Editor’s Note: This post was originally published in March 2017 and has been edited and updated for relevancy and comprehensiveness.

The crowdfunding scene in Singapore is really taking off, and this article will guide you in understanding how you can benefit from the opportunities that crowdfunding has to offer.

Crowdfunding is a refreshing concept of getting funds from numerous individuals who each contribute a small sum for a certain project, venture or cause. With the help of the internet and social media, anyone who requires money to set a business or solve a problem can access funds from people online, transcending geographical boundaries.

It is fast becoming mainstream; you’ve probably heard about the coolest stuff at Kickstarter or lucrative real-estate social projects at Ethis. Hence, it is no surprise that crowdfunding is labelled as the “most disruptive” new model of finance.

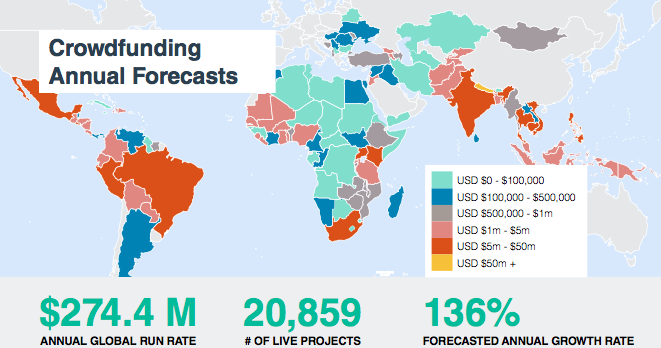

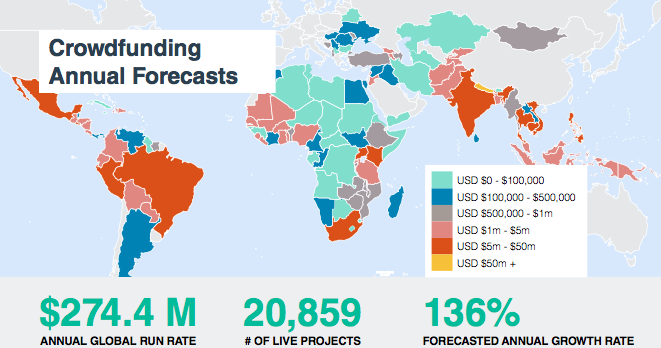

How Big is Crowdfunding?

By the year 2025, the crowdfunding industry will be expected grow to over SGD 426 billion. And believe it or not, we are at the forefront of its exponential growth as the Asian continent represents a key crowdfunding region. Asia became the second largest crowdfunding region ahead of Europe with an astounding 320% growth in terms of crowdfunding volume! The huge growth potential is therefore a great catalyst for us to get on the bandwagon. (See also: Crowdfunding: A New Way to Grow Your Wealth)

Crowdfunding In Singapore

Crowdfunding in Singapore is gaining huge traction, with numerous platforms available each with its own purpose. Singapore possesses the status as a prominent financial hub in Asia with a strong infrastructure and a favourable business climate. This makes it a natural choice for crowdfunding to take off and grow. By and large, there is a vibrant array of crowdfunding platforms focused on:

- Peer-to-peer (P2P) lending

- Real-estate

- Donations

- Social initiatives

Presently, a considerable portion of crowdfunding platforms in Singapore are centred towards debt-based P2P lending for Small and Medium Enterprise (SMEs) to fund their operations. That being said, the availability of a diverse range of crowdfunding platforms allows the average person to invest in various ventures. There are different types of rewards that crowdfunding may offer, depending on your preferences and objectives. Accordingly, understanding the potential rewards is a good start for your crowdfunding journey.

What’s in it for me?

-

Excellent returns

If you’re in it just for the financial gains, then you should really consider investing through crowdfunding platforms.

In 2016, the Singapore stock market generated a return of a measly 1.59%, while bonds had a higher return of around 2.5%. Compare that to real estate crowdfunding platform EthisCrowd, with annualised returns close to 15%. Or Kapital Boost, an Islamic P2P crowdfunding focused on SMEs, with a whopping 20%. Undoubtedly, these above-market returns is a good motivator for anyone to start investing, and an excellent addition to investors’ current portfolio.

-

Social Cause

Crowdfunding is a powerful tool for social initiatives. Social entrepreneurs, non-profit organisations or community groups that want to effect a positive change in the world can more effectively raise funds through crowdfunding. This is done through tapping on individuals that share the same values while transcending borders. Enter GIVEasia, a Singaporean-based platform for individuals, groups or organisation to raise money for charity or personal causes. In fact, they do not charge any transaction fees and have raised more than $8 million for charities and those in need. (See also: Can Islamic Finance Serve 2 billion Muslims?)

While GIVEasia is a donation-based platform, Ethis is a real estate platform that is focused on affordable social housing projects for low-income families, whilst earning above-market returns. Undeniably, crowdfunding drives individual’s passion for a cause, allowing them to participate in something meaningful.

-

Small Minimum Amount

Depending on the minimum amount by each platform, you can start investing from as low as $500 (minimum amount for Kapital Boost). Additionally, the minimum investment amount for Ethis is also relatively low at $250. These affordable amounts are excellent for those who wants to perhaps “experiment” first before investing a larger amount.

Our Recommendation

A thorough analysis must be accordingly undertaken before making any investment decision. As widely understood, one of the most important factors is the potential returns generated by the investment. Besides purely financial gain, the addition of other non-financial rewards may be more uplifting.

All things considered, Ethis ranks as the top crowdfunding platform which generates not only lucrative returns of up to 15%, but also fulfilling ethical goals through social impact real-estate projects. Ethis has thus far facilitated the development of more than 5000 affordable houses for low-income families in Indonesia. Without a doubt, the achievement of high investment returns in the pursuit of profound social goals makes Ethis a holistic investment choice for everyone.

“One of the greatest values is the belief that the best investment any of us can ever make is in the lives of others”

For a more detailed explanation on Islamic Crowdfunding, check out: What is Islamic Crowdfunding?

Sources:

- CFX Alternative Investing Crowdfunding Statistics

- Massolution Crowdfunding Industry Report

- Goldman Sachs: The Future of Finance

Ethis is the world’s first Real Estate Islamic Crowdfunding Platform. Our international community of 20,000 private investors crowdfunds investments in entrepreneurial, business, trade and Real Estate activities in Emerging Asia.

Read more about Islamic Finance blog at Ethis

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You