KUALA LUMPUR, 7 March 2022 – Ethical investment and social finance platform operator, Ethis Group, will be launching EthisX as part of its global expansion plan. Approved by the Capital Market Authority (CMA) – the Sultanate of Oman’s regulator and supervisor of the capital market and insurance sector – EthisX is managed by Ethis Investment Platform LLC based out of Muscat, the Sultanate of Oman, and Kuala Lumpur, Malaysia. EthisX is unique in that it acts as a first-of-its-kind cross-border Ethical Private Capital Marketplace able to offer direct shariah-compliant investments into SME companies and special purpose vehicle (SPV) projects from around the globe.

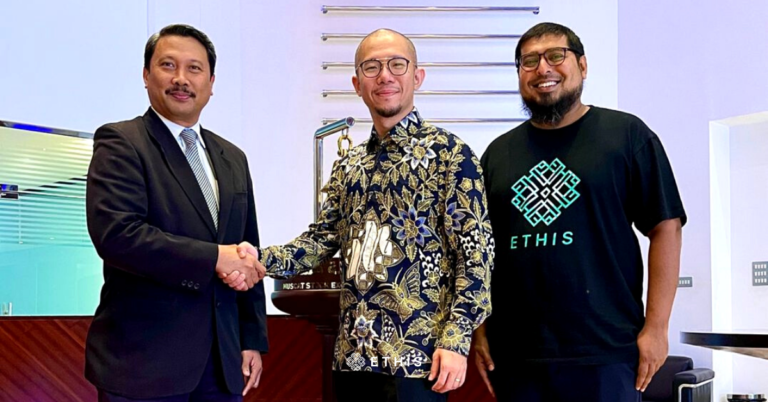

Mohamed Shehzad Bin Mohamed Islam, Chief Executive Officer of Ethis Investment Platform LLC (EIP) said, “In our focus to #CirculateGood with our global community of impact investors and donors, we are committed to working alongside Oman CMA towards a successful global cross-border marketplace. With the approval of CMA, companies from inside and outside Oman can apply to raise funding. This, in turn, allows global investors access to shariah-compliant, impactful and sustainable investments in emerging and developed markets like never before.”

He added, “EthisX will be rolled out in geographical phases starting with Oman. The platform allows companies to raise funds through equity crowdfunding (ECF) and peer-2-peer (P2P) financing that includes sukuk and micro-sukuk. For P2P, EthisX is focusing on invoice financing, asset-backed financing, working capital financing, and Buy Now, Pay Later (BNPL) financing. ECF issuances will focus on startups and growth companies particularly in the tech sector”.

Amran Mohd, Chairman of EIP, commented, “Oman is a bridge between emerging regions with the potential to extend to other parts of the world, and has great potential to be an emerging regional hub for Islamic finance and fintech. As the regulator and supervisor of the capital market and insurance sector in Oman, we value CMA’s acceptance of EthisX as a platform that curates the capital marketplace. We aim to have EthisX become a valuable contributor towards realising OMAN VISION 2040, which emphasises the country’s economic development that is anchored to Environmental, Social, and Governance (ESG) and Sustainable Development Goals (SDGs). For the Group, EthisX as our next step forward makes the best strategic business sense as Ethis is amongst the early adopters of crowdfunding as an investment marketplace and is an Islamic fintech proponent”.

“EthisX will be leveraging on the immediate transaction volume from other Ethis platforms, targeting to grow transaction value per month by at least 10 times from current by Q4 2022. We want to push our market expansion plan through EthisX as aggressively as possible, and we would like to express our gratitude towards Oman CMA for believing in our vision and execution ability”, added Mohamed Shehzad.

Umar Munshi, Co-Founder and Group MD of Ethis Group elaborated, “As one of the pioneers of shariah-compliant crowdfunding, Ethis not only has proof of concept but also substantial experience and knowledge through the management of its platforms which prioritise deals with social impact so that the community can enjoy the benefits of their investments. As a testimony to that, we are humbled and further motivated to do better when Ethis Group was recently awarded the Best Islamic Crowdfunding Platform in the World 2021 by the Awards Committee of the Islamic Retail Banking Awards (IRBA) based on the efficiency model developed by Cambridge IFA”.

Investors, whether individuals or corporates and companies seeking funding are encouraged to visit ethis.co for updates on EthisX launch.

About EthisX | The cross-border Ethical Private Capital Market Platform

EthisX, regulated by Oman Capital Market Authority, is the first platform of its kind catering to shariah-compliant and impact-driven investors globally. The platform provides investors and funders direct access to companies, issuers, and social campaigns from around the world with a focus on Asia and the Gulf region.

About Ethis Group

Ethis Group operates crowd-investment platforms approved by regulators in Indonesia, Malaysia and now Oman.

The platforms serve ordinary people, high-net-worth individuals, corporate, and government entities. Ethis built its initial track record from 2016 to 2020 in social housing in Indonesia where their global community of investors come from more than 50 countries funded development projects to build close to 10,000 homes.

Since the onset of COVID-19, Ethis has launched popular new investment products, including short-term, high-yield supply-chain financing projects in Indonesia and equity investment in ‘future tech’ startups in Malaysia. Its social finance marketplace, GlobalSadaqah plays a vital role in matching donors and Islamic economy players to better distribute social finance and zakat to NGOs and social enterprises.

Ethis’ shariah advisory, Adl Advisory, is a Malaysia-based global Shariah advisory entity that provides shariah advisory, review and auditing services in Halal & Islamic finance domains. Islamic financial institutions, Islamic fintech, Islamic crowdfunding, shariah robo-advisory, takaful-tech, Sukuk, funds, start-up investments are some of the many areas that are covered.Adl Advisory has a team of young experts in shariah and Islamic finance, including certified Muftis and AAOIFI Certified Shariah Advisor & Auditors (CSAA). Adl is led by Mufti Yousuf Sultan (Founder & CEO), who is a registered Shariah Adviser with the Securities Commission Malaysia. Mufti Yousuf is also an AAOIFI Master Trainer, an AAOIFI Consultant and sits in several working groups of AAOIFI.

Ethis exist to #circulategood. Their deep desire to create a more ethical form of finance to uplift humanity has attracted significant finance and community leaders to support its vision and mission.

For more information about Ethis Group, please visit www.ethis.co

About Capital Market Authority (CMA) Sultanate of Oman

The Capital Market Authority (CMA) regulates and supervises the capital market and insurance sectors and acts in accordance with its strategic objects to promote the sectors and maximise domestic and foreign investors’ confidence to ensure the continued development of the institutions operating in the capital market and insurance sectors and diversifying their products and engaging the largest number of participants to achieve the greatest added economic value to the Omani economy. CMA was established by Royal Decree 80/98 issued on 9 November 1998 and commenced its duties on 9 January 1999. It is a government entity with juristic personality, financial and administrative independence and its board of directors is chaired by the Minister of Finance.

For further information about CMA, please visit cma.gov.om.

For more info, please contact:

[email protected]

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You