By Mufti Ismail Desai, CEO, Global Islamic Financial Services Firm

Buy now pay later (BNPL) schemes have seen tremendous growth globally including in Australia, USA, the UK and other countries. Traditional consumers have long had the opportunity to purchase goods and services and pay for them in instalments over a term. Traditional store lay-by arrangements allow consumers to pay for purchases over time, and some retailers have offered interest-free or deferred payment options for many years. In recent years, newer types of electronic instalment payment arrangements – known as ‘buy now, pay later’ (BNPL) services – have become more prominent, as the use and acceptance of these services have grown tremendously.

BNPL services enable consumers to purchase goods and services by paying part of the purchase price at the time of the transaction and the remainder to the BNPL provider in a series of instalments. Unlike traditional lay-by, the customer receives their purchase immediately and the merchant is paid up front by the BNPL provider. In most cases, customers use a mobile app to access these services and repayments are drawn from a customer’s linked debit or credit card. Certain BNPL firms offer service free charges if all instalments are paid on time. Such BNPL services are mostly accessed online with some firms offering in store purchases. These services are also offered through virtual cards.

We believe there are significant opportunities for BNPL within an Islamic Finance context as this growing industry is estimated to be worth US$2.8 trillion, and is projected to grow to US$4.8 trillion by 2024 (BNY Mellon). BNPL can be used as effective financial tool in generating tremendous financial value for Muslim consumers globally.

