Dr. Noor Suhaida Kasri and Basma Mustaque– The COVID-19 pandemic continues wrecking global economies on an unprecedented scale. Despite its socio-economic damage, the pandemic has triggered a significant acceleration in Environmental, Social and Corporate Governance (ESG) and Sustainable and Responsible Investment (SRI) uptake, including a mainstreaming and maturing of responsible investment philosophies and practices.

Current Market Trend: A Snapshot

According to Morningstar, the first three months of 2021 saw US$21.5 billion of net inflows into ESG funds. This was more than the previous record of US$20.5 billion set in the fourth quarter of 2020 and more than double the US$10.4 billion seen one year ago in the first quarter of 2020. Blackrock reported that 88% of sustainable funds in their analysis outperformed their non-sustainable counterparts in the period 1 January to 30 April 2020.

These data points evidence the shift in investors’ focus from a pure risk and return standpoint to thinking about their role in driving real-world outcomes. The ESG and COVID-19 survey conducted by the Principles for Responsible Investment (PRI) over its signatories in 2020 show an increase in communal interest. 64% of the survey respondents indicated that the COVID-19 pandemic has brought social issues that were not a priority onto their radar.

These issues include occupational health and safety, social safety nets, worker protection, responsible purchasing practices and supply chain issues and diversity and digital rights, including privacy. Moving beyond the pandemic, these respondents placed social issues related to human rights, mental health, access to healthcare and public transport amongst their priorities.

In light of the above development, this article attempts to explain why ESG/SRI matters. The approach is to elucidate from the perspectives on how ESG/SRI contributes to the well-being of one’s society and economy and how the exclusion of any of them could affect societal and economic well-being.

This article will also look into the correlation between ESG/SRI and Maqasid-E- Shariah (Objectives of Shariah) and Islamic finance and will offer some thoughts for industry stakeholders on building a more sustainable, resilient and inclusive ESG/SRI ecosystem.

What is ESG/SRI?

