If you are not familiar with the term ECF, you may wonder, what in the world is ECF? Equity crowdfunding, or ECF, is essentially an online fundraising campaign that allows individuals the opportunity to invest in an early-stage venture or micro SMEs. In exchange for the money invested, investors will own a proportionate slice of equity (shares) in the company.

Related: Islamic Crowdfunding: A Shariah-Compliant Investment Alternative

Before the advent of crowdfunding, investing in such ventures was only restricted to accredited investors and high net worth individuals, i.e. investors with a certain defined level of income or assets, who can afford the high minimum investment amount that comes with high risks, and high potential returns.

Equity crowdfunding has allowed non-high-worth individuals to play the field. It makes such investment accessible to a larger pool of investors by offering a much lower minimum investment threshold than it used to be.

Before we dive deep into the pros and cons of investing via equity crowdfunding, let’s take a look at the types of investors as classified by the Securities Commission Malaysia (SC).

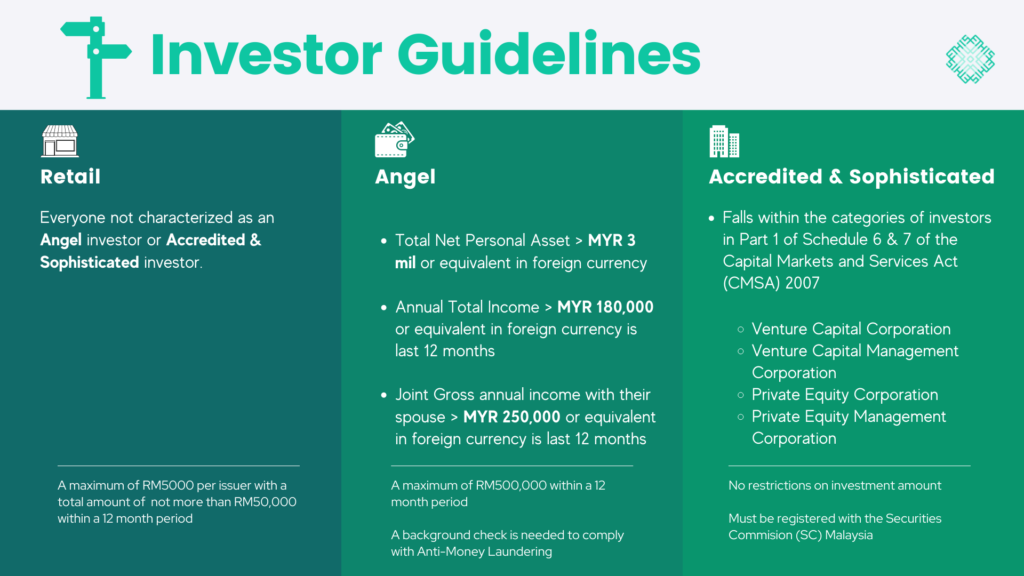

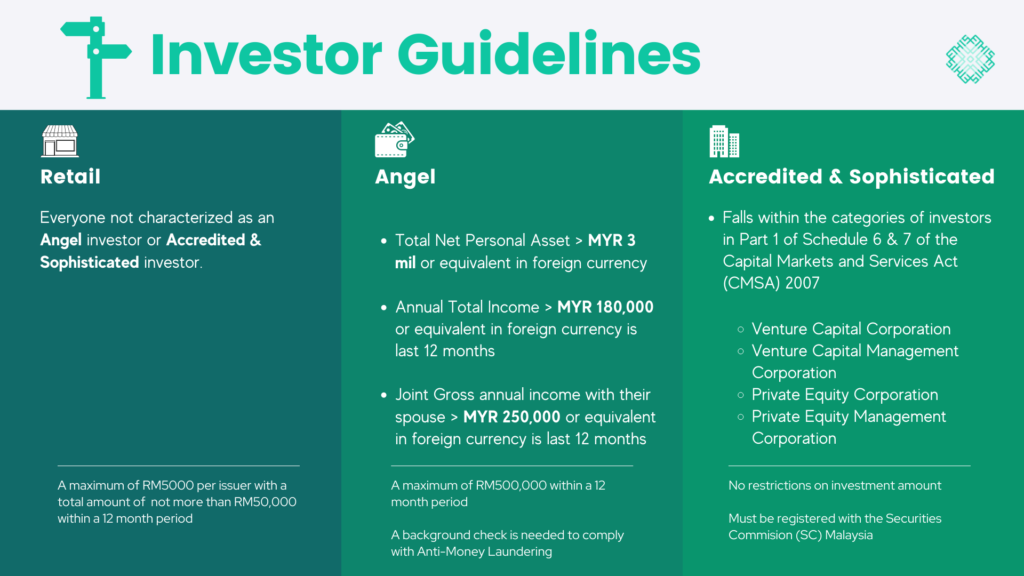

Types of Investors Who Can Invest Via Equity Crowdfunding as Classified by the Securities Commission Malaysia

1. Sophisticated investors

There are three categories of sophisticated investors:

- Accredited investors

- High net worth entities

- High net worth individuals

Sophisticated investors can invest as much money as they want – there is no investment limit for this group of investors but they must be registered under SC. You may refer to the full details for each category of sophisticated investors by SC here.

