Personal finance involves budgeting, setting short-and-long-term goals, spending, saving, and investing, among others. It is about meeting your personal financial goals, whether it’s having enough for short-term financial needs, planning for retirement, or saving for your children’s tertiary education.

It boils down to your income, expenses, lifestyle, financial goals, and coming up with a plan to fulfil those needs within your financial means. Being financially literate is also crucial. It helps you distinguish between good and bad advice and make smart financial decisions.

Do you keep track of your finances?

Let’s dive deep into how you can manage your money well with these seven money management tips.

1) Take stock of your current financial conditions

First, you need to have an overview of your current financial situation. Take stock of how you are doing financially. List down your outstanding debts, loans, and your monthly commitments.

Do you make enough money to pay off those commitments? Do you need to cut on some expenses to make it more bearable?

We recommend that you check your credit score to find out if you are in a good credit position to make more debts if you need to. Use a credit score service or free credit scoring site available in your country to access the report.

In Malaysia, you can get a free credit report from Bank Negara Malaysia by completing their CCRIS application form. Alternatively, you may also opt for a paid credit score report from CTOS, a private credit reporting agency. It is faster, and they usually offer discounts and promotions, so you only need to spend about RM20-ish per report.

Once sorted, you can then set a monthly budget to help you with your monthly expenses.

2) Set a monthly budget

Planning is how you get ahead in life and with money. There is a saying that goes, “If you fail to plan, you are planning to fail.” Do not let this describe your financial journey.

Set your budget every month before the month starts. It helps you ensure that you can cover your day-to-day expenses on top of your monthly commitments while still saving aside some emergency funds.

There are various ways to approach this. Writing the budget down in a notebook the traditional way is one. You can also use Google Sheets, download a money management app or even use the Notes function on your phone.

Not sure how to budget? Follow the 50/30/20 rule.

