Most startups and small businesses struggle with funding. As a matter of fact, despite having great potential, some of these businesses do not necessarily achieve great success in the end due to a lack of capital. According to a study conducted by Jessie Hagen of the U.S. Bank, a staggering 79% of small businesses fail because of starting with too little money. Equity crowdfunding came onto the scene to provide an alternative source of funding for micro, small and medium enterprises, as well as the “unbanked”. But what in the world is equity crowdfunding?

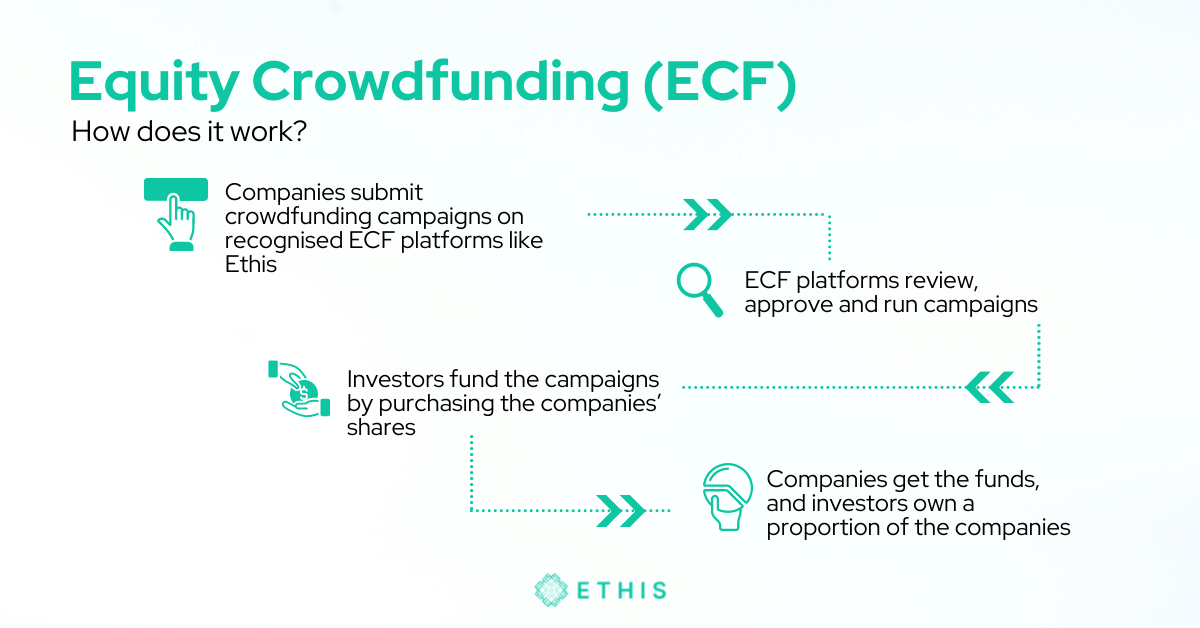

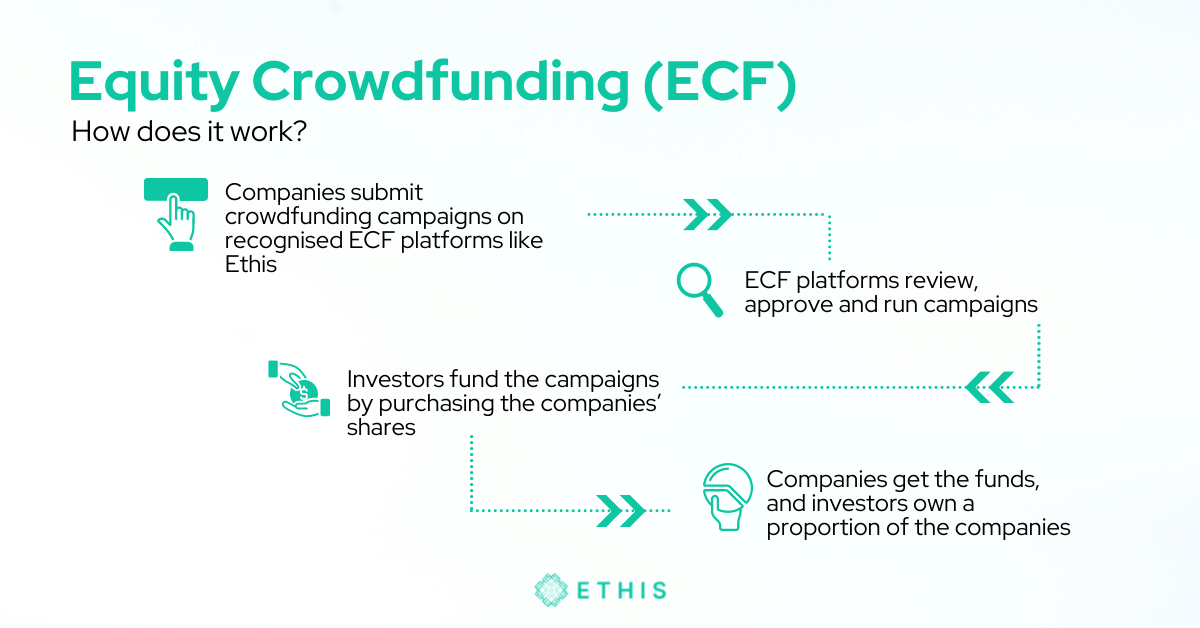

Equity crowdfunding, or ECF, is a method for private companies, known as issuers, to raise funds for their ventures via equity shares. The issuer offers their company’s equity in exchange for the funding from the ‘crowd’ or investors. In return for the money invested, investors gain a stake in the company and potentially earn their returns.

Equity crowdfunding: How does it work?

Related: Equity Crowdfunding (ECF) vs Peer-to-Peer (P2P) Lending

The advent of equity crowdfunding has disrupted and innovated the fundraising space for early-stage startups and growth-stage private companies by allowing a pool of investors to take part in the scene. In this article, we are going to cover everything you need to know about equity crowdfunding.

Before the advent of equity crowdfunding

Traditionally, businesses raise the financial capital they need by borrowing through banks, close circles, or by having investors who are interested in the ventures. But investing in early-stage or growth-stage ventures was only restricted to accredited investors and high-net-worth individuals, i.e. investors with a certain defined level of income or assets. It requires a high investment threshold that comes with high risks, and high potential returns.

