By Hanan Hussain

zakat is a type of almsgiving to the Muslim Ummah that is seen as a religious requirement in Islam. zakat is one of Islam’s five pillars to serve the needy and it is incumbent upon all Muslims who satisfy the required criteria of wealth.

Thus, zakat is a divinely ordained system embedded in Islamic society to address the needs of the most vulnerable sections of the community. Ever since the coming of Islam, zakat has played a pivotal role in the betterment of society through wealth redistribution and economically empowering the underprivileged members of society.

“And establish prayer and give zakat, and whatever good you put forward for yourselves – you will find it with Allah.” (2:110, Qur’an)

The importance of distributing zakat correctly

zakat collection and distribution can be implemented very successfully to reach the most deserving recipients. It is estimated that if zakat distribution were implemented properly, it could banish poverty completely in those countries where it is practised. The reality however is very different.

There are many reasons for this. For any project to be successful, it must have an effective implementation, and very clear monitoring and evaluation. This is not a difficult thing to achieve. We are living in a global knowledge hub and systems and data management are important components of this modern era. As such we need to look at zakat as an economic tool and strategy for poverty alleviation and present it systematically and robustly.

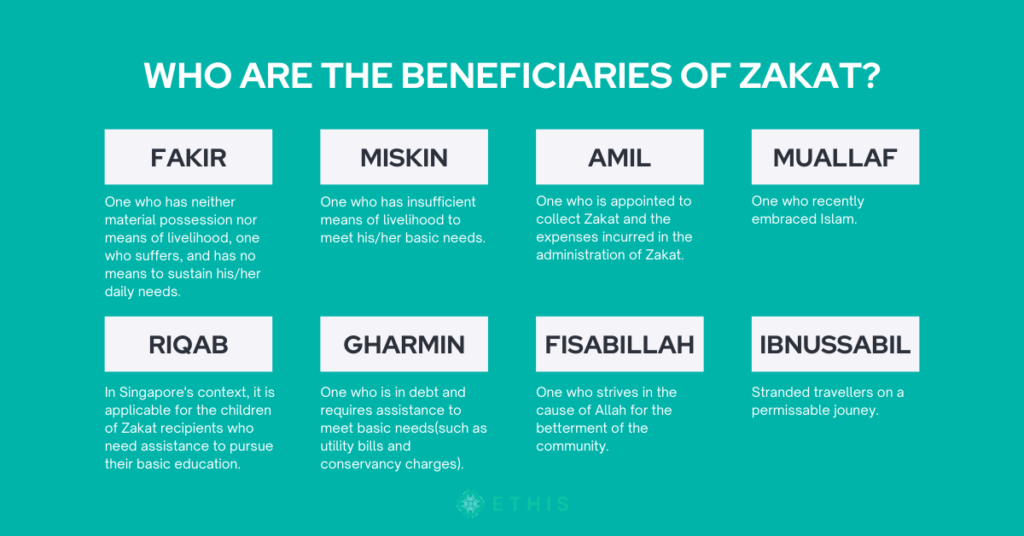

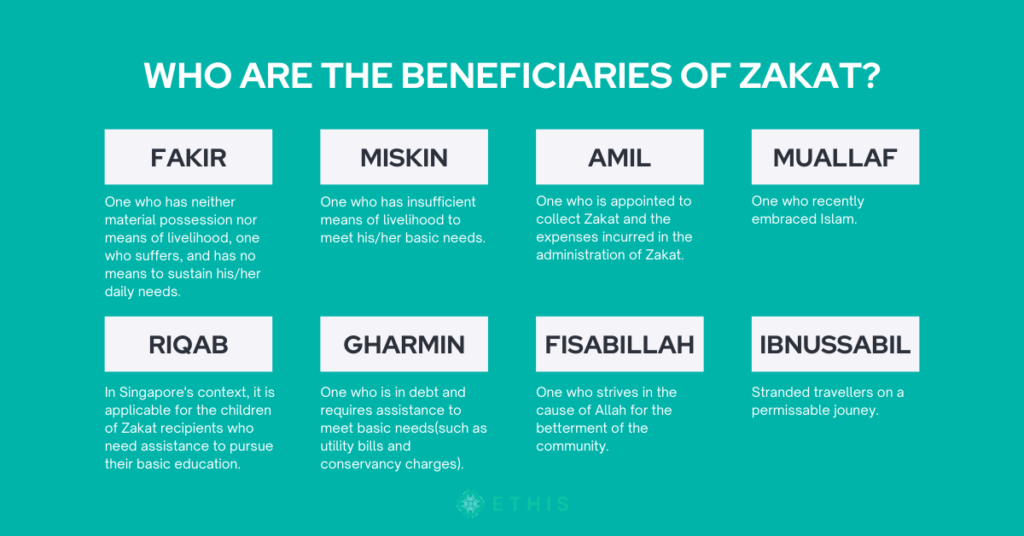

Eligible recipients of zakat

For effective implementation, identifying eligible beneficiaries and analysing them is very important.

As the Quran says:

The Holy Quran defines eligible beneficiaries as follows: ‘The offerings (zakat) given for the sake of Allah are (meant) only for fuqara (poor) and the masakeen (needy), and amaleen-a-alaiha (those who are in charge thereof), and muallafat-ul-quloob (those whose heart are to be won over), and for fir-riqaab (the freeing of human beings from bondage), and for al-gharimun (those who are overburdened with debts), and fi-sabeelillah (for every struggle) in Allah’s cause, and ibn as-sabil (for the wayfarer); (this is) an ordinance from Allah- and Allah is knowing, wise.’ (9:60).

Thus it is clear that the categories of zakat recipients are as follows:

- Fakir – (Poor)

- Miskin – (Needy)

- Amil – (Those who are in charge of collecting zakat)

- Muallaf – (Those whose hearts are inclined to Islam),

- Riqab – (The freeing of human beings from bondage)

- Gharimin – (Those who are overburdened with debts)

- Fisabilillah – (For every struggle in the way of God)

- Ibnussabil- (For the wayfarer)

Objectives of zakat

