By: Amiratul Nadiah Hasan, Nur Diyana Najwa Mohd Affendi, Aishath Muneeza of INCEIF

Islamic venture capital (IVC) have sadly not gained an equal rate of development and progress as their conventional counterpart. Though venture capital (VC) has its roots in the classical Islamic mudharabah contract, VC activity has not gained much attention and focus in the Islamic finance industry of today.

This article aims to study the issues related to IVC by exploring the potential of Islamic venture capital linked with crowdfunding mechanisms. This article also proposes a suitable Shariah framework for the application of Islamic venture capital via crowdfunding.

What is Islamic venture capital ?

A venture capitalist, according to the Business Dictionary, is a person who deals with or manages venture capital activities, usually working for a venture capital firm. Characteristics of venture capital include:

- Financing new companies or startups which usually already generate a certain level of revenue in return for equity participation.

- The tenure of investment is medium to long term, differing according to the phase or reasons for funding and potential of the funded company.

- Venture capital financing involves high risk-return investment profiles.

- In addition to capital, venture capital firms also provide support and assistance to the funded company to ensure growth, development and the targeted purpose of financing. Forms of support include training, mentoring, technical skills and guidance. Venture capital firms usually work closely with the funded company and are involved in the decision making of the company to a certain level.

- Venture capital firms will conduct specific procedures and follow designated screening methods of selecting investments options – most VC firms focus on investing in the industry/field of their expertise.

The distinct characteristics of venture capital, especially in providing support beyond capital and financing, makes it a better choice for small and medium enterprises to raise funds for various stages of business. Generally, venture capital firms provide financing for several stages;

- Early-stage or seed financing – Usually given to a company that has already completed their product development but needs financing to launch, or those which need extra funding as they have already spent their initial capital. Venture capital firms usually only fund enterprises that already exist, with running operations and generating revenue.

- Expansion financing – Also known as bridge or mezzanine financing. This type of financing is usually for the short to medium term.

- Financing for acquisition and buyout – For major expansion strategy.

Islamic venture capitals share the same concept with conventional venture capitals except that it abides by the principles of Shariah law. It is structured based on Shariah contracts and adhering to the profit- and loss sharing principles of shirkah or partnership. Islamic venture capital can only invest in companies that are engaged in halal or Shariah-compliant activities and companies with excessive leverage are excluded.

The history of Islamic venture capital

The earliest practice of Islamic venture capital is traced back to the 10th century, by the merchant community of the Arab Peninsula who had incorporated both debt and equity in their business activities. Though it is widely known that the Pre-Islamic Arabs were known for their customary practice of various types of interest (riba), it is noteworthy that they also commonly used equity; which later became the basis of classical partnership concepts like mudarabah and musharakah.

After the coming of Islam, the approach of the Prophet S.A.W in regards to business activities (muamalah) was to retain commercial practices that were not conflicting with the Shariah and only eliminate those which contained prohibited elements such as interest (riba), ambiguity (gharar) and gambling (maysir).

Such practices later evolved into the concept of mudarabah and musharakah which were used by the companions and Islamic community during the era of the Prophet. These two classical partnership concepts have become the basis for much sophisticated, modern versions of IVC.

Related: Islamic Crowdfunding VS Islamic Banking & Finance

However, the development of IVC has not been as robust as its conventional counterparts. Though historically, the practice of commenda in Italy and Europe was argued to be inspired by the idea of mudarabah and musharakah, and in the western community in general, venture capital was only practised later in the 19th century, the level of conventional venture capital today is inarguably more developed than Islamic venture capital.

The modern evolution of Islamic venture capital only took place with the rise of Islamic finance in more recent times. Much focus has been placed on the banking sector which involves a great deal of debt-financing activities, rather than the equity side which concerns the capital market.

For the record, in 2004, the first fund established under the title of Islamic venture capital was the Injazah fund of Dubai. The first corporation set up just for Islamic venture capital was founded in Malaysia in 2008, and called Musharakah Venture Tech and Management, while the first bank dedicated for Islamic venture capital was established in 2006 in Bahrain, named Venture Capital Bank.

