Did you know that crowdfunding has the same principles that form the anchor of Islamic finance, such as promoting financial inclusivity, impact, and sustainability, amongst others?

Amidst the rapid rise of fintech in Islamic finance (in itself a USD2.4 trillion global industry), a number of shariah-compliant crowdfunding platforms have emerged in recent years. These include Malaysian-based Ethis, UK-based Qardus and UK-based Yielders, correcting the common but erroneous assumption that shariah-compliant crowdfunding is restricted to Muslims, or to countries with a large or majority Muslim population. While Muslims may be the primary customers of shariah-compliant crowdfunding, no barriers exist in restricting non-Muslims from participating.

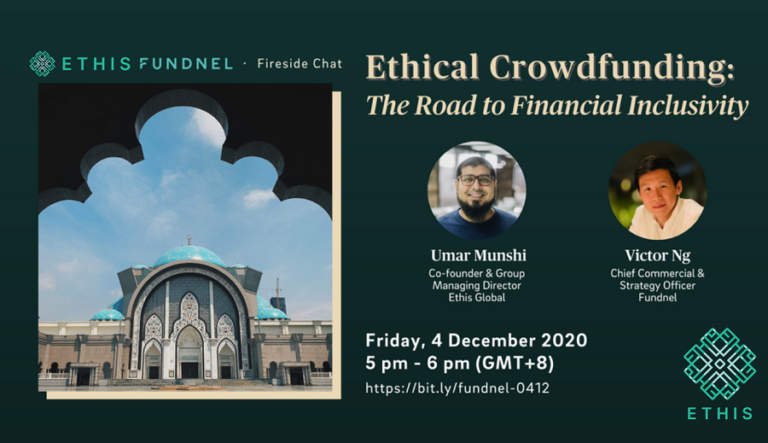

Fundnel’s Chief Commercial & Strategy Officer, Victor Ng recently chatted with Umar Munshi of Ethis Global who is well-known in the Islamic fintech and crowdfunding space. The discussion encompassed dissecting the concept of shariah-compliant financial services and fintech, understanding its similarities to ethical finance, why non-Muslims should participate in it and exploring its potential growth across the globe.

The Guest Speaker

Umar Munshi · Co-Founder & Group Managing Director, Ethis Global

Missed the webinar? Check out the replay or read a summary below.

The content below has been summarised and edited for brevity.

This topic on ethical crowdfunding and Islamic finance is close to my heart – I first worked on this issue about 18 years ago, when I worked for a government organisation doing some research in this area. Let’s start off with some basic questions for members of the audience who might not be very familiar with this topic. What is Islamic finance?

This question is a heavy one but I’ll try to break it down in a way that can be more relatable. Essentially, Islamic finance can be seen as a form of ethical finance, ESG finance or impact investment. It’s a subset with some unique characteristics and principles, which are then implemented in certain models within the current modern financial landscape. A key aspect of Islamic finance is that the logic and approach behind it is derived from religious sources in Islam; the Quran, our holy book, references and stories from the Prophet Muhammad and other studies from scholars of the religion.

Sometimes the term Islamic can confuse or scare off people, and non-Muslims would think it’s not for them. But one way I can relate this is food – everyone can eat halal food. McDonald’s is halal, Subway is halal (in Singapore). What’s halal is a specific way of preparing food and some limitations on the ingredients. So it’s governed by a kind of ethical framework. Similarly, when applied to finance, there are unique principles that Islamic finance needs to adhere to to be halal.

The most basic fundamental principle underlying everything in Islamic finance is that it is meant to espouse justice — to protect justice and to circulate just and fair finance in society. Firstly, money (in itself) is not accepted as a way or form through which you can use to make more money – we are not supposed to lend money and charge interest because you are just making money from money by doing so. You can invest, but it needs to be more participatory; the investment needs to go into the business and whatever profit you get is from the business activity, typically through profit sharing. A second type of activity to earn money is through trading, where you use your money to produce/buy and sell assets and make profits. And lastly, money can be earned from rental where you have or buy an asset and make money from it. In all these three examples, there is an underlying business activity as compared to just lending money based on creditworthiness, etc – there’s no underlying activity that generates income in that.

