Balancing faith with financial matters is one of the greatest challenges for Muslims today. The dunya (worldly life) demands money for survival, while the deen (religion) reminds us of our true purpose: to worship Allah ﷻ. So how does a Muslim handle money in a halal, balanced way? Here are six timeless yet updated tips for 2025.

Get Rich or Die Trying? No Thanks.

A big house, luxury car, or dream vacation may look attractive and there’s nothing wrong with enjoying Allah’s blessings. But wealth should never be the ultimate goal.

As Muslims, we know Allah ﷻ created us to worship Him, not to burn ourselves out chasing status or net worth. Therefore, its Muslim aim in life should not be limited to working to death in pursuit of a higher status and a bigger net worth. This dunya is temporary, and true success lies in the Akhirah.

The fact remains, however, that one does need to pursue a halal income to provide for oneself and one’s family. Allah ﺳﺒﺤﺎﻧﻪ ﻭ ﺗﻌﺎﻟﻰ is ar-Razzaq, the Provider, but we must do our part—because bills won’t pay themselves and food won’t appear without effort.

There’s No Wealth Like Halal Wealth

For starters, we should only pursue income strictly from halal means. Be wary of engaging in jobs or businesses that sell haram products, such as alcohol or interest-based securities.

It is also pertinent that you, as a Muslim, ensure the transparency and fairness of all your transactions; never cheat or defraud anyone (Muslim or not) for the sake of selfish or short-term gains. There is indeed no barakah in haram earnings.

In addition, extra income should always be put to productive use, as hoarding is frowned upon in Islam. Don’t be a miser or get too attached to money and worldly possessions. Plus, as you know, keeping money under your mattress or in the bank will only be detrimental as it will lose value over time thanks to inflation. Inflation refers to the ever-increasing cost of living, which results in the loss of value of money.

What are some examples of halal investments to produce halal money?

One way to guard against inflation is through halal investing. Thankfully, the Islamic finance industry has grown rapidly in the last decade. By 2028, global Islamic finance assets exceed $7.5 trillion (ZAWYA data), offering Muslims more choices than ever.

Some halal investment options include:

