By Aneesa Ismail Rahman

Developing a successful business can be challenging.; it is considerably more difficult if you do not have access to startup funding. Equity Crowdfunding (ECF) may be the ideal option for your company if you have a good business strategy and the ability to build buzz around your brand.

An Overview: What is equity crowdfunding (ECF)?

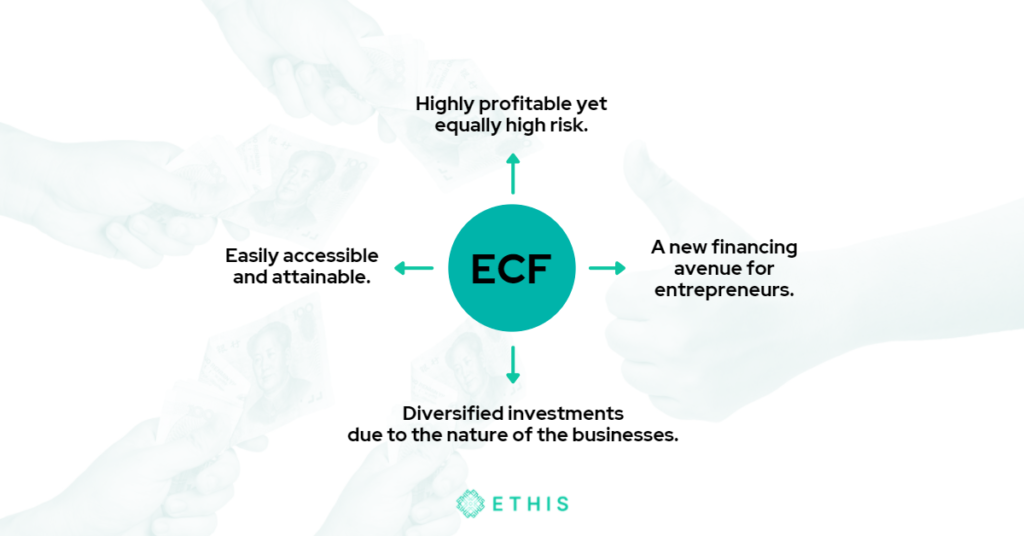

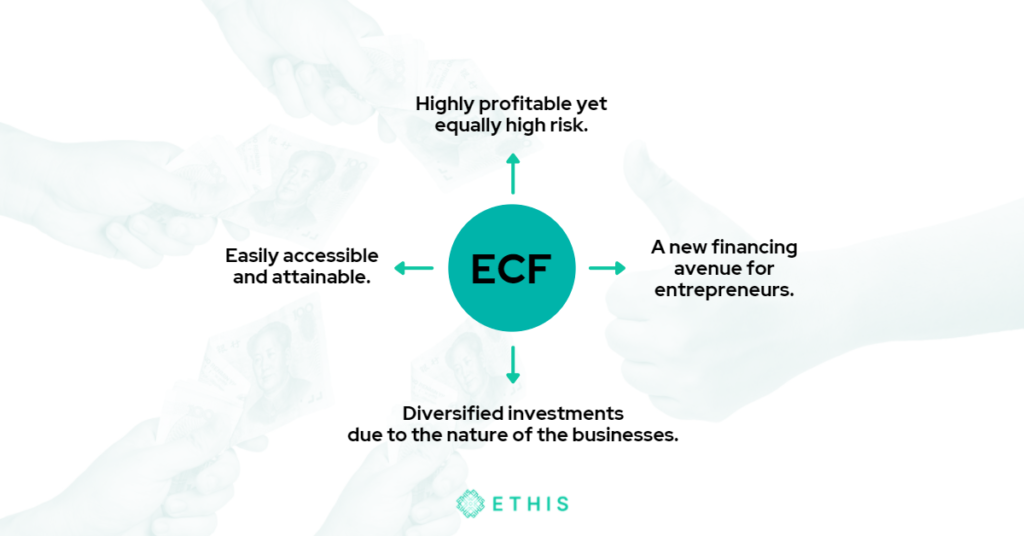

Crowdfunding is the process of raising money from the general public (the “crowd”), typically through online forums, social media, and crowdfunding websites, to support a new project or business. This is taken one step further with equity crowdfunding. Public investors receive a proportionate share of the business venture’s equity in exchange for relatively small sums of money.