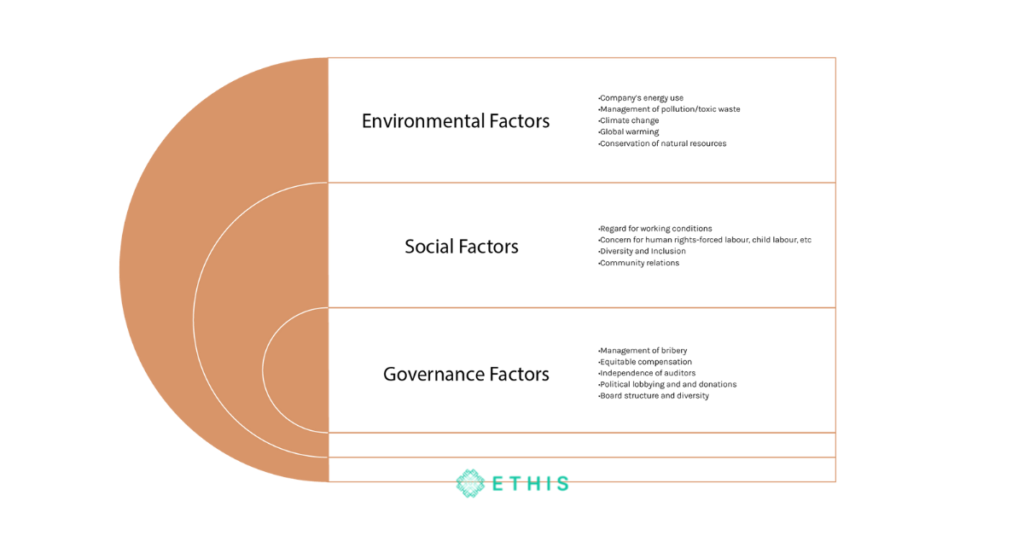

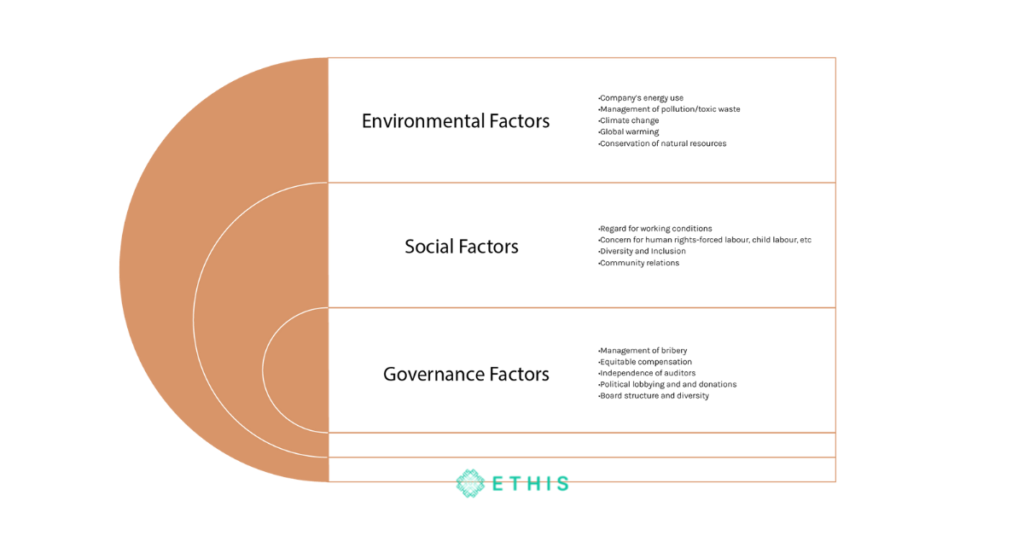

Simply put, ESG investing implies investing in companies that score high on environmental performance, social impact, and governance issues. On the other hand, SRI is an investment that is screened using ESG criteria. The diagram below illustrates the ESG factors under the respective environment, social and governance pillars.

How does ESG/SRI contribute to the well-being of one’s society and economy?

In view of the ESG/SRI factors described above, we hereby argue that ESG investing or SRI for that matter contribute to the well-being of our social system and economy in many ways. Below are some of their worthy rationales:

Environmental

Firstly, ESG/SRI contribute towards effective environmental and climate management. A robust climate, for example, ensures food security for society and agricultural supply for restaurants, airlines, hospitals, and many other sectors. Climatic conditions, therefore, impact the employment of many people, directly or indirectly.

Secondly, ESG/SRI will help conserve natural resources, such as oil, gas, minerals, water, timber, etc. which constitute a significant proportion of wealth for most economies.

Natural resources are used as essential inputs for production in many sectors, and therefore, it is important to use the resources efficiently to ensure continuity of industry, employment, and supply of goods and services.

These natural endowments act as a sink for waste and emissions. Wetlands, for example, filter water while forests filter air pollution which is eventually consumed by society. They provide numerous health benefits through their filtering properties. At the same time, natural ecosystems provide opportunities for scientific research and aesthetic enjoyment.

Due to the significant drop in export and import activities because of the COVID-19 pandemic, the world faced increased food insecurity. Globally, food prices rose by approximately 20% between 2020 and 2021, impacting mostly countries that depend on food imports.

In this regard, conserving natural resources becomes more crucial than before and efficient use of agricultural input is required to ensure food security. A more clean water supply is needed for washing and cleaning thus mitigating the spread of the virus. At the same time, greater quantities of natural minerals are needed for hospital supplies.

Social

ESG/SRI can enhance the relationship between a company and its employees, and with the communities in which it operates. At the same time, it provides employees with a workplace that is physically and emotionally safe. It also correlates to consumer protection through product quality.

Employees can focus on their duties without fear of harassment, unfair discrimination, loss of privacy, or other dangerous conditions. Consumers do not encounter faulty/unsafe products, incomplete services, misleading prices, or advertisements. These factors contribute towards the wellbeing of society and the economy as these can limit consumer protests and labour strikes. There is likely to be lower absenteeism and turnover among employees and therefore the economy will not experience a loss of productivity. Consumer confidence will boost investment and spending.

In the aftermath of COVID-19, there is heightened awareness about the need to protect employees and customers. There are Standard Operating Procedures (SOPs), such as temperature checks, hand sanitizing, compulsory face masks, etc. which must be enforced by businesses.