Islamic Crowdfunding & P2P Platforms

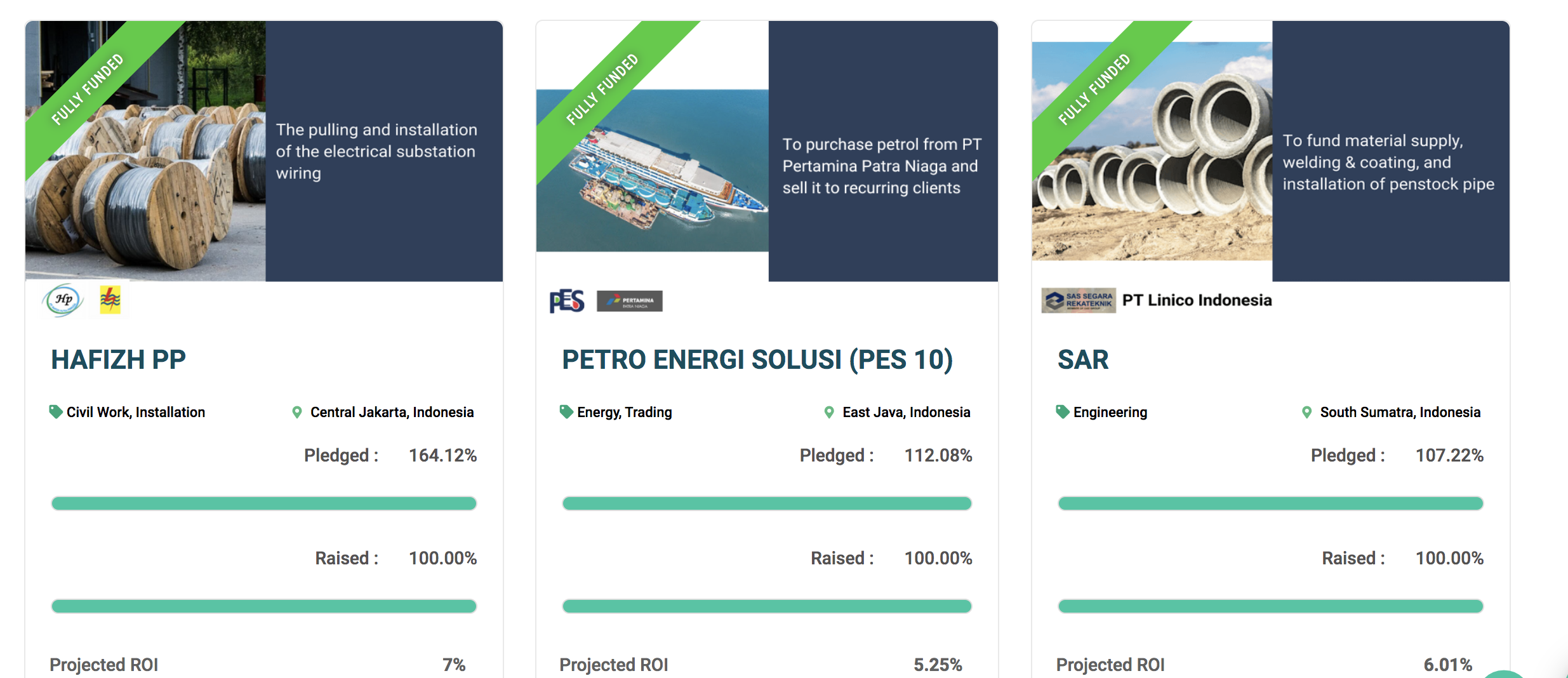

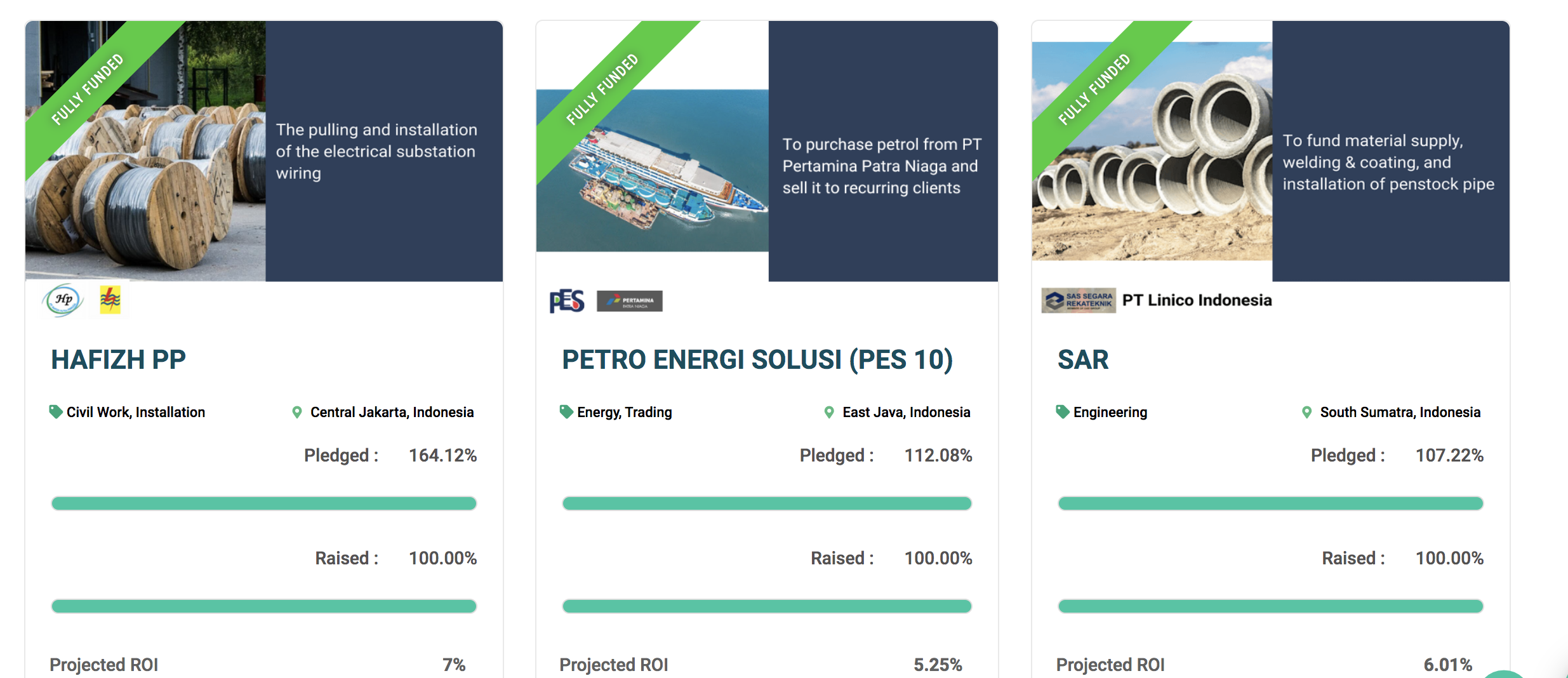

Islamic investment through crowdfunding is one such platform and service that is fast gaining in popularity, especially so for investment crowdfunding where you can either invest in a company or a project.