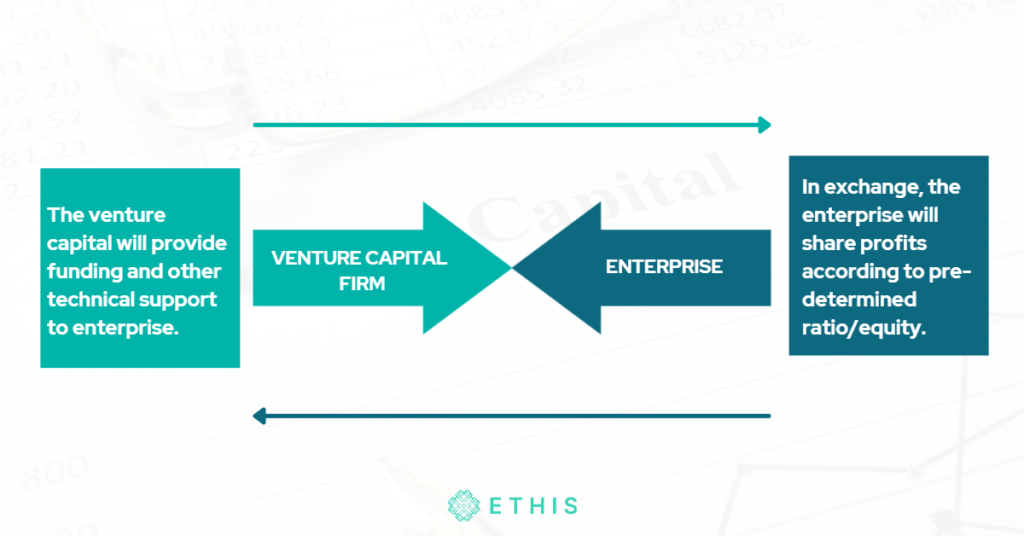

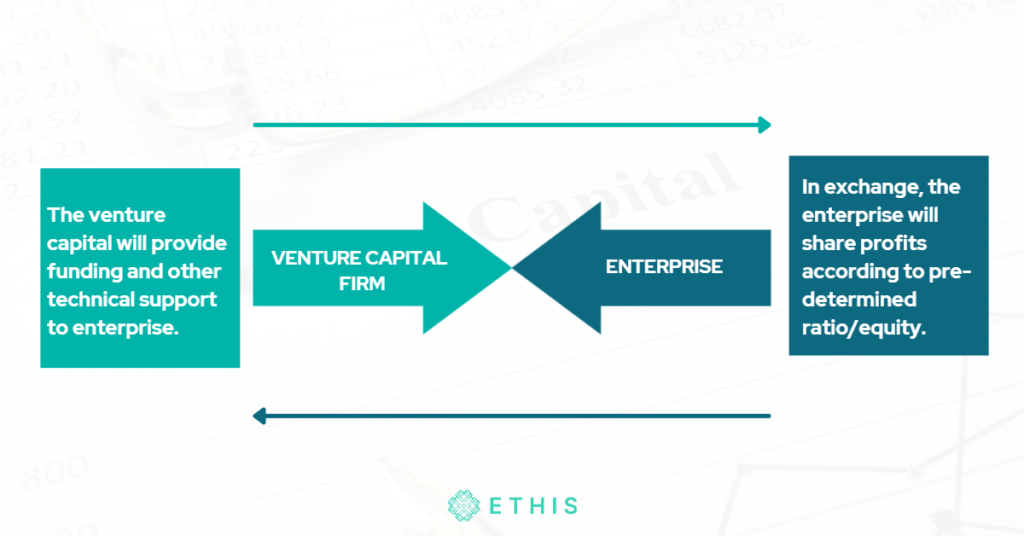

Generally in an application, a venture capital firm, both conventional and Islamic, works in the following simplified structure:

- A venture capital firm usually consists of two types of partners; general and limited partners.

- General partners; who are practically the venture capitalist, are the ones that are responsible to make investment decisions (according to their respective screening methods and criteria), working closely with the startups or selected projects and continuously providing the assistance needed, be it technical, guidance or mentoring. General partners usually possess a certain level of skills and experience in the industry/field of their investment.

- The limited partners are the investors and consist of people or organisations that provide the necessary funding/capital to the entrepreneurs via a venture capital firm.

- Venture capital firms then profit from the management fees and a portion of shares that they receive from the funded companies (shared with the investors).

Related: Crowdfunding Vs Islamic Crowdfunding

What is Islamic crowdfunding?

Islamic crowdfunding (ICF) came into existence in the last couple of years to distinguish itself from mainstream crowdfunding. Similar to Islamic venture capital, Islamic crowdfunding uses the same concept of crowdfunding but adheres to Shariah law and principles.

The concept of crowdfunding entails financing an idea, a project, a person or a cause through the collection of small amounts of money from a larger number of providers. At the outset, crowdfunding was dominantly used for non-profit activities. There are four types of crowdfunding namely lending or P2P crowdfunding, donation-based, reward-based and equity-based.

