By Hanan Hussain

The Islamic economy concerns itself with the “Social Dimension” as the core of the entire system. Thus the larger societal interest is given preference over the individual interest. This is so because it is not a man-made system based on serving vested interests, but a divinely revealed system. Thus the Islamic economy focuses mostly on social aspects and overall development in a broader perspective. Islamic Social Finance which is very much part of it could be the best option for community development and economic empowerment as we know it.

What is Social Finance?

Social finance is aimed at creating positive social and environmental outcomes for both investors and society. The term “Islamic Social Finance” refers to financial practices that are based on Islamic ideals and meant to help society. Zakat (almsgiving), Waqf (endowments), Sadaqah (charity), and Qard Hasan (interest-free loans) are among these practices.

In the present global context, Islamic Social Finance can contribute immensely in achieving the UNs Sustainable Development Goals and gearing up to face the challenges of the pandemic.

The three major fund sources that are part of Islamic social finance are Zakat, Sadaqah and Waqf. As per global statistics, it is estimated that more than 700 million people live under extreme poverty conditions. They struggle to fulfill their most basic needs such as food, access to clean water and sanitation, shelter, health and education. Most of these people are living in predominantly Muslim societies. Due to the pandemic, this estimation will further increase. Islamic Social Finance can therefore be mobilized to channel the charitable wealth collected through Zakat, Sadaqah and Waqf.

We here propose to highlight the role of Waqf in alleviating the hardships faced by the community and how it can effectively contribute to the betterment of the society amid this pandemic and even a post-COVID-19 scenario.

What is Waqf?

Waqf or endowment in perpetuity is an important component of Islamic Social Finance.

- Waqf means holding certain property and preserving it for the confined benefit of certain philanthropic activities and prohibiting any use or disposition of it outside its specific objectives.

- Waqf also can be defined as a form of “Sadaqatul Jaariyah” (continuous charity), as it is created by giving away an asset that produces benefits/revenues for a targeted objective permanently.

Waqf as Lifestyle – Waqf Culture

Throughout Islamic history, and ever since the time of our Prophet Muhammad (Peace Be Upon Him), Waqf has played a remarkable role in the betterment of Muslim societies. Most of the welfare and social services in the Islamic world were provided through Waqf institutions. Almost everybody at that time benefitted from Waqf resources.

In the noble Quran, we find the Beautiful Loan (Qard Hasan) mentioned six times with promising multiple folds in returns hereafter. But did you know that Waqf is the most promising Sadaqatul Jariya – benevolent loan – given to Allah? It is an eternal investment. There is a hadith: “Give it in waqf and spend from its produce” (Sahih Muslim). During the Prophet’s (PBUH) time, it was more or less a lifestyle, so much so that Jabir Ibn Abdullah said: “Every companion who had the capacity established a waqf” (Al Mughni by Ibn Qudama).

The concept of waqf was an important tool for the development of the Muslim city-state of Medina. Encouraged by the Prophet (PBUH), his companions formed Awqaf of gardens, wells, fruiting trees and orchards to support the residents of Medina. Each companion was eager to reap the rewards of this powerful concept. The most profitable investment in terms of return on investment (ROI) is the waqf of the Third Caliph Usman Ibn Affan which continues to this day, even after 1400 years. The Waqf “Bi’ir Rummah” he founded grew date palms and the revenue was utilized to support the poor and orphans though half of it was reserved for reinvestment. At present, the waqf generates revenue of approximately 50 Million Saudi Riyals per annum.

Another important Waqf was the Waqf of Umar Ibn Khattab, the Second Caliph of Islam. When Caliph Umar acquired land in Khaibar, he asked the Prophet (PBUH): “O Prophet of Allah, I have gained a valuable piece of land in Khaibar and I do not have any other thing more valuable than it. What do you command me to do with it? The Prophet S.A.W replied: “If you wish, you can give its benefit to charity while preserving it. So that it can no longer be sold, nor bought, nor may it be possible to give it away or bequeath it”. Hazrat Umar dedicated the land to the benefit of the poor and needy relatives, to set free slaves in the way of Allah and to provide for guests and travellers.