Previously, company owners had to borrow money from friends and family, apply for a bank loan, approach angel investors, or go to private equity or venture capital firms to raise funding. They now have another alternative with equity crowdfunding.

According to Business News Daily, equity crowdfunding is becoming increasingly popular as a means of raising cash for a company. It is based on a concept of a large number of smaller investments. The concept is that raising small amounts of money from a vast number of people is easier than raising large sums of money from a small number of individuals.

Even the world’s largest corporations, such as Google and Amazon, began as startups. Therefore ECF enables ordinary people to participate right at the start of a potentially massive scaling process for companies.

How does equity crowdfunding work?

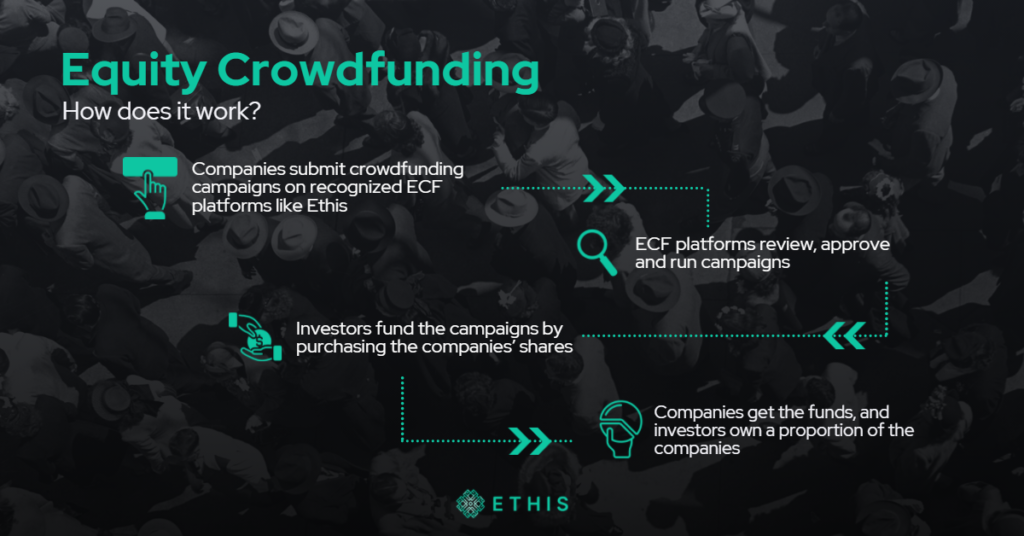

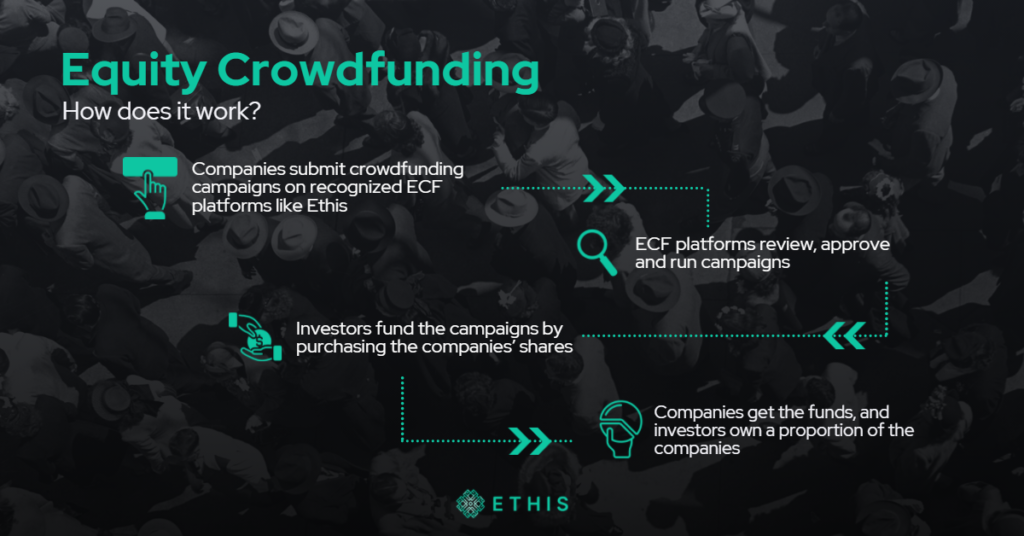

There are many online crowdfunding platforms you can use to kick off your business. You select a platform and then build an online profile that contains your business pitch as well as specific business information, such as financial records and a company history, that investors may use to assess growth prospects. In the end, investors want to know if there’s a strong chance that the company’s value will rise over time.