In essence, crowdfunding is compliant with the Islamic rules in conducting any commercial or contractual business deal. Similar to venture capital, crowdfunding brings the spirit of sharing capital, gains and losses. All types of crowdfunding are more or less in line with Islamic teachings, except for lending-based crowdfunding. This is due to the presence of interest; or a fixed rate of return which is prohibited in Islam.

Related: 5 Ways Equity Crowdfunding Can Benefit Society

Hence Islamic crowdfunding platforms use profit and loss sharing contracts i.e. mudarabah to substitute the lending or P2P type of crowdfunding. The profit and loss sharing contract combines features of both debt and equity. It is similar to debt because it does not entitle the investor to any ownership or shareholding rights, and is similar to equity. After all, the investors share the outcome of the financed project, be it a profit or a loss. This type of agreement is interest-free and therefore compliant with Islamic principles of doing business.

The advantages of equity-based crowdfunding from an Islamic finance perspective are as follows:

- Equity-based crowdfunding is based on profit and loss sharing basis and therefore compatible with the original form of Islamic finance;

- Providing access to capital to a wide range of entrepreneurs, hence reducing funding gap;

- Minimising risk through diverting limited capital across multiple start-ups;

- Promoting innovation and keeping talent local; and

- Creating jobs through companies and projects funded.

Islamic crowdfunding provides an opportunity for investors donors and entrepreneurs for the socio-economic development of the micro and small enterprises sector in Islamic countries Some examples of Shariah-compliant or Islamic crowdfunding platforms are Ethis Group, Ata Plus, Kapital Boost and the latest waqf-based crowdfunding platform, Waqf World.

Issues detected in operating Islamic capital ventures and Islamic crowdfunding separately

Now we will discuss the limitations and issues in the current framework of IVC and ICF that operate independently.

The above structure shows the framework by which Islamic venture capital operates. The IVC will adopt either musharakah or mudarabah as its underlying contract.

Under the mudarabah contract, the venture capital will act as rabbul mal and provide funding to the enterprise, usually in exchange for stocks of the invested company/enterprise or in exchange for returns. The enterprise will act as mudarib and invest its time and effort into the business. As with any other mudarabah contract, the profits of the business/project will be shared between the venture capital firm and the enterprise according to the pre-agreed ratio, while the financial loss will be borne by the venture capital firm.

Under the musharakah contract, both venture capital firms and enterprises will act as partners and share the profit according to a predetermined ratio while the loss will be borne according to capital contribution. In this case, the venture capital as musharakah partner can be involved actively in the business operations and decision making, unlike the mudarabah contract. The Islamic venture capital under the musharakah contract justifies the extra inputs by the venture capital firm as capital put into the musharakah contract is not restricted to cash and money, but also in kind and skills.

However, there are several issues detected in this IVC framework that includes both operational and Shariah perspectives.

- In this structure, the capital raised by venture capital firms is limited and small. Since venture capital firms obtain their funding from their limited partner (usually high net worth individuals or specific organisations), the choices of projects/companies to be funded will also be restricted, usually to the company that the firms are familiar with or to partners that have some level of knowledge and expertise. This creates the problem of limited and biased funding. The opportunity to be funded by a venture capital firm will be narrowed down through the investment screening, and as a result, many companies/enterprises will not be able to receive funding despite their potential.

- By using mudarabah as the underlying contract, the VC firm is not able to be involved directly in the business it funded. This is because the rights and responsibility of rabbul mal do not allow them to be involved in the business. This is very unsuitable to the nature of venture capital, as it is known that among the distinct characteristics that work to its advantage over other methods of funding, is the ability to give more than just financial help, but also guidance, mentoring and providing necessary skills to help the business.