In today’s context of a pandemic ravaged world, the economy is in doldrums, a lot of people are unemployed yet we see the financial economy moving in its own direction. You can see how the financialisation of the economy has reached a point where it is separate from what is really happening in the economy. This is part of why I feel Islamic finance can be a viable solution — it pushes funds to the real economy, not to the financial economy.

What are some of Islamic finance’s most common misconceptions?

One misconception is that it’s only for Muslims, especially in countries where Islamic finance is not so prevalent. An interesting statistic in Malaysia is that more than half of the deposits in Islamic banks come from non-Muslims in Malaysia. The understanding of Islamic finance here is best in the world at this point. Islamic finance is for everyone, just as halal food can be enjoyed by all.

The other misconception is that it’s complicated. The underlying basis of Islamic finance is not complicated; what complicates matters is when we try to fit in the framework that is fixed into a modern context where it may not be applicable, then there would be what some would consider confusing structuring that needs to be done.

For example, the most common application that poses a challenge to Islamic finance is consumer lending. As I mentioned earlier, we can’t lend money to earn interest with no underlying activity that generates profit and income. So how do Islamic banks do that? Here’s where a lot of the banks need to be creative. Some banks have a safekeeping fee, and sometimes banks have a transaction in between where commodities are bought and sold instantaneously at a markup and that markup is the source of the additional amount considered as the profit in this case. So these are certain creative ways to go around the principles yet trying to adhere to it and this is where it can become rather complicated.

So what makes an investment shariah compliant? What makes it ethical, sustainable, and socially responsible?

Islamic finance is based on universal ethical principles. Of course, one may not agree with everything in Islamic finance based on one’s own perspective for looking at what’s ethical and what’s not. I think a very key component is firstly, not to have any clear cut elements of things that are disallowed and that essentially can be divided into two parts.

One part is the nature of the activity or the business. Certain sectors, also so called “vice sectors”, cannot be considered or be a part of the transaction. This includes gambling, pornography, weapons and so on – things we can all generally agree upon. The tricky part comes when the investment or the policy of the fund is investing in conventional financial institutions or fintech, because if these are not following Islamic principles, then the investment itself becomes non-compliant. So this is where it becomes more of a differing point.

The other component is that the transaction itself needs to be clear – the transaction, the relationship and the rights of the parties need to be clearly stated. The third component is the element of speculation, akin to gambling, which is not allowed in Islam. There are grey areas at times; for example, the issue of investing in cryptocurrencies. In essence, a lot of the major Islamic finance scholars have said that it is permissible because there’s nothing wrong or non-compliant (haram) about it. But the thing is, a lot of people do it in a very speculative manner — in this case, other scholars believe that it is not to be encouraged or should even be disallowed. So these are the three elements – no element of direct interest, or making money from money. Secondly, transparency and clarity. Thirdly, the aspect of gambling must be avoided.

To go deeper into the ethical and sustainable component, I think the broad point is not to cause harm to individuals, society, and the environment. It’s very important to not cause any form of injustice or to create any negative repercussions. One area that I think Islamic finance is still catching up on is looking into the environmentally-friendly aspect of things, because the idea of global warming wasn’t a well-known issue 30-40 years ago when Islamic finance was still in formulation. That’s why what is important in Islamic finance is the underlying principles and its implications, because it does evolve based on how the world moves.

That’s so interesting because as you describe it, I’m just thinking that all these principles really had foresight because today we are talking about ESG investments as a big thing, but actually a framework for that was more or less set out in Islamic finance more than decades ago.

Yes! Another thing I wanted to share is on social finance. The concepts of endowments and trusts, like the British trust law which is the basis of most of the trust and endowment acts around the world, was actually derived from a concept in Islamic finance called waqf which today of course, translates back to endowment. This concept of an institution that is set up to safeguard some assets for a specific social, beneficial use was actually something that existed in Islam over 1400 years ago, and even before that although it was not termed in that way. You know, when you see Muslims going to make the pilgrimage and you see the big black box, the Ka’bah – that’s also considered an endowment made for the Muslim world from a long time ago.