Another example is the Zubaida Waterway in Mecca, which is an extensive system of tunnels over 10 miles to direct the spring water to the city. This waqf was initiated by Zubeida, the wife of the famous caliph Harun al Rashid.

Al Azhar University founded in Cairo, Egypt in 972, is the world’s oldest and most renowned of all Islamic educational institutions and has always been financed by waqf properties. Al Noori School in Damascus was built as a Waqf by Sultan Noor al din Al shahid. The school served students from all over the Muslim world. Maintenance and all of the services offered were funded by the revenues from awqaf. Al Noori Hospital in Damascus (Built in 1145) and Mansuri Hospital in Cairo (Built in 1248) were also financed by awqaf.

Throughout Islamic history Waqf institutions have continued to grow rapidly with the establishment of thousands of schools, madrasahs, libraries and universities. Due to the motivation, thousands of individuals regardless of self-interest endowed their properties for the wellbeing of society.

In this manner, houses were converted into inns for travellers, palaces were converted into hospitals and universities, wells and waterways were built to provide free water, hospitals were constructed to treat patients freely, schools were built to provide free education and public kitchens were established to feed the poor and travellers.

As Dr.Hendri Tanjung, Chairman of the International Council of Islamic Finance Educators (ICIFE), Indonesia famously noted:

“Thanks to the prodigious development of the Waqf institution, A person could be born in a house belonging to a waqf, sleep in a cradle of that waqf and fill up on its food, receive instructions through waqf-owned books, become a teacher in a waqf school, draw a waqf-financed salary and at his death, be placed in a waqf-provided coffin for burials in a waqf cemetery. In short, it was possible to meet one’s needs through goods and services mobilized as waqf.”

Sadly, shortly after the great wars, the world changed dramatically. 20th century geopolitics ushered in a new world economy. New nation-states were formed but the glory of waqf was lost. Therefore it is time to focus again and reinvent waqf institutions to meet 21st century challenges.

Categories of Waqf

Waqf can be categorized into three types based on the target service.

- Waqf for religious needs: Many waqfs were established to look after Masjids and madrasahs

- Waqf Institutions for social welfare: Beneficiaries of these waqfs are usually the most vulnerable sections of the community as well as to provide welfare services to the general public.

- Family Waqf: This kind of waqf rarely exists now. It is primarily meant for family management.

Progress of Waqf

- Throughout much of history, the most popular form of waqf was property waqf. So Schools, universities, hospitals, libraries and Inns were built or donated.

- Then Land Waqf, especially agricultural lands were given as waqf for income generation.

- After this, many waqfs were established to provide services such as food, water, health, education and many more.

- In modern times, Cash waqf was introduced as an innovative form. Many waqf funds were developed. These funds were invested in many profitable fields and sectors. Income generated from these waqfs has been used to provide specific products and services. Due to its flexibility, it enabled benefits to be distributed to the poor in any location and for different kinds of needs.

Today we come across many issues, such as climate change, disasters, wars and conflicts and now the COVID-19 pandemic as well as the challenges encountered in achieving sustainable development goals. So we have to focus on waqf institutions as a robust mechanism to sustain emerging social needs. Now the waqf concept has been developed into the following types to meet the present-day context.

- Waqf for Educational and Human resource development

- Waqf for Healthcare services

- Waqf for Emergency relief and environmental protection

- Waqf for Water and sanitation

- Waqf for Women empowerment and Orphans care

- Waqf for Micro Finance services

- Waqf for Employment and Income generation

Waqf and Sustainable Development Goals

A study released by the Islamic Development bank on Waqf based development and Sustainable development goals highlights three focus areas.

- Poverty alleviation

- Improved access and quality of health services

- Improved quality education.

Another study published by Mohamed Abdullah in 2018 in the International Journal of Social Economics under the theme “Waqf, SDGs and Maqasid al Shariah” states: “Waqf assets are estimated to reach USD 1 Trillion worldwide. So it is possible to realize them if waqf assets can be managed productively and can get a rate of return 10% per annum, then every year there will be global funding of USD 100 Billion from the benefit of Waqf”

It has been noted that waqf has a very flexible nature of implementation when compared to Zakat. Funder specifications and beneficiary specifications are open and flexible. Therefore it can be a robust alternative source of finance to serve society. Almost all Sustainable development goals can be accommodated in such a system for easy, practical implementation.