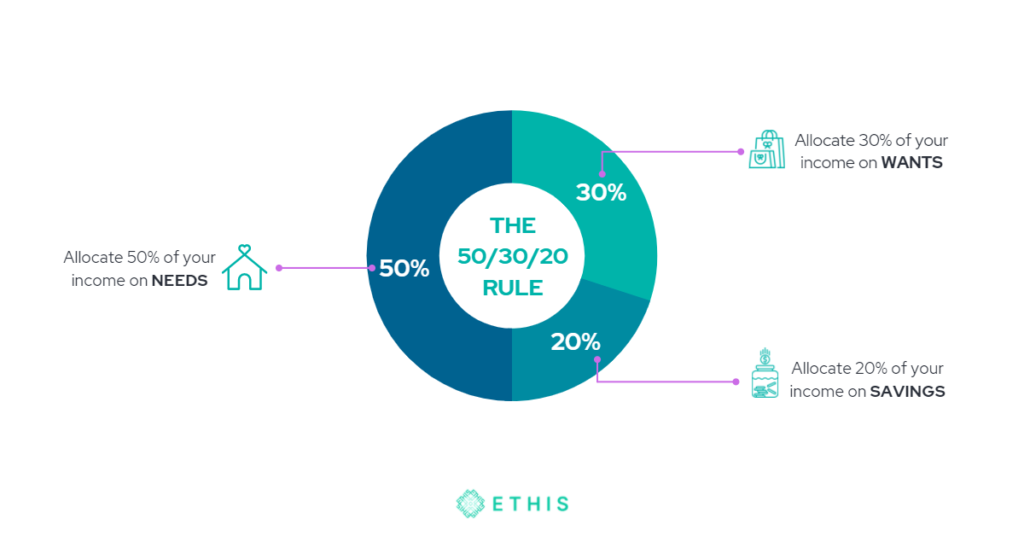

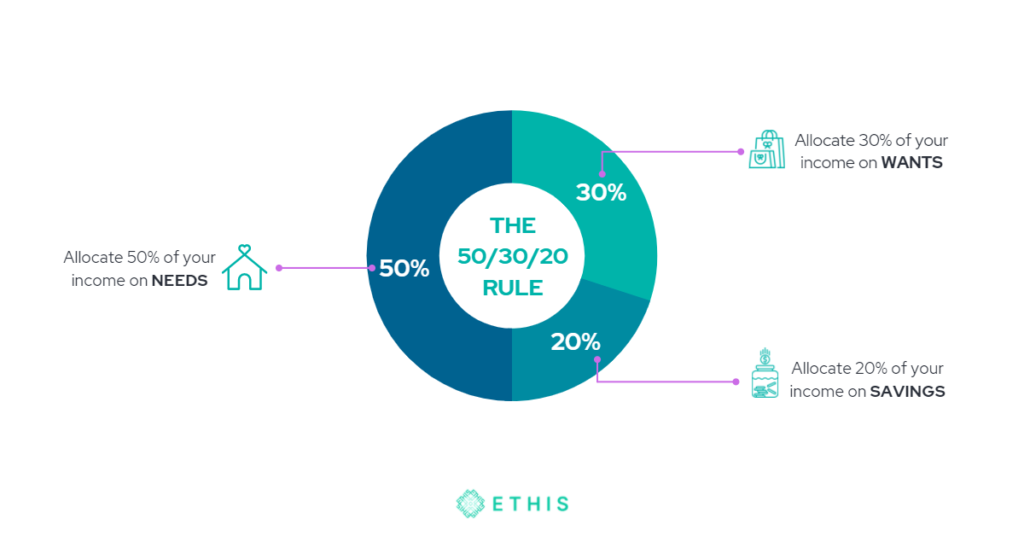

3) Follow the 50/30/20 rule

Have you heard of the 50/30/20 rule? It’s a simple money rule to help you allocate your budget effectively. Set 50% of your net income on needs, 30% on wants, and the remaining 20% on savings.

50% Needs

Needs are those bills that you must pay and other things necessary for survival. These include your rent or mortgage repayment, car loan, groceries, takaful (a protection plan), phone bills, utilities, and other must-haves.

If your needs take up more than 50% of your net income, you may need to consider downsizing your lifestyle. Think about moving into a smaller home, opt for a cheaper car, a more affordable phone plan, and a less premium grocer.

30% Wants

Wants are everything else that is non-essential. They include fancy dinners, Netflix subscriptions, branded perfumes, the latest gadgets, and you name it. These are things that make your life more comfortable and enjoyable but not necessarily richer.

You may need to consider cutting down on some of your wants if you have been spending extravagantly. Make sure it does not exceed 30% of your net income.

Related: Buy Now Pay Later (BNPL): Shariah Compliant?

20% Savings

Put aside 20% of your net income for savings. The goal is to have at least three to six months worth of your net income for emergencies. Having a sufficient emergency fund, especially in an uncertain time like during this COVID-19 pandemic, is vital. It helps to be financially prepared for what may come your way.

Once you have saved enough, you can start growing your money by investing it.

4) Spend within your means

In Islam, we are taught to spend moderately, not too thrifty and not too lavish either.

“And [they are] those who, when they spend, do so not excessively or sparingly but are ever, between that, [justly] moderate. (Surah al-Furqan: 67)

As long as you spend within your means, you are off to a great financial future. When you spend within your means, you save yourself from wasting money trying to impress others or keeping up with the riches.

Falling into the trap of keeping up with the Jones is a surefire way to stretch your wallet too thin. You gain nothing out of it but a thin wallet.

5) Pay off your credit card(s)

There are pros and cons to having a credit card. On the one hand, the rewards, cashback, and rebates may be enticing and beneficial to you. On the other, credit cards can be a disaster if you have not learned how to use them wisely.

Getting into credit card debts is the last thing you would want to happen. Once it has spiralled out of control, you will be paying a handsome sum of the snowballed profit charges from late payment than the actual debts you have.

The trick is to use it only when necessary and pay it off before it is due. It is also best that you do not own more than two cards.

Pro tips: If you are in a poor financial predicament due to credit card debts and struggle to get out of it, seek help from credit management bodies or agencies such as AKPK in Malaysia.

6) Track your expenses

Managing money well involves tracking your expenses. Your budgeting will go down the drain if you do not keep tabs on your spending. You need to know where your hard-earned money goes and cross-check whether it follows your budgeting by tracking it.

Keep track of your expenses throughout the month and not just at the end of it. Better yet, jot it down every time you spend your money. That way, you won’t miss out on a single spend, and you will be able to get a broader picture of your spend vs. budget.

There are a lot of money management apps or tools you can use for easy tracking. You can download the app on Google or Apple store, use Google sheet, Microsoft Excel, or even the Notes function on your phone.

7) Start investing early

The sooner you have your finances in place, the earlier you can start looking to invest your money.

It takes time for your money to grow. So the earlier you start investing, the greater the accumulated return on your investment and the more money you make.

There are various investment options you can consider. Research to find the ones that suit your finances and your financial goals the most. Check whether the minimum investment is one-off or recurring and how long do you need to commit before you can reap the returns.

When it comes to investing, it’s best to diversify. Don’t put all your eggs in one basket.

Related: Take Charge of Your Financial Health: Halal Investment Guide for Youth

At Ethis, we are all about making a positive impact and circulating good through ethical investing. Grow your money through our equity crowdfunding campaigns in Malaysia or P2P lending projects in Indonesia. Learn more at ethis.co.

When you manage your money well, you will have more time to focus on other things in life that money cannot buy.

Read more about How Inflation Impacts The Value of Your Money

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You