By Fazna Fazmi

From youngsters to experienced professionals, people of all ages are being taught to think of themselves as “competent,” and this idea is permeating our culture. Modern human resources departments at companies and cutting-edge colleges are experimenting with competency-based education and are good examples of this kind of learning environment.

The Holy Quran narrates the story of Prophet Musa as to how he was hired by Shuaib based on his competency level. The story begins with Musa, who after escaping Egypt, enters the town of Madyan and helps two women struggling to water their sheep.

Their father invites Musa to reward him, and at that instance, one of the daughters says: “O my father, hire him. Indeed, the best one you can hire is the strong and the trustworthy.”[Surah Al-Qasas 26]. The above Quranic verse indicates that even Islam encourages choosing competent people to do the right job the right way.

Islamic Banks and Financial Institutions need to follow these steps too. Finding and training employees is vital with ever-growing technology and new trends emerging. Even though Shariah’s rulings do not change, the world is changing. The way the world does banking is different from the yesteryear generation. Cryptocurrency, cloud financing, and blockchain technology are taking the lead in the industry, and Islamic Banks should evolve accordingly by adapting to the precise Sharia’h interpretation.

It is essential to develop competency with a design thinking mindset. It is a process for solving problems by prioritising the consumer’s needs above all else. It must rely on observing, with empathy, how people interact with their environments and employs an iterative, hands-on approach to creating innovative solutions.

In order to provide innovative solutions for sprouting consumer needs using design thinking, Islamic Banking and Finance institutions should develop a competency framework.