2. Angel investors

Individuals who are tax residents in Malaysia with the following criteria:

a) whose total net personal assets exceed RM3 million or its equivalent in foreign currencies; or

b) whose gross total annual income is not less than RM180,000 or its equivalent in foreign currencies in the preceding 12 months; or

c) who, jointly with his or her spouse, has a gross total annual income exceeding RM250,000 or its equivalent in foreign currencies in the preceding 12 months.

Angel investors can invest up to RM500,000 within a 12-month period.

3. Retail investors

Anyone who is not an angel investor or sophisticated investor.

The maximum investment limit for retail investors is RM5,000 for a single investment and no more than RM50,000 within a 12-month period.

Now, let’s go back to the question of whether investing via equity crowdfunding is for you. As with any form of investment, you need to be mindful of what you are getting into and exercise your due diligence before investing.

Let’s dissect the pros and cons of investing via equity crowdfunding relative to conventional equity investing which was only accessible to certain types of investors.

Equity Crowdfunding Pros and Cons for Investors

Pros

1. Easy to start

Equity crowdfunding is open to anyone looking to diversify their investment portfolio. Since the investment activities are all done online, getting started is relatively easy and hassle-free. Everything is accessible at the tip of your fingers.

All you have to do is research and compare the various equity crowdfunding platforms available and their issuers. Make sure that the platform is legal, credible, and regulated. Once you have decided on the platform, complete the sign-up process, and you are good to go.

In Malaysia, equity crowdfunding platforms are regulated under Recognised Market Operator guidelines by the Securities Commission. Ethis Malaysia is a Recognised Market Operator (RMO) approved under the Securities Commission to carry out equity crowdfunding business activities in Malaysia.

Related: Pioneer Islamic crowdfunding group Ethis Group raises RM6.8million (US$1.7million) from Super-Angels

2. Low minimum investment

Equity crowdfunding makes it possible for everyday people to invest in early-stage companies or startups with a much lower investment amount. You don’t need huge capital to own a slice of equity in those companies (referred to as issuers) that are raising funds through equity crowdfunding platforms.

The low entry amount makes this investment option one of the more popular options among average investors.

Related: 7 Money Management Tips to Improve Your Personal Finance

At Ethis, you can start your equity crowdfunding investment journey from as low as RM1,000. Learn more at ethis.co/my.

3. Personalised and diversified investment selections

Unlike other investment options such as mutual funds and unit trusts that invest in a predefined portfolio chosen by the fund manager, equity crowdfunding investors have the liberty to decide which companies they want to invest their money in. The discretion lies in the hands of the investors themselves.

You can choose to invest in companies that resonate with you and diversify your investments by spreading your capital across multiple campaigns.

As an ethical and Islamic investment platform, Ethis’ campaigns include distinctive and promising companies whose business operations are in line with the United Nations Global Impact Ethical standards and based on Islamic finance.

Related: Equity Crowdfunding: How can it Help Your Startup?

4. Potential for high returns

With high risks come high returns. While it’s likely that some equity crowdfunding investments can go bust, and you may lose all of your capital, so is the chance for the business to flourish and for you to profit from the investment.

You can win big should the company continue to perform well financially and go public in the future. When that happens, you can sell your portion of equity for a much higher rate and exit.

Another upside of owning equity in a company is having the right to dividends. The company will pay you a certain percentage of money in the dividend pool proportionate to the equity you own if the company makes significant profits.

Cons

1. High Risks

Investing in early-stage companies means there are inherent risks to factor. These include the risk of business failure and bankruptcy. In other words, should the business go south, odds are you may not be able to recover your initial investment.

Technically, your capital is not guaranteed and may be at risk, just as with any other type of investment. So you shouldn’t put all your eggs in one basket and only invest the amount of money you can afford to lose.

2. Long-term game with an indefinite timeline for returns

To quote Warren Buffet, “successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time.” And so is the case with equity crowdfunding investing – it’s a long-term game. It may take years for investors to reap the returns, if at all.

A good equity crowdfunding platform will indicate the potential dividend payout the issuer is targeting to pay and an exit strategy. Read up the disclosure in detail before investing.

In sum, all investment options have their pros and cons, risks and rewards. Carrying thorough research is crucial before you invest your money into a financial instrument.

At Ethis, we manage the risks by conducting thorough due diligence on each issuer before launching the campaign. Grow your money the halal way via ethis.co/my.

Read more about Equity Crowdfunding

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You