Equity crowdfunding has made such investment accessible to everyday investors like most of us by offering a much lower investment threshold than it used to be. This opens the door for a pool of investors who are interested in equity investing to own a portion of a private company’s equity which was traditionally dominated by wealthy individuals.

Meanwhile, it offers the issuer an alternative financing mechanism at a much shorter turnaround time than the conventional bank loans which are notorious for their lengthy processes and stringent requirements. Equity crowdfunding is a win-win game for both the issuers looking to raise funds for their ventures and for investors looking to diversify their investment portfolios.

Equity crowdfunding offers an alternative financing mechanism to businesses.

Equity crowdfunding is rapidly gaining traction globally, not only in western countries but also in Southeast Asia regions including Malaysia. Let’s take a look at the equity crowdfunding scene in Malaysia.

A peek into ECF in Malaysia

In Malaysia, equity crowdfunding platforms are regulated under Recognised Market Operator (RMO) guidelines by the Securities Commission Malaysia (SC). The RMO guidelines set out registration requirements and impose a set of obligations applicable to equity crowdfunding operators. There are about 10 approved RMO under SC and Ethis Malaysia is the first shariah-compliant equity crowdfunding platform approved by the SC.

Related: Equity Crowdfunding (ECF) in Malaysia: At First Glance

SC was among the first in Southeast Asia to provide equity crowdfunding with a regulatory framework and formally endorsed it as part of the recognised capital market.