The primary objective of zakat is to pull Muslims out of economic hardship, empower them economically and reduce or eradicate poverty.

Any zakat-based economic empowerment program must consider the immediate basic needs of the poorest of the poor because our primary aim is to uplift the weaker section of the community economically. Thus, zakat doesn’t need to be paid to all the eight categories of beneficiaries simultaneously. It is a matter of discretion and based on scientific evaluation of the situation and the contexts.

Allocation of zakat among these eight categories will change as per time and situation. At a time of pandemic coupled with conflicts and disasters as we are witnessing now, we can see an increase of Fuqara (poor), Masakeen (Needy) and Ibn as-sabil (in the form of refugees) categories compared to more stable times.

In addition, as a result of the COVID-19 pandemic globally micro, small and medium scale enterprises were adversely affected, increasing the number of Al-gharimun or people overburdened with debts (who belong to one such category of zakat recipients).

It is well known that micro, small and medium scale enterprises account for 90% of businesses among Muslim communities and generate 50% of employment in these communities. Indeed, it is projected that 60% of the Muslim population will be affected by poverty by the year 2030. Hence, this issue is something that stakeholders within the Muslim economy must take very seriously.

First, we need to agree that the core aim of zakat is poverty reduction and that there is a clear priority given to the poor in the implementation of a zakat program. As our Prophet Muhammad (peace be upon him) pointed out: zakat is to be collected from the rich and paid to the poor. Throughout Islamic history, zakat has played an important role in pulling out the less fortunate sections of society from economic hardship.

Although Islam has presented zakat very well conceptually, Muslim societies have, in practice, not properly implemented the right approaches and systems geared to achieving maximum effect. Thus, there is a dire need of developing a system that could meet new demands and fit the modern context.

Islamic social finance: the answer to eradicating poverty in the Muslim world?

Social finance may be described as a set of investment methods with the primary goal of achieving positive social and environmental results for both investors and society.

As part of the sustainable development agenda established in 2015, governments all around the globe agreed to a set of goals to eradicate poverty, preserve the environment, and secure prosperity for everyone. The Sustainable Development Goals (SDGs) have established the global objectives and ambitions for 2030, based on the idea that no one should be left behind.