One example is Ethis, which through its P2P platform, allows investors to dip their hand into impact-driven halal investments in the supply chain industry, among other projects. Crowdfunding breaks the wealth barrier by allowing a group of investors to come together online to each contribute different amounts to the campaign. Ethis has facilitated investors from more than 84 countries to invest directly in projects in Indonesia to share in the profits of local projects.

Real Estate Investment Platforms

Companies like Yielders (UK) and other global startups make property investments more accessible—even to small investors—without needing large capital upfront.

Shariah-Compliant Robo-Advisors

Platforms such as Wahed, ShariaPortfolio, and Cur8 Capital provide Muslims with tailored halal portfolios, balancing risk, goals, and values. These tools also extend into property and alternative investments, making it easier to diversify while staying compliant with Islamic principles. AI-driven robo-advisors are becoming more advanced in automating portfolio management, helping investors align both financial growth and faith-based values.

Sukuk (Islamic Bonds)

While returns are usually moderate, sukuk remain a safe, low-risk option. They provide stability for those looking to preserve wealth without engaging in riba.

Alternative Investment Platforms and Funds

For those seeking a more structured investment approach, HASAN.VC offers a leading halal venture capital fund dedicated to nurturing innovative startups. The fund specializes in identifying businesses with high growth potential while ensuring strict adherence to Shariah principles.

By investing through HASAN.VC, individuals gain access to a professionally managed and diversified portfolio. This approach spreads risk across multiple ventures, while maximizing opportunities for returns in ethical and future-ready industries.

Most importantly, HASAN.VC allows investors to grow their wealth with peace of mind, knowing their capital supports ventures that create real societal impact while remaining fully compliant with Islamic values. Interested investors can explore opportunities directly at HASAN.VC.

Swap Haram for Halal—Start Today

If you have money in haram investments—like interest-based bonds, CDs, or stocks tied to impermissible products—the best course is to exit and give away any gains as sadaqah.

If the loss feels too heavy, scholars advise making a sincere intention to switch as soon as practical.

If you’re burdened by credit card debt (which in 2025 still carries extremely high interest), restructure your budget and prioritize repayment. Then make the intention to avoid credit card debt in the future.

Mortgages remain a major challenge. Conventional interest-based loans are not permissible, but Islamic home financing options (e.g., Guidance Residential, UIF, Ijara financing models) are expanding across more countries.

Be prudent—avoid overspending on houses or cars that will tie you to debt for decades.

Keep Your Eyes on the Prize: On building halal money, focus on the end goal

Tracking finances may feel as exciting as watching rice cook, but it’s essential. Without keeping an eye on your income and expenses, money management quickly slips out of control.

There are many tools and apps that make this task relatively easy. One such app is Kestrl, a money management app that allows Muslims to budget, save and invest in line with their values.

It helps you to aim and think of your long-term goals. Instant gratification is fun for a while, but the novelty soon wears off when you are always broke and buried in bills. There truly is greater satisfaction in striving towards a juicy goal and accomplishing it through hard work and persistence.

Live Moderately: Waste Not, Want Not

Moderation is a principle of Islam. Spending wisely doesn’t mean living miserably; it means avoiding extravagance and waste.

In 2025, consumer culture is louder than ever, with constant ads pushing us to buy more. As Muslims, we must resist excess and be grateful for what we already have. Remember, wastefulness is a form of ingratitude.

Gratitude Turns Wealth Into Barakah

Take time daily to reflect on your blessings. Maybe you’re not where you want to be financially, but gratitude softens the heart and attracts more rizq. The Prophet ﷺ said: “Whoever is grateful, Allah increases them” (Qur’an 14:7).

Increase Your Real Wealth: Give Back

True wealth isn’t in accumulation but in giving. Charity—whether financial, time, or skills—never decreases wealth. On the contrary, it purifies money and multiplies blessings.

In 2025, Muslims worldwide are also using Global Sadaqah and platforms to give instantly across borders. Whether supporting orphans, funding wells, or backing education, your contribution has lasting impact.

Final Thoughts: Halal Money as a Path to Success

Balancing deen and dunya in financial matters isn’t easy—but it’s achievable. Earn only halal, avoid debt where possible, invest wisely, spend moderately, give generously, and always stay grateful.

Money is a tool, not the goal. The real prize is a heart at peace, wealth with barakah, and success in both dunya and Akhirah.

2 Replies to “Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance”

Hey, Thank you for taking the time to write this. I have to start blogging again soon ugh.

Thank you I have made big halal money

Top Posts

Islamic P2P Crowdfunding Explained

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You

Islamic Crowdfunding Platforms: A Possible Tool for Financial Inclusion