Who benefits from equity crowdfunding?

- For startups and small businesses, ECF opens the doors for founders and business owners to connect to a large pool of potential investors as well as a way to interact with them directly. ECF platforms act as a matchmaker and facilitator to investors, adding a degree of accountability to their investment experience.

- For firms with high growth potential, ECF is a viable alternative. It’s for entrepreneurs who wish to grow their small firm by diversifying their markets or adding new offerings.

Is equity crowdfunding (ECF) a good fit for your business?

Before making any decision, you must first consider the advantages and disadvantages of ECF and how they relate to your company plans.

The advantages of ECF for startups:

- Create thousands of brand advocates all around the world.

- Provide public validation through successful crowdfunding.

- Boost brand recognition.

- Maintain control over your company (ECF doesn’t give investors a hand in how it’s operated)

ECF’s drawbacks for startups:

You must be at the right stage of your company’s growth.

- You’ll need to raise brand awareness.

- You must be at the right stage of your company’s growth.

- Pre-aligned investment is frequently required to pique people’s interest in your product.

- It might be a lengthy procedure.

Something else to consider is that a large number of small investors will not be instructing you on how to run your business; rather, they will be going out into their communities and spreading the word about it, which may have substantial short- and long-term benefits.

What is the best way to get started with equity crowdfunding (ECF)?

Apply on a crowdfunding site to be eligible for ECF. Prepare a convincing presentation that includes marketing and project plans, financial forecasts, and a riveting video that leaves no question that your concept is unique and will pay off handsomely to attract investors.

Before making a decision, ask yourself these questions:

Is it true that you’re the new kid on the block?

If you’re a first-time entrepreneur or a company with little experience, traditional investors may be hesitant to invest. Since it is simpler to persuade someone to take a $100 risk on an unknown firm than it is to get someone to take a $100,000 risk, ECF may be the way to go.

Why do you require funding?

When it comes to raising money for a specific product development or project, ECF may be incredibly successful. Start a crowdfunding campaign for a specific expansion project or product campaign instead of simply asking for a large chunk of funding.

How much time do you have on your hands?

It takes time to find venture capitalists who are interested in investing in your company. It might also be difficult to ask for a large quantity of money from one individual. You’ll need to work hard to secure access from investors, pitch your company, and demonstrate that you’re a worthwhile risk. The time it takes to persuade a big group of people to give you, for example $500, on the other hand, is significantly shorter.

What portion of your business are you willing to part with?

Equity crowdfunding requires the distribution of ownership percentages to investors. Those investors will profit if your firm succeeds. If it doesn’t, they’ll lose money on their investment. Dividing the firm into sections for investors, on the other hand, dilutes your ownership. Consider how much of your ownership you would want to keep before beginning this process.