Islamic social finance instruments such as zakat can also be utilized to bridge financial shortages and establish social safety nets. For example, in Indonesia, a zakat fund of $350,000 was utilized to support the development of a Micro Hydro Power Plant in Jambi, supplying power to families, schools, and clinics, directly benefiting at least 4,448 people and indirectly benefiting many more businesses and services.

Therefore, Islamic social finance offers a lot of promise for enhancing social well-being and environmental sustainability. If properly created, managed, and used with transparency, accountability, and efficiency, Islamic social finance mechanisms such as zakat may successfully promote the SDGs.

Social Finance in action, globally

The susceptibility and fragility of our worldwide connected economy, healthcare system, and the social safety net was evident following the COVID-19 outbreak. However, it has provided the ideal conditions for digital Islamic social philanthropy to flourish as a viable vehicle for social development and financial inclusion.

GlobalSadaqah, based in Kuala Lumpur, Malaysia is an example of this. It’s one of the first Islamic charity crowdfunding platforms globally. An award-winning CSR, zakat, and waqf management platform, it collaborates with religious authorities, foundations, banks, and corporations, as well as the general public, to improve efficiency, sustainability, and effect of Social Finance.

Some examples of zakat campaigns currently offered by Global Sadaqah are listed below:

Paying zakat to the Poorest Families in Northern Nigeria

Covid-19 Emergency: Help India Breathe

Emergency Help and Medical Aid for Palestinians Attacked by The Israeli Occupation