In fact, companies have been asked the manner in which they tackled COVID-19 related issues. The 2020 PRI survey showed that companies were asked about COVID-19 related issues during their 2020 AGM season. The survey also indicated that the PRI signatories/investors will continue to engage with companies on pandemic-related issues post AGM season.

Governance

ESG/SRI will ensure that resources in the economy are utilised efficiently. Equitable compensation policies will ensure fair distribution of resources across society and allow allocative efficiency of free markets, resulting in economic development and a higher standard of living.

Transparency, accountability, and independent audit of financial documents, in the context of globalization and free trade, helps attract additional capital inflows into the economy which can help alleviate poverty.

In the context of COVID-19, good governance will ensure fair, and efficient distribution of healthcare, such as vaccines and other life-saving medicines. Equitable policies will enhance the response to emergency situations, for example, by diverting funds for oxygen cylinders to the underprivileged beneficiaries, instead of diverting it to those with influence in society.

How would exclusion of ESG/SRI affect the wellbeing of one’s society and economy?

Based on the above rationales, we argue that disregarding ESG/SRI would detrimentally affect the social and economic wellbeing of the global nation.

As Mark Carney, the then Governor of the Bank of England, once said: “Companies that don’t adapt (to climate change) – including companies in the financial system – will go bankrupt without question. (But) there will be great fortunes made along this path aligned with what society wants.”

The following are some adverse impacts on the environment and society by ignoring ESG/SRI investing:

Environmental

The exclusion of ESG/SRI could create several environmental issues for society and the economy.

Climate change, for example, results in massive human migration. It is estimated that by 2050, there will be 200 million climate migrants. They are expected to be displaced due to coastal flooding, land degradation, droughts, natural disasters, etc. The countries from which the migrants leave risk losing qualified individuals with high education and technical skills.

The host countries into which migrants enter might experience a fiscal strain if the migrants require economic assistance in the form of basic needs like food, clothing, and shelter. At the same time, social unrest could potentially erupt if the migrants resort to stealing, drugs, prostitution, and petty crimes to make ends meet. Also, nationalistic, anti-migrant, and xenophobic protests by the host communities could potentially result in violence.

Given the COVID-19 situation, host countries are concerned about migrants carrying the virus, which could strain the local health care systems. Illegal migrants create an additional risk of spread because they do not identify themselves for fear of deportation.

Social

The exclusion of ESG/SRI could encourage forced/child labour, which could obstruct the development and growth of human capital as forced/child labour typically involves low-skilled, labour-intensive tasks. Government cannot collect tax revenues from these labourers as it could from highly paid and skilled labour.

Hence, society bears an opportunity cost because individuals with the potential to become professionals are exhausting their time in factory work instead of acquiring an education. Without an education, these individuals will likely remain in the Bottom 40 group and will continue to depend upon government benefits.

The exclusion of ESG/SRI could potentially create unjust and unfair discrimination in the workforce and limit people’s opportunities and social inclusion. As a result, talented individuals could be excluded from the workforce, which would hinder the optimal use of human resources.

Governance

In reality, good governance assures a corruption-free environment. Corruption discourages investment and adds to the cost of conducting economic activities. It, therefore, reduces GDP and economic growth.

Bribery and corruption diminish public trust. It reduces motivation for society to extend effort as individuals are not rewarded for effort, but instead, for displaying corrupt behaviour. It impacts human development and has a corrosive impact on the rule of law. Therefore, it can eventually lead to a situation where lawlessness and crimes become rampant.

The COVID-19 pandemic has caused many economic sectors to face a significant drop in their revenue and cash flow. As a result, some companies adopted defensive accounting policies to show higher cash reserves to impress shareholders. This creates an increased risk of accounting fraud and/or window dressing, bribery, and corruption. Boards must ensure transparency of financial statements, implement anti-corruption policies, and monitor compliance to accounting standards to protect investor confidence within the economy.

ESG/SRI vis-à-vis Maqasid Shariah

The notion of ESG/SRI is naturally ingrained in Islam. While Shariah (Islamic law) in general covers all aspects of human life, Maqasid -e- Shariah refers to the higher objectives or purposes behind the promulgation of Islamic Law for Allah, the lawmaker, who never creates or makes things in vain.