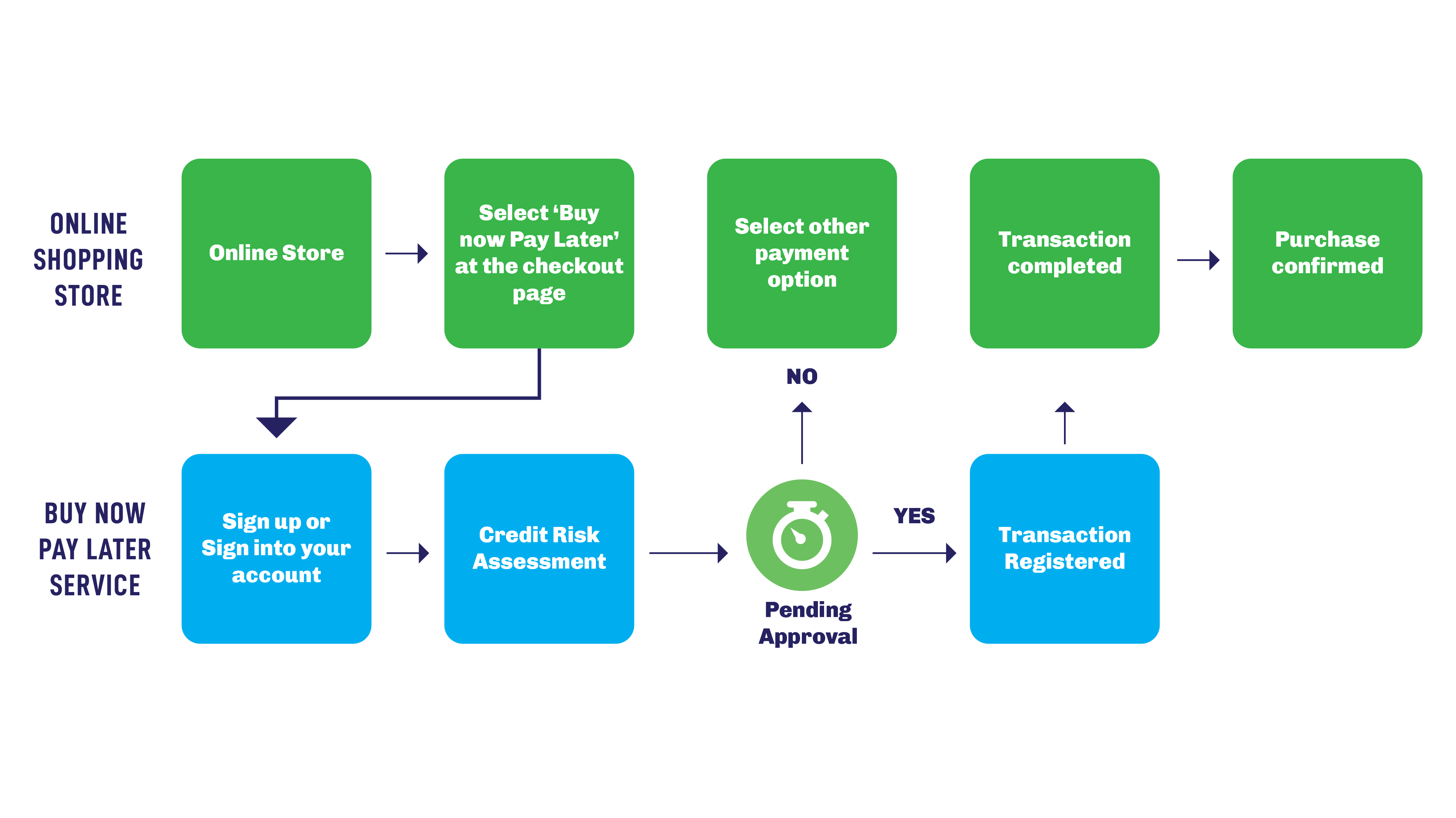

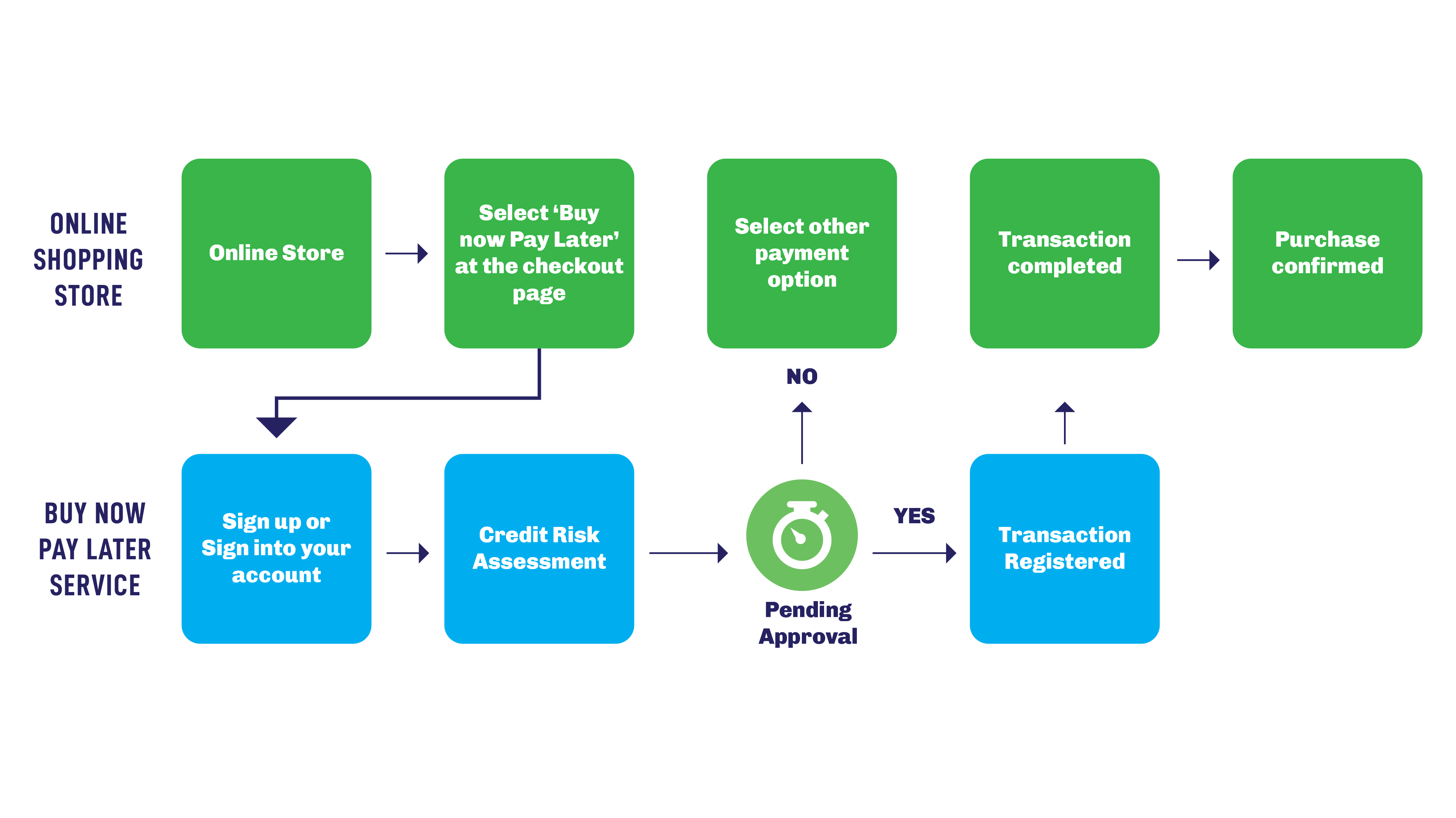

The following diagram depicts a traditional BNPL scheme financial model:

Current BNPL services are not shariah-compliant for four reasons:

- Interest – Interest is charged when a payment is missed or if the customer chooses to convert their payment to monthly instalments over a term.

- Prohibited goods/services – BNPL has no restriction on the nature of the goods and services that can be purchased.

- Terms and Conditions – There is no shariah-compliant contractual basis for the BNPL transaction between the merchant and the customer or between the BNPL provider and the customer. The underlying transaction between the BNPL provider and the customer is that of a straight interest bearing loan with/without service charges/penalties.

- Insurance – Most goods/services come with an insurance policy especially for e-commerce. Conventional insurance schemes and products are prohibited in Shariah. Credit insurance policies are also impermissible.

The shariah-compliant alternative to BNPL would be as follows:

The client purchases only permitted goods/services from the BNPL provider via the merchant with a cost plus financing structure (Murabaha) or no cost plus financing structure (Tawliyah).

- The client may enter into a separate service agreement (Ujrah) for the BNPL provider to manage the transaction on behalf of the client in exchange of a fixed predetermined service fee.

- The client purchases a Takaful (Islamic indemnification policy) if required to cover for credit default and warranties for goods/services.

- The client signs two separate shariah-compliant and approved agreements in order to conclude and execute an effective Shariah compliant Murabaha transaction.

- The BNPL will have a separate shariah agreement to purchase the goods/services from the merchant under a valid shariah-compliant purchase/sale agreement (Musawamah) and Wakalah (agency) mandate to manage the subsequent sale/purchase to the end user client.

A sample of a shariah-compliant BNPL transaction