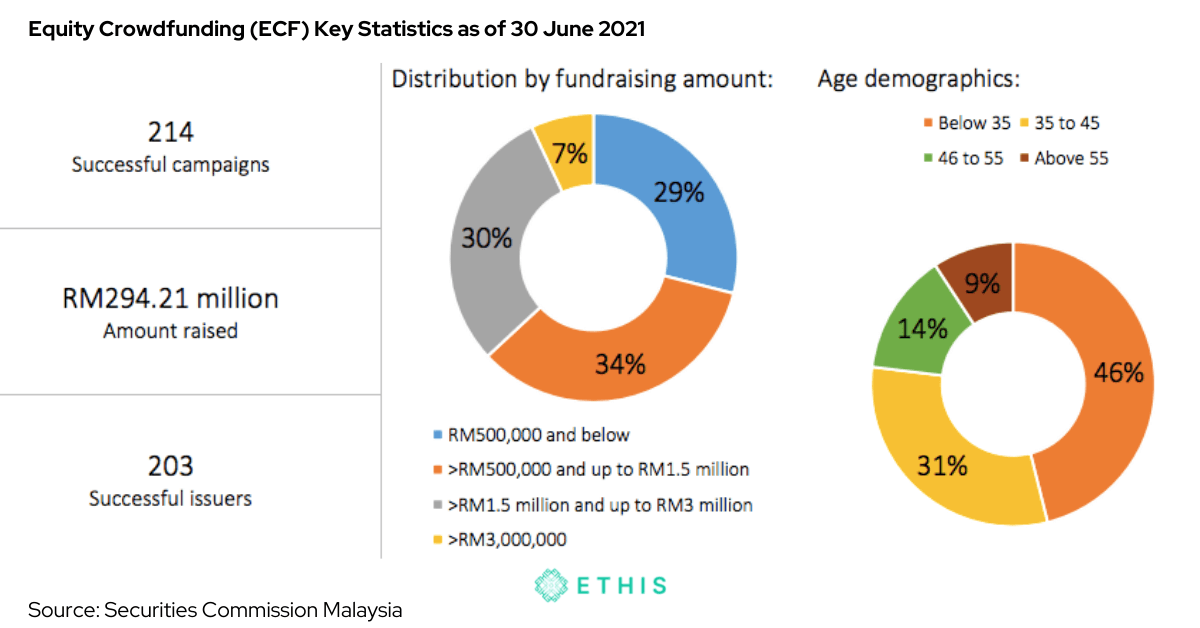

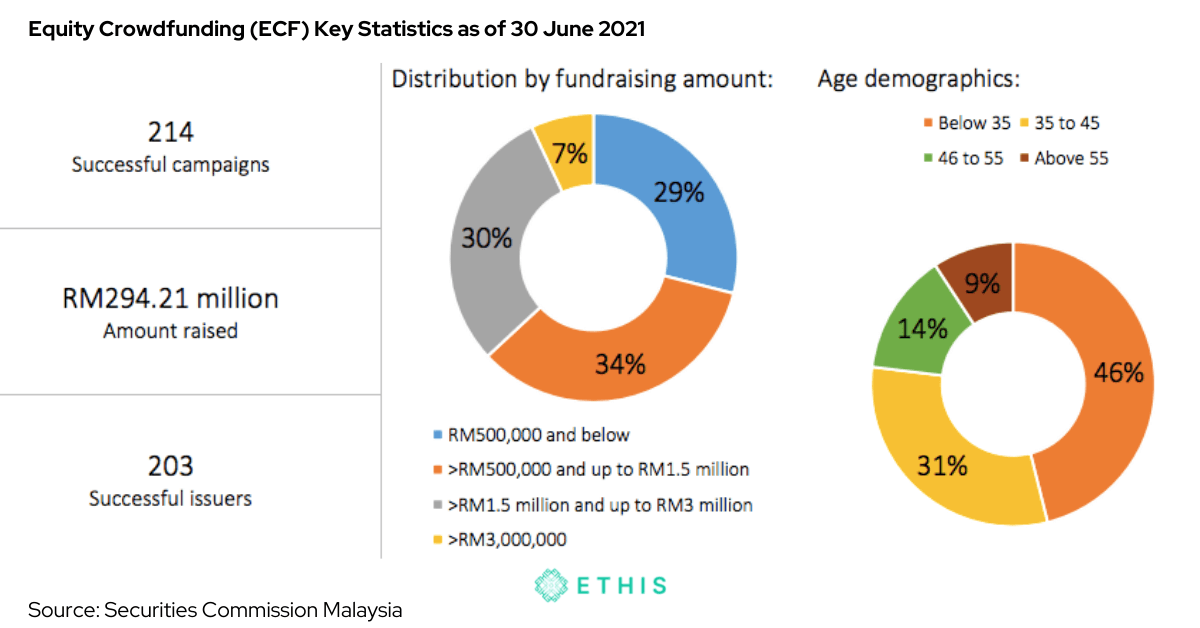

According to SC ECF Statistics as of 30 June 2021, 203 issuers have raised a cumulative of RM294.21 million in funding through 214 successful crowdfunding campaigns since 2016. The majority of issuers are based in Kuala Lumpur and Selangor and 60% of the businesses are technology-focused.

Equity crowdfunding key statistics since inception, as of 30 June 2020.

In terms of investors demographic, over half the investors are retail investors and most of them are aged below 35 years old to 45 years old, signalling a tech-savvy and financially stable demographic.

Who can invest via ECF in Malaysia?

Anyone can invest via equity crowdfunding but SC has classified investors into three types, retail investors, angel investors, and sophisticated investors. Each type has a certain investment limit based on certain income levels and assets.

|

No. |

Types of Investors |

Criteria |

|

1. |

Retail investors |

Anyone who is not an angel investor or sophisticated investor. The maximum investment limit for retail investors is RM5,000 for a single investment and no more than RM50,000 within 12 months. |

|

2. |

Angel investors |

Individuals who are tax residents in Malaysia with the following criteria: a) whose total net personal assets exceed RM3 million or its equivalent in foreign currencies; or b) whose gross total annual income is not less than RM180,000 or its equivalent in foreign currencies in the preceding 12 months; or c) who, jointly with his or her spouse, has a gross total annual income exceeding RM250,000 or its equivalent in foreign currencies in the preceding 12 months. Angel investors can invest up to RM500,000 within 12 months. |

|

3. |

Sophisticated investors |

There are three categories of sophisticated investors:

Sophisticated investors can invest as much money as they want – there is no investment limit for this group of investors but they must be registered under SC. You may refer to the full details for each category of sophisticated investors by SC here. |

Diversify your investment portfolio with equity crowdfunding

When it comes to investing, there is one most important rule that every investor should live by, i.e. “don’t put all your eggs in one basket.” To put all your eggs in one basket means to risk losing all the money you invest by depending entirely on only one investment portfolio for your money to grow.

Smart investors diversify their investments by spreading their capital across multiple investment portfolios. Depending on your risk appetite and financial goals, equity crowdfunding may make a good investment vehicle in your diversification strategy as it represents an additional investment asset class.

Diversify your investment portfolio with equity crowdfunding.

This means, with equity crowdfunding, you can diversify your investments beyond the traditional asset classes. Let’s weigh the pros and cons of investing via equity crowdfunding.