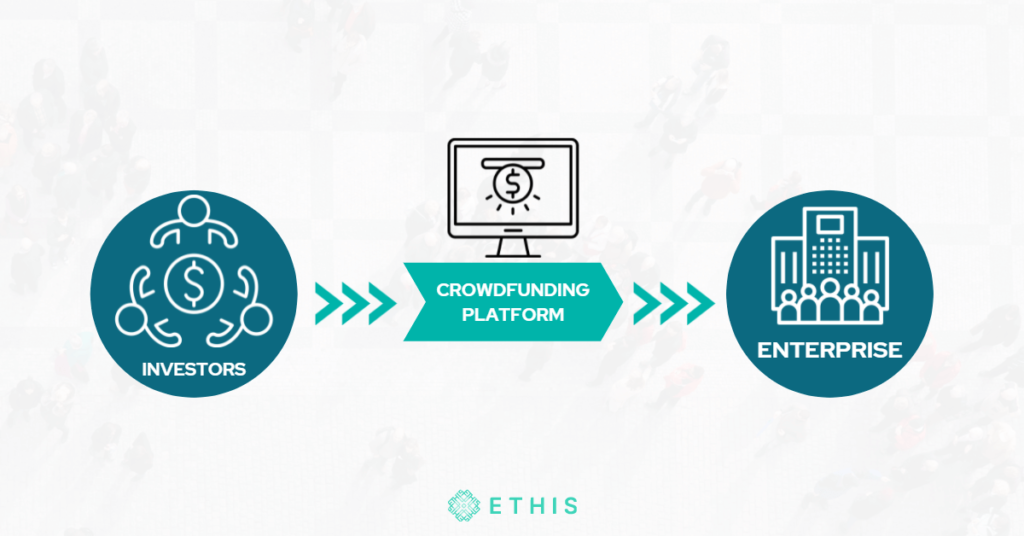

The ICF platforms act as intermediaries between the pool of investors and the enterprise. The ICF platform will act as a fundraiser for the enterprise and will raise the amount of funding needed by the enterprise in the stipulated period. The investors in this structure will play the role of rabbul mal while the enterprise is the mudarib, while the ICF platform is entitled to some wakalah fee. However, some issues detected in this ICF structure are;

- ICF typically only raises funds for a stipulated period, for a specific purpose. The enterprise or funded company will not be able to obtain any additional capital injection from the investors, as the nature of ICF is short term or one-off funding.

- ICF does not have such expertise as IVC, thus would not be able to extend beyond financial help to the enterprise.

Related: The Tech In Fintech:Technopreneurship & Equity Crowdfunding

Proposed shariah structure for Islamic venture capitals via crowdfunding

From the above discussion, it is evident that VC and crowdfunding have their governance structure and strengths.

The objective of this proposed shariah structure of IVC is to formulate a shariah-compliant structure that will merge crowdfunding mechanisms to IVC in a manner that will ease micro, small and medium enterprises to raise capital without collateral.