So that concept around a century ago manifested into the British trust law and today endowment is such a powerful concept, funding big universities and many other things.

Well, there’s two interesting things I’ve learned already. Going along those lines, as we talk about ESG, investors always wonder whether this means taking less profits. Are shariah compliant investments less profitable than conventional financial instruments?

Based on data, it’s not. There was a recent research paper that was undertaken, that talks about modern portfolio theory in the shariah perspective, which found that Islamic finance is very competitive and essentially, provides better returns. Of course, this depends on which period you look at and many other factors, but if the underlying principles as I shared earlier are adhered to, then you’re investing in businesses and companies that are fundamentally more resilient. And in the long run, that definitely makes for a big plus point when it comes to investing.

In the immediate term, there are certain industries that provide high returns which Islamic fund managers and investors are not able to go into, for example alcohol. So I guess that does have an impact on our returns and limits it. But on the other hand, technology stocks like Apple, Google, are shariah compliant. So in general I would say no, it does not result in lower returns, but potentially results in higher returns with some evidential backing.

My view is that when you invest, it’s a combination of numbers and also the human factor. I mean, it’s our money and we want to do something good with it. So I think that component, although not directly tied to financial returns, is also something that investors are increasingly keen on which is why I think Islamic finance can bring value to investors.

What are maybe the top three things that a non-Muslim should know if I want to participate in Islamic crowdfunding?

In Islamic crowdfunding, there aren’t too many big players yet. In fact when Ethis started back in 2014 in a slightly different form in Singapore, we weren’t aware we’d turn out to be one of the first in the world; we were just trying to solve a problem that our community faced. Islamic finance has grown a lot in banking and fund management, but has taken some time to really catch on in fintech and crowdfunding.

Something to consider is whether you align with a platform; whether you like the platform’s activity, track record, management, who you’re investing with and what they are doing.

What’s important is also who’s supporting the company or providing services to the company for the shariah compliance. There are reputable shariah advisory firms and so on. At Ethis, we engage one of the top organisations here in Malaysia called ISRA Consulting which is affiliated to Bank Negara Malaysia. They are very robust in how they screen and structure the deals together with us.

And something that I think investors should also look at for Islamic crowdfunding is the opportunity to be in emerging markets. A lot of the emerging world like Indonesia, Malaysia, is actually in the Muslim world. We are finding that when the financing or the platform is Islamic, it tends to have more appreciation from stakeholders in that country and there are very good deals that are only looking for shariah financing. So we have the advantage of being able to access that.

Ethis has been in Indonesia for a long time. We received our licence recently and are scaling up and activity is very dynamic. In Malaysia, we just launched our equity crowdfunding platform. So those two have seen a lot of very interesting deal flow. I think Islamic crowdfunding is very much on the upswing and although it started late, right now globally there are close to 50 platforms.

From the business owners’ point of view, what do they stand to gain from choosing to raise funds through Islamic financial instruments rather than conventional market instruments?

I think it goes back to what I mentioned earlier regarding the type of activities that we can do such as trading, participatory financing, profit sharing and income from assets rental.

For businesses that have these specific needs, it would probably bring them a lot of benefit to go into Islamic financing, as compared to taking a loan. Because when it comes to the former, say it’s participatory financing where you are going for a profit and loss sharing model – the investor and the business/project owner are aligned and they share the upside, the risks and the downsides as well. Of course, this goes back to selection, risk mitigation and other things but for the business/project owner, you know that your investors are with you. When you succeed, you’re happy to share even more than you would if you were to take financing from the bank. But at the same time, if there are challenges or delays and the profits are not yet realised, then investors have to bear that together with the business. So for the business it’s not just “take this money, and whatever happens, you have to give it back to me or I will kill you” – the very punitive kind of lending that a lot of businesses are forced to go to, from loan sharks, private borrowing, credit cards and so on. That’s not what Islamic finance is; it cannot and should not be doing that.

