase their company to a community of global investors.

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You