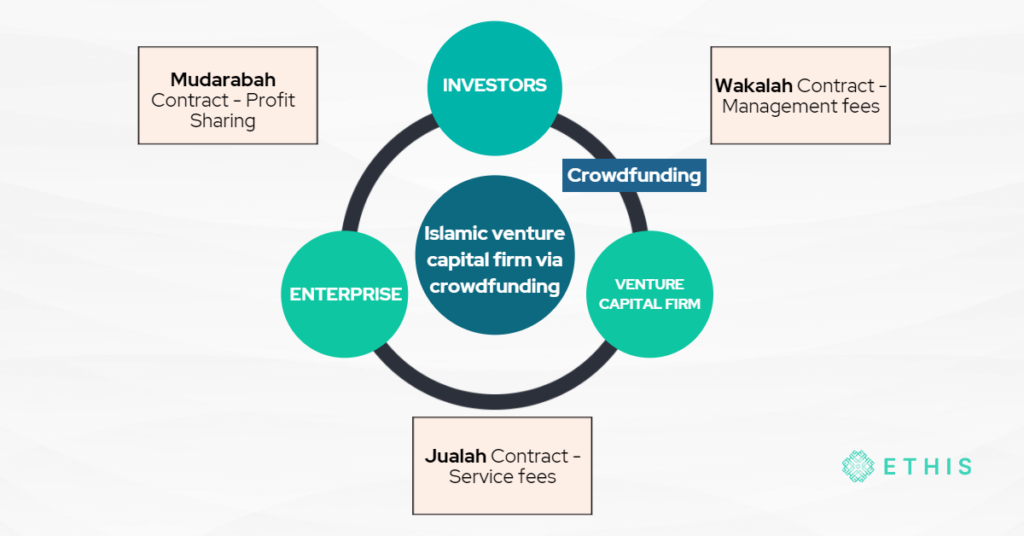

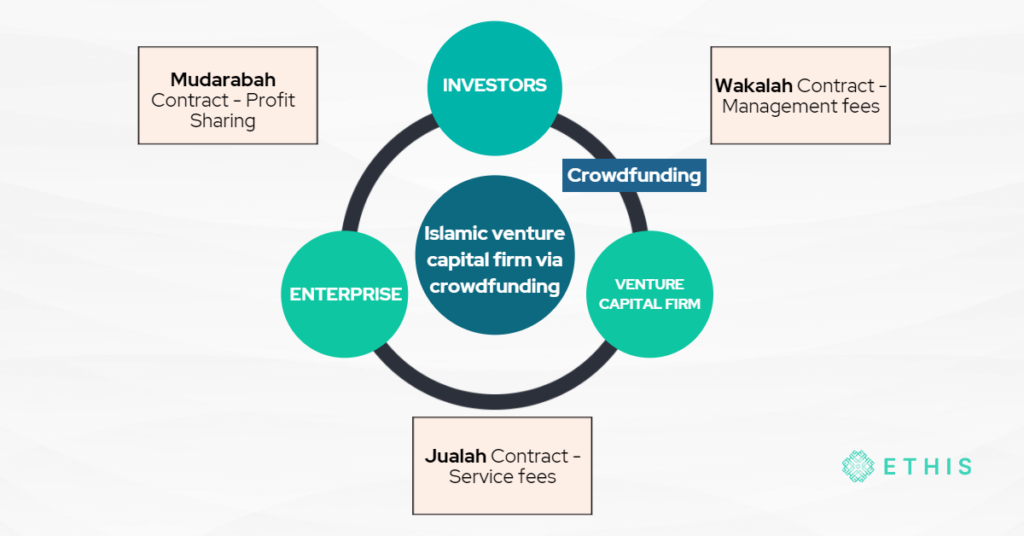

According to the visual above, the VC firm will be receiving service fees for the service they perform for the enterprise, which is to raise the needed amount for their funding. VC firms will provide the enterprise with support, guidance and technical skills, thus justifying the payment of service fees.

Through crowdfunding channels, VC firms will raise funds from investors. The investors will appoint a VC firm as their wakeel (agent) of the investors, to manage (channel) the fund to suitable projects/company that is chosen by them through a designated screening process. For this role and services, the VC firm is entitled to receive management fees from the investors and service fees from the enterprise. Therefore, wakalah (agency) and jualah (promise of commission) contracts will be used as the underlying contracts for the respective transactions.

The relationship of the investors and enterprise will be defined by the mudarabah agreement. Since in this structure, the investors play no direct role towards the enterprise and only provide funding, the investors fit perfectly into the description of a rabbul maal (capital provider). As in typical mudarabah contracts, the profit sharing ratio will be determined upfront between the rabbul maal (investors) and mudarib (enterprise), while the financial loss will be fully borne by the investors, except for the loss due to the negligence of the mudarib.

Through this proposed arrangement, it is believed that an innovative way to use IVC could be formulated. Given the advantages of IVC and crowdfunding, combining both can provide a wider reach out and better access. As most Islamic countries are categorised as developing countries, to put heavy reliance on investment from high net worth investors and institutional investors, like normal venture capital, seems unrealistic. Thus the crowdfunding method of pooling small individual investors are more practical in Muslim countries like how Ethis Group is implementing it.

Furthermore, such arrangements could give benefit to Islamic businesses and startups as IVC could provide alternatives for financing that comply with Shariah in terms of initial or working capital. Besides that, IVC could also assist in terms of training, mentoring, technical skills and guidance toward the businesses.

This proposed structure where IVF is combined with crowdfunding will advocate the use of profit-sharing contracts such as mudarabah and musharakah as a viable type of financing and at the same time decrease the reliance on small businesses towards debt financing.

Heavy reliance on debt financing will increase the risk of default for small, unstable businesses to service the interest payment. Thus accessible financing alternatives such as IVC via crowdfunding will be able to shift the reliance on debt financing to profit and risk-sharing financing.

There are, however, some limitations to the proposed IVC via the crowdfunding model. Given the objective to enhance Islamic countries’ level of investments and help enterprises and startups to attract Shariah-compliant funds, the proposed model must be accessible and affordable to everyone.

While the modern crowdfunding platforms are created and operated in a virtual world, the internet plays a major role in its successful implementation and user-friendly software which will fall within the ambit of FinTech will be required. As such, building such an infrastructure from scratch might be costly.

Conclusion

Although the most significant factor for the slow progress of IVC is due to heavy reliance on classical banking financial institutions, due to Fintech, the development of crowdfunding platforms in recent years has paved the way for IVC to rely on an alternative mode of financing.

This research concludes that IVC can be incorporated with crowdfunding. The Shariah structure proposed here is based on a tripartite relationship between the investors, venture capital firms and enterprises. Shariah contracts such as mudarabah and wakalah are the underlying shariah contracts used to ensure that the mechanism complies with shariah. This proposed model will assist micro, small and medium enterprises to raise capital in a shariah-compliant manner without collateral.

Read more about Islamic P2P Crowdfunding

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You