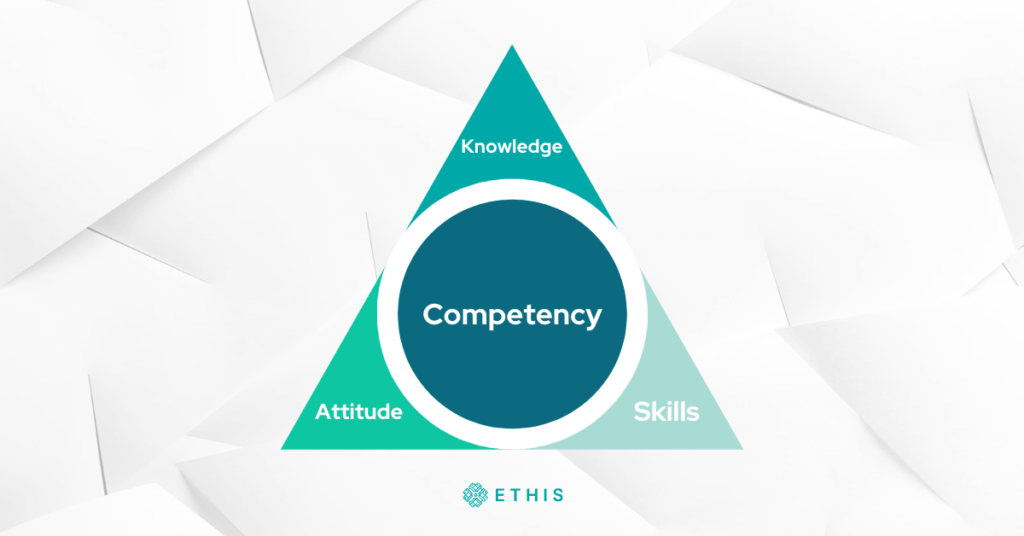

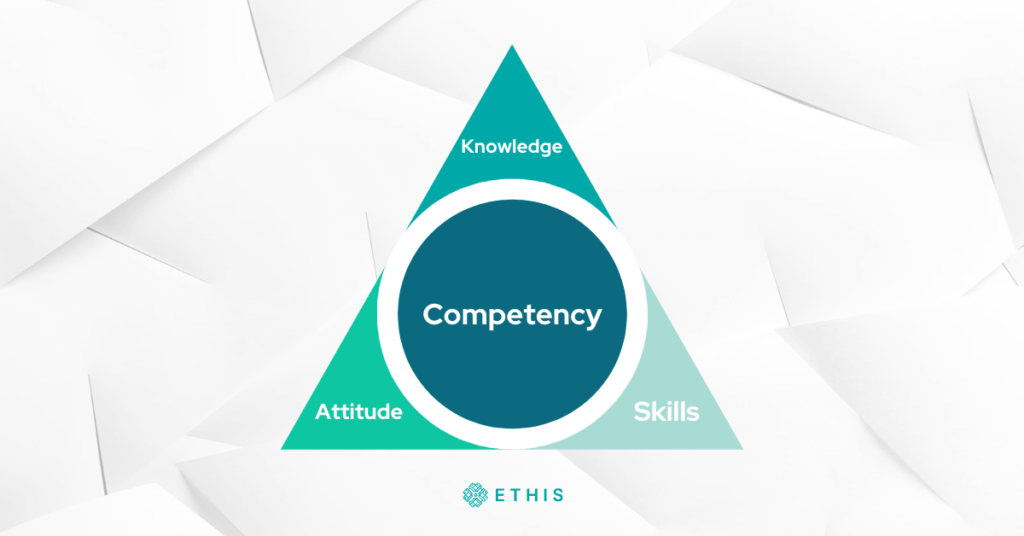

In such a framework, three attributes can be discussed:

1) Knowledge

Creating a culture where knowledge is accumulated, stored, and efficiently shared may dramatically boost Shariah compliance, productivity and employee satisfaction in Islamic Finance Institutes. Shariah compliance is not only about the lack of riba (interest). It is also about financial literacy and inclusion. Every choice an IFI makes is based on the knowledge they possess. Hence, it is critical to developing team members’ knowledge and expertise.

“The seeking of knowledge is obligatory upon every Muslim” [Baihaqi, Mishkat]

2) Skills

Sufficient skills are required for the Islamic financial sector to grow and compete with its conventional counterpart. It is essential to have well-trained and experienced employees. Islamic financial organisations are thus on the prowl for qualified personnel. A lack of qualified workers slows the Islamic finance industry’s growth. It is not only a matter of a lack of knowledge.

The paucity of Islamic finance specialists may be attributed to a shortage of training institutions and schools that provide Islamic financial capabilities. Another factor contributing to the lack of expertise in the market is the existing inexperience of Islamic financial institution employees. Hence, it is crucial to develop a system to develop skills in this industry.

“Read! And your Lord is the Most Generous, Who taught by the pen—taught humanity what they knew not.” [Surah Al-`Alaq, 3-5]

3) Attitude

This is a representation of an individual, goals, personality and one’s organisation. The correct attitude plays a significant role in any situation. When faced with hardship, the outlook a person has about it shapes the response, the capacity to learn and develop, the ability to overcome obstacles and the magnanimity to form connections with others. This attitude is needed for the Islamic Finance Industry to grow. A mindset of positivity and the courage to drive the industry forward is needed to be developed in employees.

“It is out of Allah’s Mercy that you (O Prophet) have been gentle in your dealings with them – had you been harsh or hard-hearted, they would have dispersed and left you – so pardon them and ask forgiveness for them. Consult with them about matters, then, when you have decided on a course of action, put your trust in God: God loves those who put their trust in Him.” [Surah Ali ‘Imran 159]

A competency framework for all

A competency framework should be developed on a platform whereby it could reach both the yesteryear generation and generation Z, the drivers of the future. This younger generation does not need a trainer, but they need training. They prefer a simulated training environment where the concepts are taught on the job.

