When it comes to investing, there is one most important rule that every investor should live by, i.e. “don’t put all your eggs in one basket.” To put all your eggs in one basket means to risk losing all the money you invest by depending entirely on only one investment portfolio for your money to grow. Smart investors diversify their investments by spreading their capital across multiple investment portfolios. One of the investment options you can consider in your diversification strategy is equity crowdfunding. Before we weigh the pros and cons of equity crowdfunding diversification, let’s understand the basics of equity crowdfunding.

What is Equity Crowdfunding (ECF)?

In essence, equity crowdfunding is an online offering of a private company’s equity in exchange for funding from the ‘crowd’, or the public. Investors gain a stake in the company in return for the capital invested. It’s an alternative to conventional bank lending that offers a mechanism for early-stage companies to raise funds for their ventures.

Equity crowdfunding is rapidly gaining traction globally, including in Asian countries as bank lending in several Asian economies begins to slip amid a pronounced start-up boom.

This alternative funding mechanism allows average investors, like most of us, the opportunity to invest in a domain that was traditionally dominated by wealthy individuals, venture capitalists, and angel investors.

Related: Investing through Equity Crowdfunding (ECF): The Pros and Cons

Why You Should Consider Equity Crowdfunding Diversification In Your Investment Portfolio

Depending on your risk appetite and financial goals, equity crowdfunding may make a good investment vehicle in your diversification strategy. Let’s drill down into the five reasons.

1) Equity crowdfunding is open to anyone

In contrast to conventional equity investing that was only accessible to accredited investors and high-net-worth individuals, equity crowdfunding is open to anyone looking to diversify their investment portfolio.

This emerging investment asset class allows you the option to diversify your investments beyond the traditional asset classes to suit your goals and risk profile.

Related: Investing in Stock Markets vs Ethical Investment in Ethis Crowdfunding

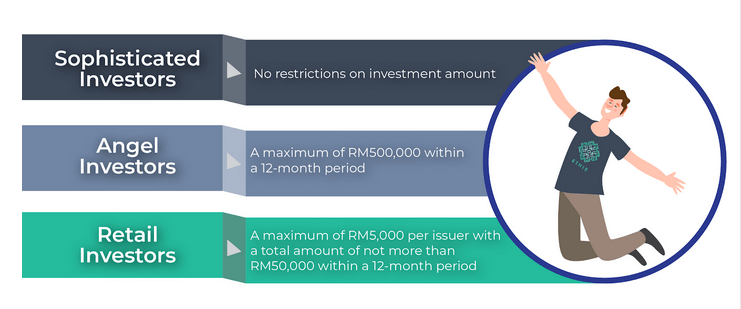

There is no investor profiling that will disqualify or restrict you from investing in this emerging asset class. But in Malaysia, investors are categorised by the Securities Commission Malaysia into three types: retail investors (average investors like most of us), angel investors (individuals with a certain income or personal assets), and sophisticated investors (high net worth individuals or entities, and accredited investors).

The two key differences between these types of investors are their income group and the maximum investment limit.

2) Relatively low minimum investment

Traditionally speaking, equity investing requires a high minimum investment, which in a way, translates to why it was only accessible to high-net-worth individuals. On the contrary, equity crowdfunding offers a much more affordable entry amount. You don’t need huge capital to get off the ground.

At Ethis, you can start your equity investment journey from as low as RM1,000.

The relatively low minimum investment makes it possible for any Tom, Dick, and Harry (or Ali, Ah Hock, and Muthu, in the Malaysian context) looking to have a dip in equity investing to play the field.

3) Long-term game

Except for your short-term financial goals, your investment plan is essentially your long-term savings plan. So it only makes sense that you have a couple of long-term investment options in your investment mix.

But there is an opportunity cost that you have to consider since long-term investments lock in your capital that could be used or invested elsewhere. This is why it’s important to align your diversification strategy with your financial goals and risk appetite.

Related: Crowdfunding: A New Way to Grow Your Wealth

Meanwhile, equity crowdfunding is a long-term investment. It may take years for you to reap your returns, if at all. The illiquid nature of this investment vehicle makes it suitable for those looking for long-term gain, notwithstanding the risks that come with it, which brings us to the next point.

4) It’s a high-risk investment

Investing in early-stage companies carries high risks. The business may not do well, there is a risk of business failure and even bankruptcy. Should the business go south, so will your investment. You may not be able to recover your initial investment and lose all of it.

However, diversification means you should also consider varying your risks. Since the nature of this investment is a high risk, you may consider adding equity crowdfunding into your high-risk investment portfolio as part of your diversification strategy. But remember, when it comes to high-risk investments, and any investment for that matter, only invest an amount that you can afford to lose.

5) The high risk comes with high potential returns

As with other types of investments, the higher the risk, the higher the potential returns. While it’s possible that the early-stage companies you invest in can go bust, and you risk losing all of your capital, so is the chance for the business to flourish and for you to win big.

Related: How to Earn Halal Money? The Money Mindset

The returns you can anticipate will depend on how consistent the business is in making profits – so you can earn your dividends, and how strong is the company’s exit strategy – so you can sell off your shares once the company has the financial capability to buy back your shares or go public.

Therefore, it’s crucial to carefully assess the company’s profile before deciding to invest. Research their founders, the problems they are solving or trying to solve, the market demand, the growth potential, proof of concept, if any, and other concerns that you may have.

Strategise Your Equity Crowdfunding Diversification via Ethis

At Ethis, we make it easy for investors to access this information related to issuers on our platforms by making it available on our platform. Most importantly, we don’t just accept any investment deals that come our way. We curate and filter them through, conduct thorough due diligence on each issuer, and ensure that their business is Shariah-compliant before having them on board. This is part of our standard operating procedure to manage the risks while maintaining quality issuers on our platform.

Ethis is a fintech, impact investment, and Islamic crowdfunding platform based in Malaysia with a growing global community of funders from more than 80 countries. We are one of the few firms licensed to operate investment platforms in multiple countries, including equity crowdfunding by Securities Commission Malaysia.

Grow your money ethically via equity crowdfunding at ethis.co/my.

Read more about Islamic Investing

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You