- Zaid received credit approval from Nakheel BNPL finance corporation for credit.

- Zaid seeks to purchase an iphone for US$1500 using the BNPL Murabaha scheme.

- The BNPL provider purchases the iphone from the merchant for US$1500 (Musawamah)

- The BNPL then re-sells the iphone for US$1750 with a mark-up including service charges to Zaid (Murabaha).

- The merchant has been appointed as a Wakeel (agent) to manage the purchase/sale with Zaid.

- Zaid pays for the iphone over a fixed term to the BNPL Provider.

The fundamental shariah issues when dealing with BNPL schemes are as follows:

- Terms and Conditions – The underlying terms and conditions including contractual arrangements should be shariah-compliant.

- Shariah Approved and Certified – A competent Shariah board should be appointed to certify and issue a Fatwa in favour of the BNPL scheme.

- Shariah Audit and Review – A proper Shariah audit and review should be conducted on a periodic basis to ensure 100% Shariah compliant and global Shariah compliance credibility.

- Shariah taxation and accounting – A proper shariah taxation and accounting review should be conducted to ensure the scheme is compliant with all local regulations and laws.

- Marketing Materials – All marketing materials should also be reviewed for shariah compliance.

- Penalties and Service fees – Penalty fees should be charged if any in the event of dire default with no intention to financial benefit and should be dispensed in charity with an amount to be used for justifiable administrative expenses.

Key Markets for Islamic BNPL:

United Arab Emirates

Saudi Arabia

Kuwait

Malaysia

Indonesia

United States of America

United Kingdom

Qatar

Egypt

Nigeria

France

Conclusion

There remains a huge opportunity for the existing BNPL providers to tap the global Muslim market and Islamic finance sector which we believe will produce double digital growth rates for the incumbent players.

Read more about Islamic P2P Crowdfunding

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You