Equity Crowdfunding has been a huge factor in contributing to the fintech start-up scene in ASEAN countries

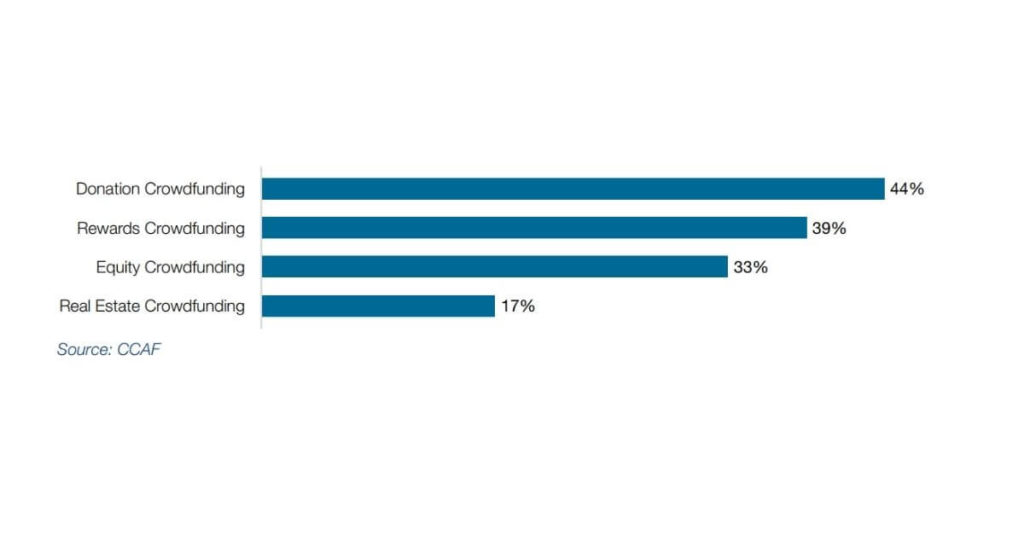

The fintech landscape in ASEAN region is rapidly expanding, with Singapore, Indonesia and Malaysia having the greatest number of domestic fintech start-ups. Within the ASEAN fintech scene, capital raising crowdfunding (donation crowdfunding, rewards crowdfunding, equity crowdfunding and real estate crowdfunding) is the third largest business model implemented after digital payments and digital lending according to The ASEAN FinTech Ecosystem Benchmarking Study.

This study also stated that crowdfunding platforms are mostly focused on donation crowdfunding and rewards crowdfunding, with equity crowdfunding coming in third place. This study also showed that equity crowdfunding platforms are mostly present in more developed countries within ASEAN.

According to Facilitating Equity Crowdfunding in the ASEAN Region, a study published by The ASEAN Secretariat in Jakarta, equity crowdfunding is an important milestone of the capital market, and it is receiving more attention from regulators and policy makers around the world. The market is expected to be a significant source of funding for small and medium size enterprise (SME) all around the world now and in the future.

Equity crowdfunding, an important alternative source of funding for small businesses, is expected to be a significant game changer within the ASEAN region, as SMEs make up more than 96% of all enterprises in the ASEAN region, according to a paper published by ACCA titled SME Development in ASEAN.

The expansion of equity crowdfunding is spurred by the development of the fintech landscape among ASEAN countries ,which are well-developed, have a relatively high GDP per capita and a high banked population (Eg: Singapore, Malaysia and Thailand).

Singapore

In Singapore, The ASEAN FinTech Ecosystem Benchmarking Study has reported that equity crowdfunding is an increasingly important source of investment funds for businesses as it has the support of the Monetary Authority of Singapore (MAS), which sees securities-based crowdfunding as an alternative source of financing for start-ups and SMEs. Platforms which undertake equity crowdfunding need to obtain a Capital Market Service licence and seven crowdfunding platforms have obtained a licence by May 2018.

Related: Crowdfunding in Singapore: What You Should Know Before Investing

Thailand

According to the ASEAN FinTech Ecosystem Benchmarking Study, the equity crowdfunding scene in Thailand is supported by various business and government agencies. This includes various commercial banks such as the Thai Venture Capital Association (TVCA), the Thailand Tech Start-up Association, the National Innovation Agency (NIA), the National Science and Technology Development Agency (NSTDA) and the National Science Technology and Innovation Policy Office (TSI).