Islamic social finance holds a lot of promise in terms of improving social well-being and environmental sustainability. Islamic social finance systems such as waqf, if properly designed, managed, and utilised with transparency, accountability, and efficiency, have the potential to successfully achieve the SDGs.

Double-effect and wealth management

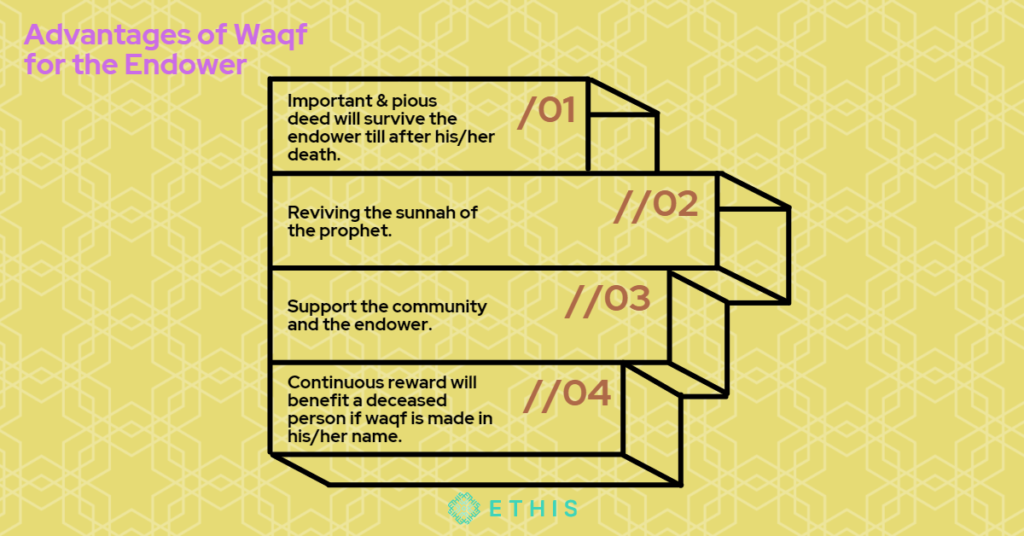

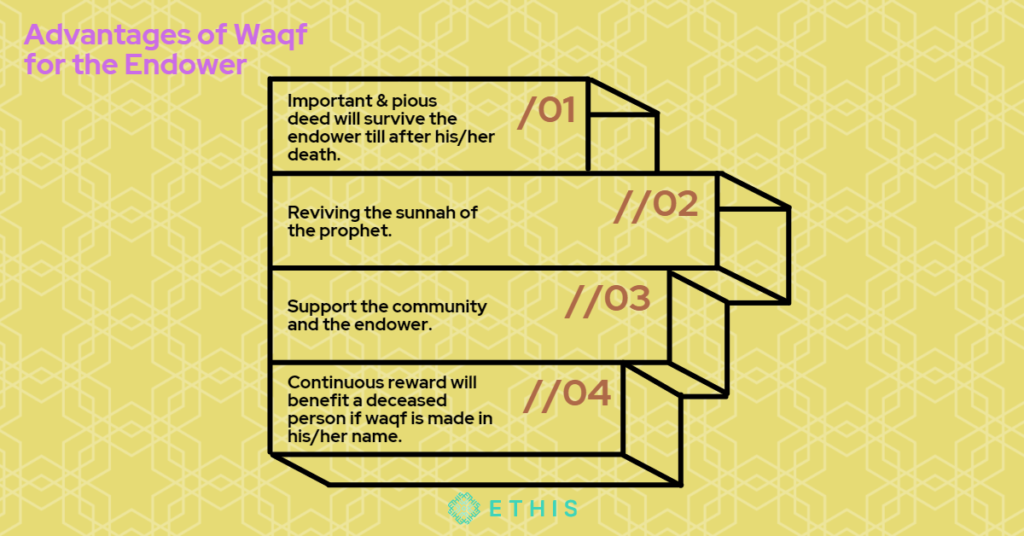

When we pay Sadaqa in our day to day life, we give away our money with an intention. That is done in the name of Allah and we tend to forget it in the trust that Allah would take it into account and reward us accordingly. When we make a waqf, it is somewhat different. it will remain permanently as the property of the public in the name of Allah.