In principle, Maqasid -e- Shariah is about preserving maslahah (public interest) and to preserve maslahah, the higher objectives of Shariah must be met. Imam Al-Ghazali succinctly described the Maqasid -e- Shariah:

“The very objective of Shariah is to promote the wellbeing of the people, which lies in safeguarding their faith, their lives, their intellect, their posterity and their wealth. Whatever ensures the safeguarding of these five serves the public interest and is desirable, and whatever hurts them is against public interest and its removal is desirable”

COVID-19 pandemic has brought forth the importance of implementing economic activities in line with the objectives of Shariah.

Islam demands economic actors to be responsible and ethical in conducting their business or profit-making activities. They must ensure that their activities are mutual to their surroundings and not cause any detrimental harm. Therefore, practices and activities that promote the wellbeing of the people, which lies in safeguarding their faith, their lives, their intellect, their posterity and their wealth are desirable.

This principle echoes well the notion of ESG/SRI. Leading Islamic markets like Malaysia for example have emphasized the importance of internalizing Maqasid -e- Shariah via the concept of Value-Based Intermediation (VBI).

By introducing VBI, the Central Bank of Malaysia (CBM) can ensure that Islamic financing institutions’ practices, conduct and offerings are propelled towards producing a positive and sustainable impact on the economy, community and environment.

The COVID-19 pandemic has accelerated the movement of the Islamic financial industry into the realm of ESG/SRI. In April 2021, the CBM introduced the Climate Change and Principle-based Taxonomy (CCPT), Malaysia’s climate-focused sustainability taxonomy for the financial sector. The CCPT is intended to guide financial and Islamic financial institutions in assessing and categorizing economic activities in meeting climate objectives and promote the transition to a low-carbon economy.

Ethis and its sustainable investments

Ethis is a leading platform for sustainable and impactful investment into real-world projects. It offers ethical and shariah-compliant financing and investing opportunities. Most of its projects take into account social considerations such as inclusiveness, investment in human capital and communities as well as supporting the unbanked and small and medium-sized enterprises.

Ethis ensures that all the investment opportunities offered on its platform are shariah-compliant and modelled on Islamic principles, which means avoidance of interest-based products, avoids alcohol, gambling, or arms and ammunition. The principles of transparency, fairness and risk-sharing are essential elements of all such opportunities.

This is more so important in today’s times given the COVID-19 pandemic and its drastic effects on all communities globally. The pandemic has had a devastating impact on marginalized communities in developing countries. The hope is that sustainable finance and socially responsible investing will enable the creation of a resilient economy and aid in a sustainable recovery from the impacts of the COVID-19 pandemic.

The Way Forward

The question now is how can we sustain the current ESG/SRI market uptake while knowing that the COVID-19 pandemic is far from over.

The answer lies in acquiring a solid understanding, appreciation, and belief in the wholesome positive return of ESG/SRI. This requires organic growth – initiated from within the key organ of commercial institutions. Here are some thoughts for consumers, investors, policymakers and regulators to ponder and consider:

- Encourage the adoption of the ESG/SRI best practices, particularly those companies found to have relatively lower levels of adoption.

2. Integrate sustainability considerations in the companies’ corporate strategy, governance and decision-making.

3. Strengthen board holistic oversight of the business coupled with proactive and effective measures to anticipate and address material ESG risks and opportunities.

4. Equip Boards with sufficient understanding and knowledge of sustainability issues relevant to the company and its business. This can be measured by their ability to tackle questions and deliberate on sustainability issues.

5. Enhance Boards’ capacity by identifying their professional development needs on sustainability, which include considering whether a change in their composition or skills matrix is required to strengthen board leadership and oversight of these issues.

6. Integrate ESG factors in institutional investors’ investment decision-making process as part of their fiduciary responsibility, including by using shareholder votes to hold boards and senior management accountable for the management and oversight of sustainability

The above suggestions may seem a colossal task but with the right strategic adaptations, these could lead to healthier, cleaner, peaceful, compassionate, resilient and sustainable economies which benefit not only businesses but humans, animals and the larger environment.

Read more about Islamic Investing

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You