Fighting Hunger: Free Bread For 2000 Poor Families in Yemen

Emergency Relief: Massive Floods Wreak Havoc In Yemen

A multidimensional approach to zakat

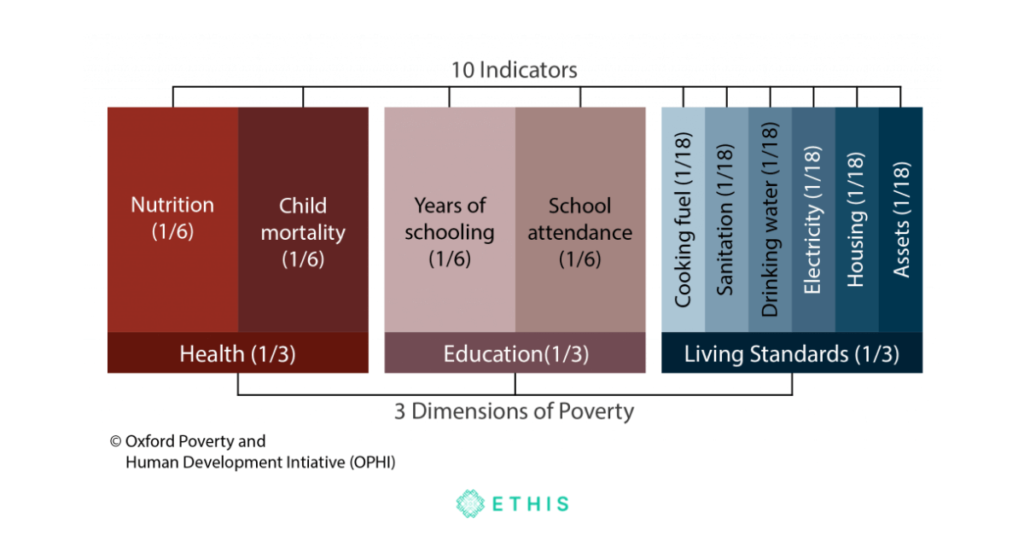

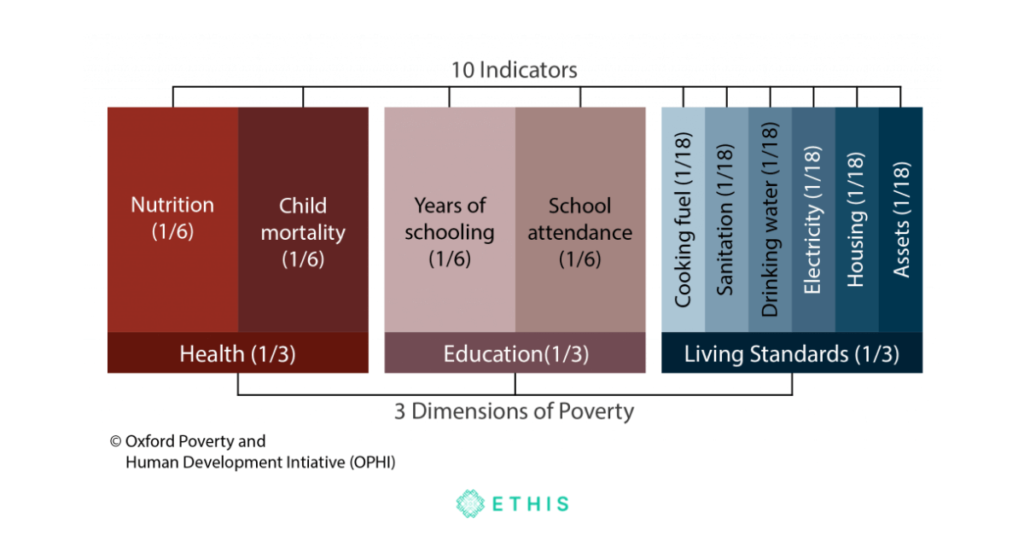

For improved distribution and execution of zakat programs, a multidimensional poverty index based on the Alkire-Foster approach should be established. This measure necessarily has to take into consideration the many aspects of poverty such as food insecurity, unemployment, poor living standards, lack of health care, access to education and so forth.

This Multidimensional Poverty Index (MPI) has been developed to address global and national poverty issues. They use individual or household surveys to map poverty in all its multidimensional aspects. A scientific system has also been developed to identify and monitor progress in poverty reduction. To achieve our goal effectively we must have a robust tool to identify the poorest of the poor people and to track poverty over a period and analyze whether it has indeed decreased due to renewed manner of disbursing zakat.

This tool or index can be applied to identify the poor who experience the most deprivations at any given time. It also pinpoints the multiple deprivations that a family has at the same time. By selectively targeting such individuals and groups using the index, poverty reduction programs can be more effectively implemented.

Structure of the global MPI

Benefits of a Multidimensional Poverty Index

If a multidimensional poverty survey based on MPI can be developed for zakat management, it will help us in many ways:

- It can be used to guide the allocation of zakat by which targeting will be more efficient. This means targeting resources to the regions with the highest rates of poverty or targeting individuals or households whose levels of poverty are at the highest. It can also be used to evaluate welfare programs aimed at reducing poverty. A detailed analysis of the indicator composition of poverty can be used to redistribute the resources according to the needs of each region or group to accelerate poverty reduction.

- It will provide a comprehensive picture of the poverty in a selected area. Furthermore, it will enable us to look into details of regions, sectors and demographic groups who are most affected.

- It will allow us to compare the poverty between some regions and groups and detect which ones bear a disproportionate share of poverty.

- It allows us to track poverty over time and measure whether it has decreased or otherwise. This will considerably support the making of policy decisions.

- By detailing the multiple deprivations that a family has at the same time, efforts can be directed to reduce the proportion of simultaneous hardships faced by the poor, even if they have not yet moved out of poverty.

Thus the larger part of the zakat would have to be channeled to the three most deserving categories out of the eight mentioned categories i.e. the Fakir, Miskin and Ibnussabil.

In conclusion, in times of pandemics, conflicts, and disasters, such as we are now experiencing, we can notice an increase in the Fuqara (poor), Masakeen (needy), and Ibn as-sabil (in the form of refugees) categories, as opposed to more stable periods.

The COVID-19 pandemic has negatively impacted micro, small, and medium-sized businesses throughout the world. This increased the number of Al-gharimun, or debt-ridden individuals (who belong to one such category of zakat recipients).

Islamic social finance has a lot of potential in terms of improving social well-being and environmental sustainability. Specifically, mechanisms like zakat can help organizations and countries achieve the SDGs if they are properly developed, administered, and utilized with transparency, accountability, and efficiency.

Global Sadaqah aims to fulfill this dire need of the times in order to to target and monitor zakat recipients to ensure poverty reduction programs are effective and have a lasting impact in relieving and empowering the most underprivileged sections of the community.

One Reply to “Zakat Implementation -A Multidimensional Approach”

You really share a great piece of content and useful information. It will be a great source of knowledge for the people. Thank you for enlightening us.

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You