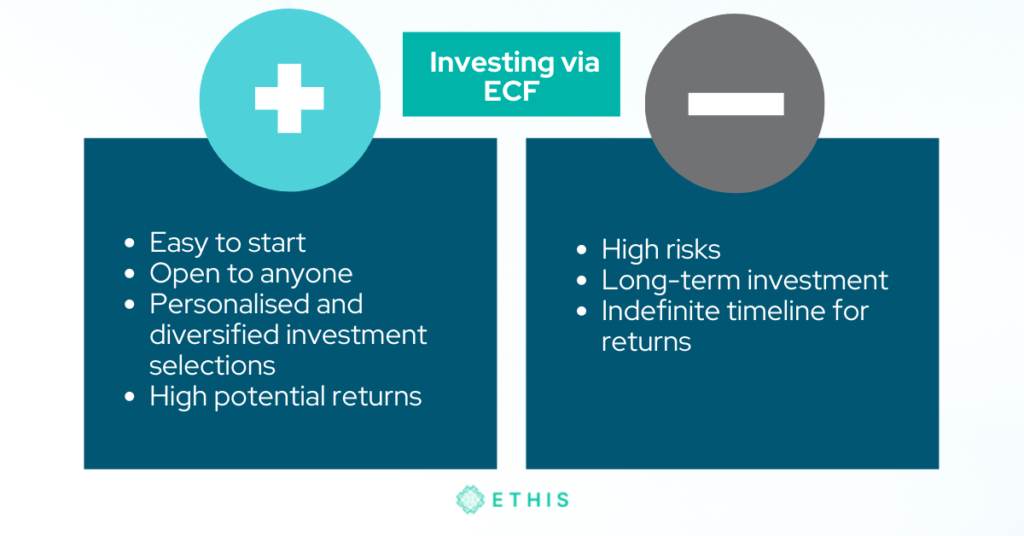

The pros and cons

PROS

1) Easy to start

Investing via equity crowdfunding is all done online. Getting started is relatively easy and hassle-free as everything is accessible at the tip of your fingers.

All you have to do is research and compare the various equity crowdfunding platforms available and their issuers. Make sure that the platform is legal, credible, and regulated. Once you have decided on the platform, complete the sign-up process, and you are good to go.

2) Open to anyone

As opposed to traditional equity investing which was restricted to accredited investors and high-net-worth individuals with certain income levels and assets to match the high investment threshold, equity crowdfunding makes it possible for everyday people to invest in early-stage startups and private companies by offering a much lower investment threshold.

At Ethis, you can start your equity crowdfunding investment journey from as low as RM1,000. Learn more at ethis.co/my.

3) Personalised and diversified investment selections

Unlike other investment options such as mutual funds and unit trusts that invest in a predefined portfolio chosen by the fund manager, equity crowdfunding investors have the liberty to decide which companies they want to invest their money in. The discretion lies in the hands of the investors themselves.

You can choose to invest in companies that resonate with you and diversify your investments by spreading your capital across multiple equity crowdfunding campaigns.

As an ethical and shariah-compliant investment platform, Ethis’ campaigns include distinctive and promising companies whose business operations are in line with the United Nations Global Impact Ethical standards and based on Islamic finance.

4) High potential returns

Investing in early-stage companies is risky but with high risks come high potential returns. While it’s likely that some equity crowdfunding investments can go bust, and you may lose all of your capital, so is the chance for the business to flourish and for you to profit from your investment. More on how equity crowdfunding investors can earn their returns in one of the subheadings below.

CONS

1) High risks

Investing is risky, let alone investing in early-stage companies. It carries a high degree of risk, including the risk of business failure and bankruptcy. In other words, should the business go south, odds are you may not be able to recover your initial investment.

As with any investment, your capital is not guaranteed and may be at risk. So you shouldn’t put all your eggs in one basket and only invest the amount of money you can afford to lose.

2) Long-term game with an indefinite timeline for returns

To quote Warren Buffet, “successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time.” And so is the case with investing via equity crowdfunding – it’s a long-term game. It may take years for investors to reap the returns, if at all.

How do investors earn returns from equity crowdfunding?

As with any investment, investing via equity crowdfunding does not guarantee returns but here are four of the more commonly known ways for equity crowdfunding investors to make money from the investment.

1) Share buyback

Unlike investing in stocks, equity crowdfunding investments are relatively ‘illiquid’, which means you can’t easily sell your shares and exit your investment. But as part of the exit strategy, some issuers may offer a buyback option at a certain target price within a predetermined time frame. This allows investors an opportunity to exit their investments and earn their returns.

One of our latest issuers, Baloy, which raised RM6.16 million in equity crowdfunding, one of the highest ECF amounts in Malaysia, for example, is targeting a buyback within 36 to 60 post-ECF fundraise, at a target price that matches the issuance price.