This wealth will generate income and benefit throughout its existence and the reward would accrue to the account of the donor in perpetuity. Thus waqf is a perpetual investment and this we must not lose sight of. Therefore society ought to think of a strong waqf embedded culture as the way forward. Charity embedded wealth management can be easily promoted among us. Divide the accumulated cash and wealth into three portions.

- One third for basic requirements

- One third for seeding or re-investment

- One third for perpetual investments in the hereafter, ideally a waqf fund

This principle can be easily incorporated into Islamic wealth Management.

Further innovations in Waqf

- The creation of waqf-based entrepreneurship

- Development of microfinance institutions

- Waqf based agricultural activities

- Waqf embedded takaful insurance

- Waqf embedded equity shares

And the best part is all technological platforms such as Fintech and Blockchains could be utilized to support the progress of the concept.

COVID-19 and Waqf

Waqf has established the proper conditions for digital Islamic social philanthropy to thrive as a viable vehicle for social development and financial inclusion, in the aftermath of the COVID-19 epidemic.

Within the framework of Islamic social finance, waqf can play a major role in combating the Covid-19 pandemic.

The following responses can be devised to address the crisis.

- Emergency response

- Restoration of normal life

- Restarting economic activities

Waqf based financial resources can be channelled to provide timely needed healthcare assets such as High flow oxygen machines and ventilators.

Waqf based funds could be utilized to feed the poor and to provide emergency food dry rations.

Waqf based microfinance institutions can mobilize short term and long term financial support to restart economic activities.

Therefore, following the COVID-19 epidemic, the susceptibility and fragility of our globally interconnected economy, healthcare system, and social safety net became clear. However, it has created the right conditions for digital Islamic social philanthropy to thrive as a viable vehicle for social development and financial inclusion.

GlobalSadaqah, based in Kuala Lumpur, Malaysia, is an example of this. It’s one of the world’s first Islamic charity crowdfunding platforms. It is an award-winning CSR, zakat, and waqf management platform that works with religious authorities, foundations, banks, and enterprises, as well as the general public, to increase the efficiency, sustainability, and impact of Social Finance.

Global Sadaqah currently offers the following waqf campaigns:

- Building Africa’s First Masjid Using Only Cryptos

- Waqaf A Quran In Masjid al-Haram In Makkah | Phase 2

- Sea Ambulance: Emergency Medical Assistance for Indonesia

- A Bus Ride to Jannah: Support New Muslims in Papua New Guinea

- Empowering The Legacy of Singaporean Ulama

In terms of increasing social well-being and environmental sustainability, Islamic social finance holds a lot of promise. Mechanisms like waqf, in particular, can assist organisations and countries in achieving the SDGs if they are properly created, administered, and used with transparency, accountability, and efficiency.

GlobalSadaqah aims to support poverty reduction projects that are both successful and long-term in relieving and empowering the community’s most vulnerable members.

In brief, we need to revitalize the waqf concept. Knowledge sharing, Awareness Drive and finding New Approaches to enhance this time-tested tool of Islamic Social Finance will go a long way in making the world a better place to live for all of us.

GlobalSadaqah is an online platform for charity, Sadaqah, zakat, and Waqf. Corporate donations are always welcome. The company’s headquarters are in Malaysia, however, clients are served all around the world.

Read more on How Islamic Finance Contributes to the Growth of Sustainable Finance

One Reply to “Waqf – Islamic Social Finance for Continuous Development”

A timely article to empower the knowledge and importance of WAQF, Jazakallahu Khairan for the Author of this valuable Article.

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You