Presently, there are two registered equity crowdfunding portals which are Live Fin Corp Co., Ltd (also known as LiVE) and Phoenixict Co., Ltd (also known as Sinwattana Crowdfunding). LiVE is 99.9% invested by the Stock Exchange of Thailand (SET).

Among alternative crowdfunding platforms such as donation-based, reward-based, loan-based or investment-based crowdfunding, only equity crowdfunding is regulated by the Thailand Security Exchange Commission (SEC).

Malaysia

Malaysia is the first country in ASEAN to put forward a regulatory framework for equity crowdfunding and related activities in 2016 by the Malaysia Securities Commission (SC). This provided a structured framework for equity crowdfunding in Malaysia. To date, there are a total of 10 equity crowdfunding platforms including Ethis, which is the only shariah-compliant ECF platform in the country.

Related: Malaysia’s Equity Crowdfunding: The 4 Players

The Importance of equity crowdfunding

1) Essential to the SME & start-up climate in ASEAN

SME and start-ups mostly rely on personal funding by borrowing from close friends and families. There are also other options such as venture capital and private equity firms, where business owners are required to fork over a percentage of the business’ equity for business funding.

It is more difficult for business owners to obtain bank loans than large companies due to the complexity of obtaining a business loan. Sometimes it could also be the case of business owners not having the best finances. When applying for loans, banks will look into your debt-to-income ratio, require sufficient collateral, credit score, a bad CCRIS among other requirements, which vary with different bank policies in different countries.

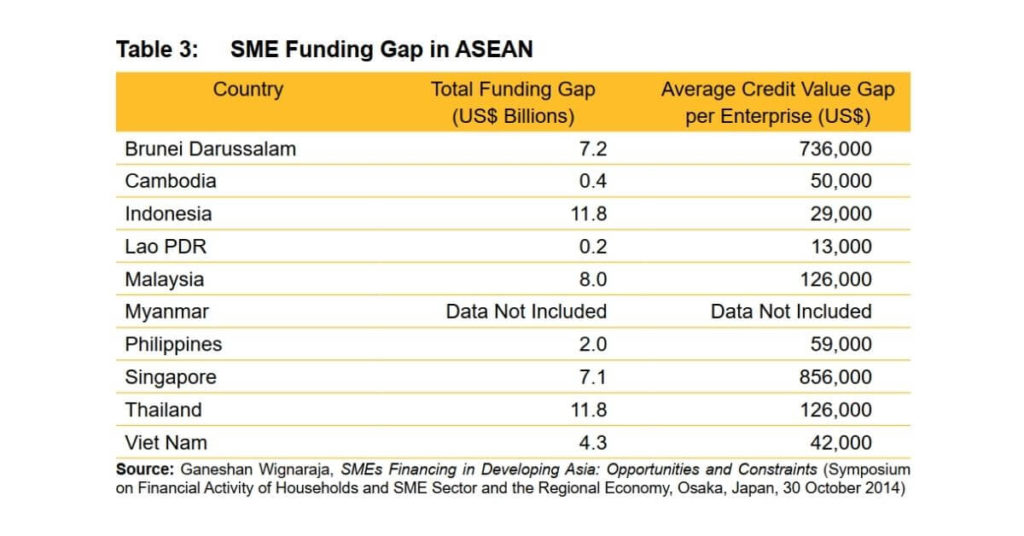

The lack of sufficient funding has caused a funding gap of US$ 52.8 billion in 2014 for SMEs in ASEAN, according to a study titled Facilitating Equity Crowdfunding in the ASEAN Region. The detailed breakdown of the funding gap can be found in the table below.

Because of these circumstances, increasing governmental support towards fintech, particularly equity crowdfunding, can be seen in many countries. These support manifest itself in the form of digital transformation policies such as Thailand 4.0, Malaysia 5.0, Indonesia’s Nexicorn, Vietnam’s National Digital Transformation Programme and the Philippines’ Digital Transformation Strategy.

According to asset management firm Mercer, the region has seen a rapid increase of fundraising by VC funds since 2015, peaking in 2019 with a record US$2.2 billion of capital raised.

In addition, a study titled Venture Capital in Southeast Asia, revealed that despite the occurrence of the COVID-19 pandemic, fundraising in 2020 (year-to-date through October 28) has been fairly strong, demonstrating the attractiveness of this region despite the ongoing pandemic.