The other two forms are in relation to a very specific activity that is being funded. So the owner is tied to a subset of his business or one component of his business and investors participate knowing that that is the activity that will bring profits back to them. For the business owner, you can sort of ring fence that component with financing from the Islamic source.

Let’s maybe zoom out to the more macro level just to get a sense of the industry itself. How do you estimate the kinds of inflows of capital into Islamic finance? And what does that split look like between say Islamic banking versus other financial services like what you’re doing with Ethis?

Islamic finance has grown by double digits every year, even in recent years across the board globally. It’s growing much faster than conventional finance, but at the same time, it is still significantly smaller than the rest of the financial world.

When it comes to investments, I would say for the past five years, there was definitely a big gap for Islamic fintech because there are very, very few shariah-compliant VCs, and angel investing is something that’s only recently picking up right now amongst Muslims which is very interesting, because if you get angel investors from the Middle East, they’re automatically ultra high net worth individuals whose ticket is not USD10-20,000 but USD100-200,000 per startup. In the past, they would just be LPs or invest in a fund but right now, there’s a lot more awareness that they can go direct and crowdfunding is one avenue to access these kinds of projects and businesses.

Recently, there have been some high profile investments in Islamic fintech, mainly from Singaporean VCs into Indonesia, and a few in the UK. These reputable VCs see the opportunity of the Muslim market and the wider ethical market. There are just a couple of Islamic fintechs that have raised significant amounts and reached valuations of 100 million and above but they have managed to raise from significant stakeholders like government-linked companies too. I would say recognition that Islamic fintech has huge potential is starting to pick up and money is starting to flow. This is also partly driven by government support and initiatives in Malaysia and parts of the Middle East and in Indonesia. I don’t have data for this but I think this is quite an apparent and observable trend.

How do you see the industry shaping up in the next couple of years? Will Southeast Asia take more importance compared to the Middle East?

I think it depends a lot on where the industry focuses on. Because if the focus is on the wider ethical finance space, then it’s really growing leaps and bounds in Europe right now and it’s a matter of time before it grows more strongly in other parts of the world. So if Islamic finance can position itself front and centre for ethical investment and finance, then I think this is a very big market.

Conversely, if we were to focus more on the so-called natural market of Muslims, there’s also a big opportunity. By 2030, the World Bank says that a quarter of the world will be Muslims, and of course not all may care too much about sticking to Islamic principles, but there will still be a proportion that will be strict and will not be taking part in other kinds of finance other than Islamic finance.

So both ways, I think there’s a lot of opportunity because this large global Muslim population is also the population of the emerging world. Indonesia is just one good example next door. I think the growth should accelerate and the last factor that I think will affect this is how fast the industry can embrace fintech. I would say the biggest shortcoming of Islamic finance, notwithstanding all the positives, is that it has not really managed to reach the masses in the developing world because it’s quite top-heavy. With fintech being much more nimble, you can go down to the ground and do microfinance, micro investment, micro takaful, etc. So if fintech can gain adoption faster, I think Islamic finance is in a very good position because the models are already there to be utilised.

The remaining part of the webinar focused on an engaging Q&A session with Umar where he addressed questions from the audience. Catch his answers about Ethical Crowdfunding in the recap video:

- How does one know if an organisation is a good social enterprise worth crowdfunding?

- How can we ensure that there is financial inclusiveness without offending Islam?

- In this era of fake news, where can we get trusted sources of information concerning Islamic finance?

- How is Islamic real estate crowdfunding platform different from conventional real estate crowdfunding platforms?

- Islamic banks seem to be more focused on big investors and investments and aren’t looking much into micro finance; there’s a disconnect between the essence of Islamic economics and values and its practice. Can you comment on that?

- Do you see potential for Islamic finance to rise in non-Muslim countries?

- Can technology be non-Islamic?

Top Posts

Islamic P2P Crowdfunding Explained

How to Earn Halal Money? The Money Mindset

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You