The equity crowdfunding market is growing

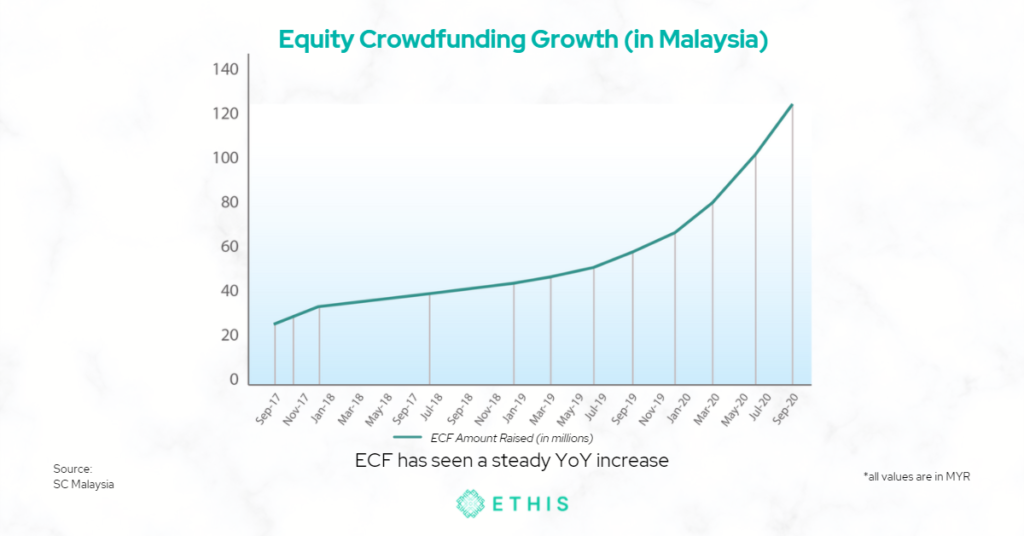

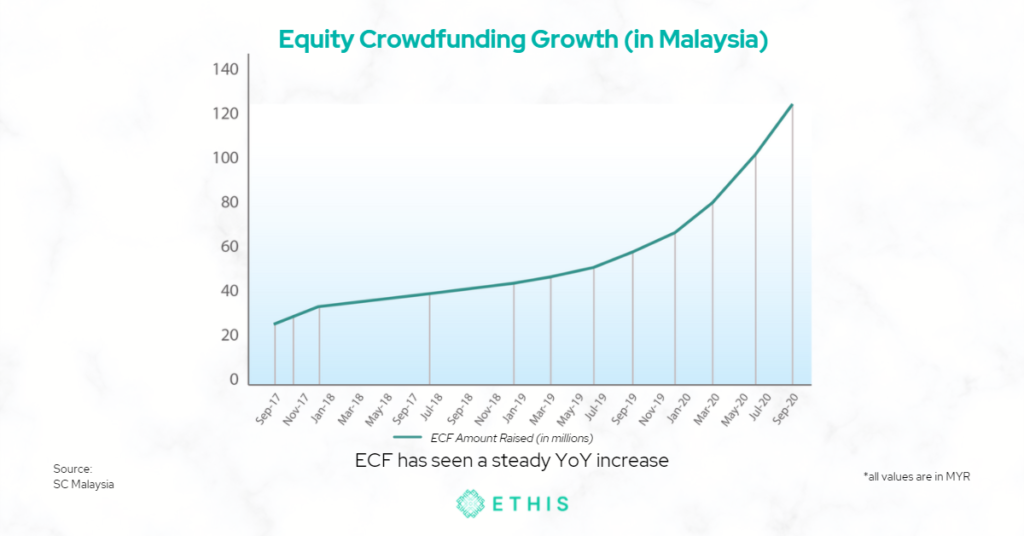

ECF is a relatively young sector, however it is rapidly growing . There are indicators that this alternative financing method might grow tremendously in the next few years when looking at marketplaces in other countries, according to?

For example, ECF laws in Malaysia are more favourable, allowing ECF businesses to develop much more swiftly. The Securities Commission (SC) of Malaysia oversees ECF and was one of the first in Southeast Asia to establish a regulatory framework for ECF and officially recognizes it as a valid capital market.

The general public in Malaysia has also reacted well to ECF in recent years, with over half of the investors being retail investors and the majority of the investors being under 35 years old, indicating a tech-savvy and financially secure population. According to the Malaysian Securities Commission, equity crowdfunding had granted RM129.64 million in capital to 113 successful issuers as of September 2020.

Ethis Malaysia is a Shariah-compliant ECF platform, forming part of the Ethis group. The following are some significant aspects about Ethis:

- A trustworthy, fully Shariah-compliant ECF platform in Malaysia.

- Has a solid reputation and a proven track record.

- Approved by the Securities Commission of Malaysia.

- A highly supportive team and community.

Take a look at this link for more information on how to raise funds through Ethis.

Final thoughts

Building a flourishing business isn’t simple, but it’s even more difficult when you don’t have access to funds. Private firms used to have few choices for obtaining capital, but ECF now provides entrepreneurs access to thousands of investors seeking the next great idea.

This is not only a great method to raise a huge sum of money, but it can also assist your marketing by generating a lot of buzz around your company. When you raise millions of dollars from investors all around the world, people will start talking about your company and become brand advocates, which is almost as important as the money you raise.

What’s holding your company back from taking off? Your startup will ascend to greater heights with the help of Ethis ECF!

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You