Now, the fundraising landscape has been further disrupted through equity crowdfunding, allowing the process of fundraising to evolve from being a private, behind-the-doors activity to being fully visible to the public.

Crowdfunding platforms such as Ethis can be used to obtain small contributions from a large number of investors who are interested in the product offering of various SMEs and start-ups in exchange for an equity stake.

Related: Everything You Need To Know About Equity Crowdfunding

2) Access to equity crowdfunding for retail investors

Equity crowdfunding is also a form of investment for retail investors who are looking to diversify their investments. Retail investors are investors who are not an angel investor or a sophisticated investor, and have less than RM3 million in assets and an annual income of less than RM180,000. They could be anyone like me and you.

Equity crowdfunding typically involves low initial capital commitment, thus making it an attractive investment option for retail investors, angel investors and sophisticated investors alike. Anyone can be an investor as long as they have the minimum amount specified on the project’s crowdfunding page on Ethis.

It is also different from the usual types of traditional investments such as stocks, bonds or options. The value of these investments typically depends on the price of the underlying security, time, interest rate and volatility. In ECF, investors typically invest due to their personal interest in the SMEs or start-ups, such as interest in the business’ innovative product offering, social enterprises that address societal issues, or having first dibs on start-ups with high success potential.

When investing in SME and start-up fundraisers, investors want to find the next ‘unicorn’ to invest in, which will bring them high returns, or to invest in start-ups that have a high potential for acquisition in the future by larger organizations for their exit strategy.

3) Equity Crowdfunding as a shariah-compliant investment

Equity crowdfunding has also revolutionised fundraising especially within the sphere of Islamic investment. Equity crowdfunding platform is designed to promote SMEs and start-ups.

As Malaysia is a country where about 60% of the population is Muslim, Islamic investment or shariah-compliant investment is important for Muslims, and the equity crowdfunding campaigns on the Ethis platform is one of those options. Ethis is a Shariah-compliant equity crowdfunding platform which promotes not only Islamic investing but also as an ethical form of investing that promotes socially desirable economic activities.

With Ethis as a platform showcasing different ECF projects from various SMEs and start-ups that are shariah-compliant, the sphere of Islamic investment has been further widened, opening a wider pool of shariah-compliant instruments for interested parties.

Related: How to Earn Halal Money? The Money Mindset

4) Better visibility for start-ups

Equity crowdfunding as an alternative financing option allows start-ups to raise investment funds that are essential for early-stage start-ups. Businesses are able to test their minimum viable product (MVP) much easier because when promoting themselves through equity crowdfunding platforms to many interested individuals willing to test out their product.

Hence, any SMEs or start-ups that wish to raise funds will receive better brand visibility as the Ethis platform attracts different types of users and investors.Therefore, there is a high chance to receive timely funding. In order to receive funding, it is important to properly communicate the purpose of funds needed, the business strategy, and the underlying inspiration so that investors understand the value behind their investment and are moved to support the business.

5) Flexibility to dictate the terms to retain control over the start-up

Traditional fundraising like obtaining funds through bank loans or line of credit from financial institutions pose a high risk to the debtor. Not only do they take on the burden of a debt and its repayment with interest, but the business also has a chance to fail without any returns.

Other funding methods like raising funds via venture capital will cause founders to run the risk of losing control over their company because of the loss in equity as well as the loss in control due to the involvement of venture capitalist partners who have a large stake in a company, and will likely determine the direction of the company. The combination of a minor equity stake and involvement of aggressive VCs, venture capital funding would likely cause the loss of ownership of your own business.

However, this is not the case with equity crowdfunding. Through the use of equity crowdfunding, you can determine the percentage of equity for sale, ensuring that you retain a majority stake. This means that you are free to dictate the terms and level of involvement and can stay focused on the company’s strategic mission and vision without being swayed by outside opinion.

Bottom Line

To conclude, equity crowdfunding has been a very viable option as alternative financing for SMEs and start-ups in the ASEAN region, particularly Malaysia, Singapore and Indonesia. Access to equity crowdfunding through multiple platforms such as Ethis will further improve the number of investors and fundraising volume in high potential SMEs and start-ups. It is expected that the equity crowdfunding platforms and alternative financing industry will further grow and expand their services and product offerings to cater to the increasing number of SMEs and startups within the region.

Read more about Islamic Finance blog at Ethis

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You