By Abdulazeem Abozaid

In general, social responsibility of Islamic banks reflects two things: the type of expectations Muslims had from Islamic banking, and the failure of Islamic banks to perform their perceived social role. However, it is unclear whether the social good is something embedded in Islamic financial transactions so that whenever they are applied on banking scale a social good is to be expected, or that the social good is something Islamic banking should undertake and seek after since it is not embedded in its transactions per se!

Should the latter be true, one, on the other hand, should not overlook the fact that Islamic banks are not charitable institutions, but rather profitable ones entrusted with investing depositors’ money, and that the absence of independent charitable organisations, whose establishment is the responsibility of the Muslim treasury under the Muslim state, must not place the blame on Islamic banks. The query however remains valid if upholding social responsibility comes at no additional financial cost or loss to Islamic banks and remains a matter or preference influenced by extra caution and subjective assessment of the potential returns.

To give a fair answer to the question raised above, Islamic financial transactions in general if executed properly and with full observance of their Shariah rules and conditions do carry within some embedded good. Nevertheless, contracts remain merely tools so they need to be directed to serve a particular purpose. If this purpose has to be the social good, then it must be set in advance and worked on, but Islamic banks would not be then doing something against Islamic banking nature, but rather they would only be administering malleable ingredients.

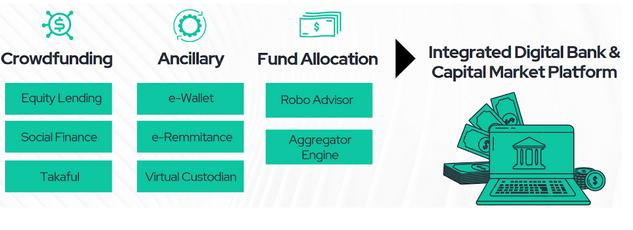

Ethis Ventures Sdn Bhd, Malaysia’s first Shariah-compliant equity crowdfunding platform, also focuses on social good, with a specific focus on impact and sustainable campaigns carried out through Islamic values & ethics. Ethis has a vision to be an Integrated Digital Banking & Capital Market platform that is Shariah compliant and free from riba (Interest).

This article will highlight the social responsibility of Islamic banking as guidance for those interested in pursuing Islamic banking license and existing Islamic banking institutions.

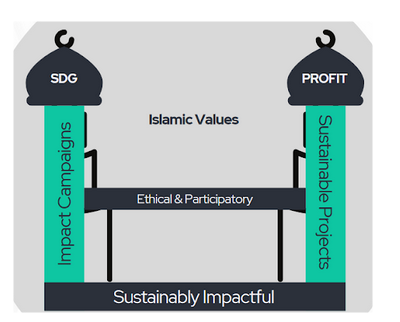

Ethis’s brand consist of two pillars, making profits and achieving goals, achieved through the bridging Islamic values and ethics, while providing a solid foundation and being sustainably impactful.

Social Expectations

The challenge is whether or not Islamic banking is willing to undertake a social responsibility! In fact, the Muslim public has legitimate demands and rights over Islamic banks. If these demands are met, the social good will come about automatically. These legitimate demands relate to the right application of Shariah rules since the very using of ISLAM as a logo by the banks gives the right to all Muslims to demand from these banks full adherence to the Islamic Shariah.

This right actually emanates from Islam being the religion of all Muslims so that no one may use its name for his or her commercial gain unless with full subjection and adherence to its rules and principles to say the least. The demands also relate to selecting financing sectors that achieve social good if doing so comes at no extra cost to Islamic banks.

Therefore, by associating their banking activities with Islam, Islamic banks are supposed to fully abide by Shariah rules and uphold at least cost-free social responsibility, and doing so requires no show of gratitude by Muslims towards these institutions.

What to reform in Islamic banking to achieve social good?

Upholding social responsibility by Islamic banks in the way described above necessitates some reformation in the following fields.

1) The finance sectors

In this regard, Islamic banks should do the following:

- Relax the stringent criteria set by Islamic banks to provide financing to the small and medium enterprises, and not favour the big enterprises in view of their better creditworthiness.

- Select financing projects on the basis of their optimal outcomes and their possible contribution to the welfare of the society.

- Invest in the economies of the Muslim and developing countries rather than in the economies of the rich countries or in ways that eventually feed their economies.

- Reduce the finance of luxury goods and services and favour instead the finance of capital goods and assets.

- Restrict the products that normally encourage unnecessary debt incurring like credit cards and personal financing.

2) The internal policies

In this field, Islamic banks should do the following:

- Observe justice when determining fees and fines, since high fees burden clients and may lead to a decision to exit Islamic banks to conventional banks where social good is not a concern.

- Take genuine risk of the financing underlying contracts and not shifting that risk to the financed clients, as this unlawful practice may unjustly burden clients and affect their ventures.

- Desist from playing around Shariah rules to obtain unlawful capital and return guarantees from the clients financed on equity basis. This practice renders the financing conventional in essence and thus leads to the same economic and social evils of Riba.

- Manage charity funds, which mostly generate from the bank’s necessary or accidental religiously unlawful earnings, to support some social causes instead of seeking some fatwas to legalize redirecting this fund for the benefit of the bank. Sadly, many Islamic banks redirect a portion of this fund to their collection department. This has reached in some cases 85% of the fund, excluding the Zakat fund!

3) The nature of the financing products

Islamic banks can never play a positive role in society unless they distance themselves from the evils of Riba. However, this will never materialize if Islamic banks persist in seeking legitimacy for their products from adherence only to the technical requirement of contracts. Just like packaging and labeling a bottle of wine in the same way a fruit juice is packaged and labeled will not eliminate the evils of wine, executing a Riba-bearing transaction with the use of some Shariah terms and technicalities will not change the fact that it is Riba.

In fact, Riba was prohibited for its evils, and the means used to reach it has no consideration in this prohibition. In the holy Quran we read that some Jews were punished because they persisted in Riba dealings “وأخذهم الربا وقد نهوا عنه” (Quran, 4: 161). However, commentators of the holy Quran mention that the Jews’ persistence on Riba dealing was indirect; i.e. through use of some subterfuges and legal devices to reach the same end result of Riba. In fact, Ibn Abbas was quoted to have said that they dealt in Riba through manipulation of some sales contracts (Al-Razi, Al-Tafseer Al-Kabeer).

Therefore, staying away from the social and economic evils of Riba entails a full departure from all Riba tricks and means, and only then would Islamic banks be able to genuinely achieve the social good. This is especially true since taking Riba with one hand and paying some charity with the other will not do society any good. In other words, no matter how benevolent and merciful Islamic banks can be in paying charity or even pricing their products, they will fail to ultimately bring about prosperity to society if their financing products are effectively conventional.

Thus, it is extremely important for any perceived social role of Islamic banks that the nature of Islamic financing products be void of Riba elements and tricks, since the evils of Riba are powerful enough to outweigh and suppress any good Islamic banking may involve.

Read more about How Shariah-Compliant is Islamic Banking?

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You