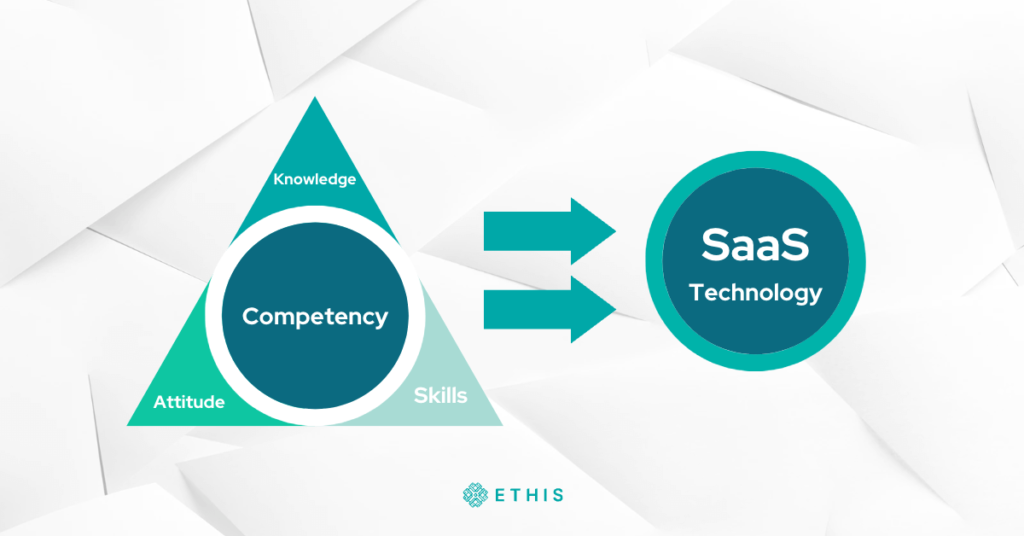

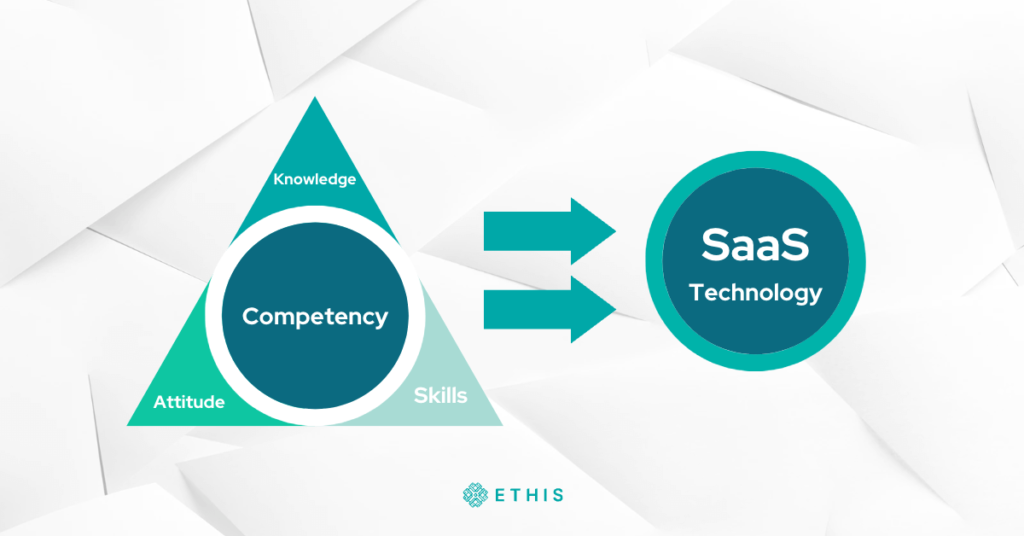

Technology plays a significant role in bridging the requirement and solutions for developing competency. Financial Technology is not only for banking, investment, insurance (takaful) and wealth management. It can also be used for developing talents.

Software-as-a-Service (SaaS) is a program licensing model in which access to the software is supplied on a subscription basis, with the software being housed on external servers rather than on servers maintained in-house.

Using the SaaS platform, Islamic Banks can develop centralised training solutions where knowledge, skills and attitude related programs, training, and digital classrooms are shared amongst the employees.

This is a centralised system where the central banks of each country can host, and each bank can customise this software suited to each of their banks.

SaaS works through the cloud delivery model. A centralised Islamic Finance software solution provider will host the application and related data using servers, databases, networking and computing resources.

The application will be accessible to any device with a network connection by other banks. SaaS applications are typically accessed via web browsers. Domains can be customised for each bank. Nevertheless, the Islamic finance industry can synergise on the data and training programs, so that competency could be developed using digital modes.

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You