2) IPO

An initial public offering, or IPO, is another exit strategy offered by the issuers to equity investors. Generally, once a company reaches a certain size, it may wish to scale the business further by going public. Once the company is listed, investors have the option to exit their investment by selling their shares at a market-determined share price and enjoy the benefits of capital appreciation due to higher valuation at the time of IPO.

3) Mergers and acquisitions

One of the ways equity investors can exit the investment is when the company they invested in is merged with or being acquired by another company.

A merger is where two or more companies combine to form a single entity. An acquisition, on the other hand, is where another company purchases a majority of one’s company shares and takes control of the company direction. When either of these occurs, investors are presented with the opportunity to sell their shares at a higher price and exit the investment.

4) Dividends

Similar to investing in public listed companies, equity crowdfunding investors are entitled to earn dividends per annum should the company they invest in hits its projected net profit based on its projected financials for the year.

The dividends payout ratio varies from one issuer to another, depending on their targeted offer during the equity crowdfunding campaign. Investors still maintain their stake in the company while also receiving the dividend payments proportionate to their shares in the company.

Related: Crowdfunding: A New Way to Grow Your Wealth

Raising funds via equity crowdfunding

At a deeper level, equity crowdfunding offers a multitude of significant rewards to both the issuers and investors. Let’s explore a few key merits of this game-changing fintech product for businesses looking to raise funds.

1) Financial inclusion

In Malaysia alone, there was an RM80 billion funding gap where banks were not funding certain micro, small and medium enterprises (MSMEs). The advent of equity crowdfunding platforms helps bridge this funding gap by offering an avenue for these businesses which have been left out in the past to raise funds and scale.

“There is a whole lot of opportunity that comes in serving the ‘unbanked’ and circulating capital and resources to them in the real economy.”

Wan Dazriq, CEO of Ethis Malaysia

On the other hand, the traditionally high minimum ticket sizes and requirements for private company’s equity investing have resulted in the exclusion of a large group of society from actively participating in the capital markets. Equity crowdfunding plays a major role in changing this status quo. It has opened the door for everyday investors to circulate money directly to the real economy of MSMEs, SMEs as well as startups, thus allowing these businesses to have the capital they need to grow.

2) Easily accessible

In comparison to other sources of funding, the main perk of raising funds via equity crowdfunding for startups and SMEs lies in the much shorter turnaround time. At Ethis, for example, each campaign is only available for a maximum of three months, meaning, issuers will get their funds within just three months after the campaign has at least reached its minimum investment goal.

Raising funds via equity crowdfunding is relatively easier to obtain than through bank loans or venture capitalists due to its much simpler procedure and requirements. It does not necessarily require a proof of concept, nor does it need the business to be in operations prior, allowing new businesses and startups to take a shot. Rather, a successfully funded campaign gives great validation and social proof for the business, attracting follow-on investments from venture capitalists, institutional investors, and the likes for the next stage of funding.

“Equity crowdfunding is like a mini IPO and investors will provide you with goodwill in the market.”Umar Munshi, Group MD and Co-Founder of Ethis

Related: Venture Capital vs Equity Crowdfunding: Which method is better when raising funds for your business?

3) Not having to give up control while receiving support

Another perk of raising funds via equity crowdfunding is that issuers get capital from issuing shares while still maintaining the management of their own business.

Beyond money, equity crowdfunding is also about supporting businesses that one believes in. Issuers gain not only investors but also a community of avid supporters who believe in their cause and what their businesses have to offer. It is especially significant for social impact businesses.

“Angels and VCs bring expertise but the crowd brings customers and fans.”

Naval Ravikant, CEO, AngelList. investor in Uber, Twitter, Yammer and hundreds more

At Ethis, we believe that capital is entrusted to all of us to benefit humanity. We are the first shariah-compliant equity crowdfunding platform approved by the Securities Commission Malaysia. #CirculateGood with our Global Community of Impact Investors by investing in promising ethical and socially responsible companies in Malaysia via ethis.co/my.