Blaring their first roar, up-and-about global cross-border ethical crowdfunding platform, EthisX has made their first step in their journey to #CirculateGood by releasing the first edition of their quarterly event, the Fintech Wave on August 27, 2022.

The event is a platform for both aspiring and established entrepreneurs, investors, authorities and like-minded individuals to come together to connect, educate, and provide opportunities to those who are interested and familiar with the topics of Fintech, Islamic Finance, Equity Crowdfunding,and Peer-to-Peer lending. Two panel discussions took place in the five-hour-long event, titled The Significance of Fintech in Revolutionising the Global Financial Market and The Impact of Emerging Technologies on Financial Services.

Ms. Riza Ismail, the COO and Compliance Director at EthisX, spoke about the goal of EthisX, which is to narrow the funding gap and aid overlooked segments among entrepreneurs and businesses.

“Technology has evolved in many shapes and forms, with different innovations and inventions taking place every single day in every part of the globe. What would have been impossible in terms of financial transactions have now allowed us to seamlessly carry out our banking and financing needs through technology. It has led to what we now know as Fintech,” said Ms.Riza.

Attendees got to enjoy two startup presentations that circulated around the topics related to finance.

As part of his presentation, Potential Impact of Islamic Wealth Management on Lowering Consumer Barriers, Mr. Omar Shaikh from Cocoa Investment provided insights and stressed on the importance of amanah in customer and business transparency, and steering clear from highly confusing jargons to overcome the barrier of accessibility and knowledge for new consumers. He said Islamic wealth management emphasises on shariah-compliance, which creates a strict ethical, sustainable, and socially responsible system on the financial landscape.

Mr. Hasam Khan, founder of Rabt, a renowned app that has been hailed as the Spotify of Islam seeks to inspire many upcoming Islamic content creators and curators to unleash their creativity and knowledge on the Internet. He spoke on the topic The Inspiration Journey of Online Islamic Content. The app itself, Mr. Hasam Khan said, aims to be a medium that spreads love and truth regarding Islam while upholding Islamic values, so that both mualafs and existing muslims have access to a one stop solution where they can learn all things Islam on-the-go.

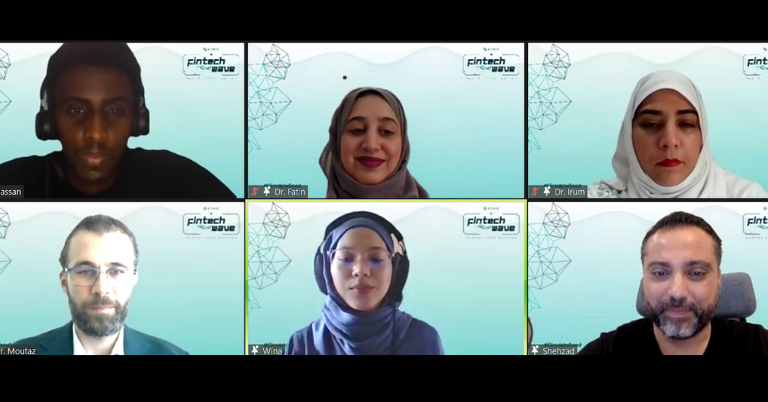

The last session, titled The Impact of Emerging Technologies on Financial Services, was a panel discussion moderated by Mr. Hassan Mursal Hassan of EthisX and joined by Dr. Moutaz Abojeib, Dr. Irum Saba, and Dr. Fatin Zadjali. Talk about doctor power! This discussion touched on how emerging technologies such as blockchain affects the banking industry, on accessibility and the new norm, as well as on how working-from-home has impacted the manpower landscape and more significantly, working women.

All in all, many thought leaders came together to share insights on various topics, making the event more invigorating!.

Follow us across all social media platforms @ethisx.co to learn more about our latest initiatives and campaign offerings!

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You