The booming crowdfunding ecosystem is changing the financial landscape by storm. Banks no longer hold the monopoly in credit and have become an option when it comes to business loans. Shariah compliant P2P lending, in particular, offers an alternative source of funding for businesses looking to borrow money.

P2P lending is the direct lending of money to businesses without the participation of a financial institution such as the banks as an intermediary. It connects borrowers directly with individual lenders via an online platform created by a financial tech or fintech company like Ethis.

While P2P lending eliminates lengthy bank processes, stringent requirements, and the role of a bank in the borrowing transaction, it does not replace the banks as a whole. Instead, it provides an alternative solution to address the financing needs of micro, small and medium enterprises and serves the “unbanked”.

As with the banking sector that offers both conventional and Islamic products, so is the case with P2P lending. Let’s dip into shariah-compliant P2P lending.

How does shariah-compliant P2P lending work?

Unlike conventional P2P lending that runs on a credit model with interests, shariah compliant P2P lending is based on Islamic contracts. It requires a product, commodity, or service as a trade-off of the financing. There are various Islamic contracts that can be used in the P2P lending transaction, such as Murabahah, Musharakah, Mudharabah, Ijarah, etc.

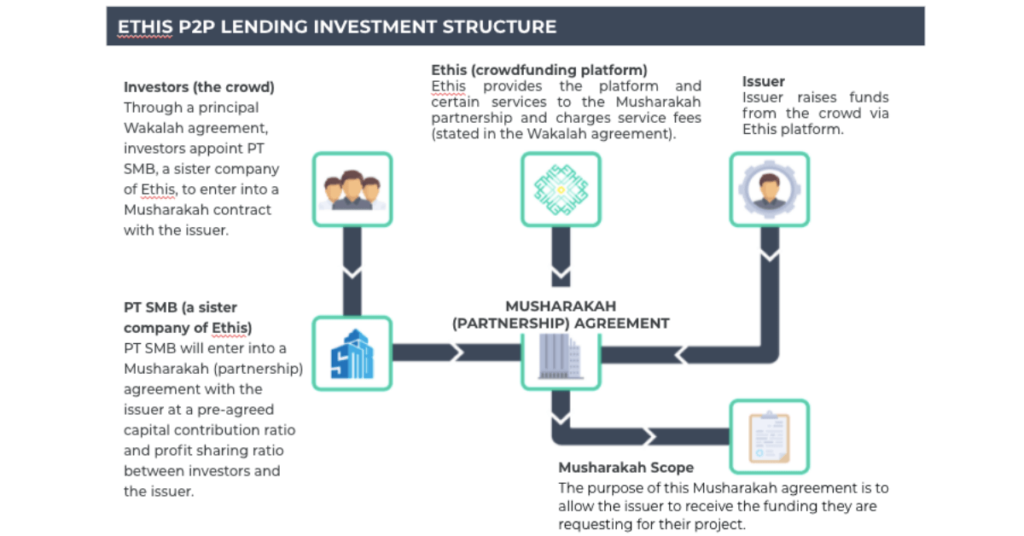

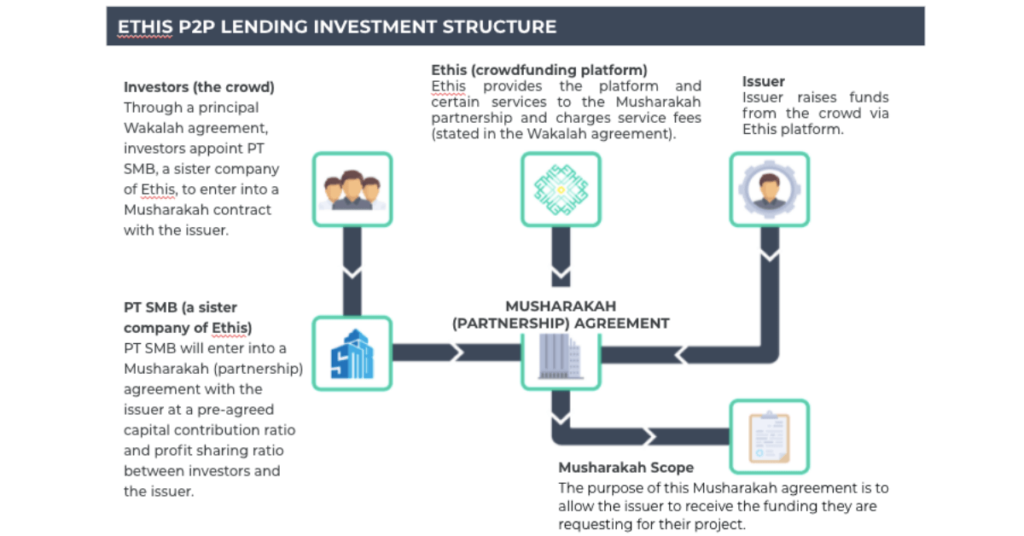

At Ethis Indonesia, a fully licensed shariah compliant P2P platform, our transaction is based on a limited-scope joint-ventures partnership known as Musharakah. The investors will appoint PT SMB, our sister company, to enter into a Musharakah partnership with the issuer on their behalf through a Wakalah agreement. Through the agreement, PT SMB will then enter into a musharakah partnership with the issuer at a predetermined capital contribution ratio and profit sharing ratio between the issuer and investors.

Wakalah refers to a contract where a party, as principal (muwakkil) authorises another party as his agent (wakil) to perform a particular task on matters that may be delegated, with or without the imposition of a fee. In this case, the investors are the muwakkil while PT SMB acts as a wakil to the investors.

The Musharakah partnership will allow the borrower to receive the financing, once it has been fully funded, to purchase the asset. Profit, if any, will be shared between the issuer and investors on a ratio that has been agreed upon earlier. As a platform that facilitates the entire process, Ethis will receive certain service fees as agreed in the Wakalah agreement.

Upon completion of the issuer’s project and receiving their payment, the issuer will pay back investors’ capital together with the profit (if any) and the musharakah partnership will be dissolved.

The rewards of shariah compliant P2P lending to investors

Similar to equity crowdfunding, P2P investing is becoming increasingly popular among seasoned investors looking to diversify their investment portfolios and mitigate risks and losses. P2P investing offers potential high-return as well as other rewards. Here are some of them.

Related: Diversify Your Investment Portfolio with Equity Crowdfunding

1) Potential high return in a relatively short period of time

Some P2P projects payout from as early as three months to up to two years. This is considered a short-to-medium-term investment.

Investors earn returns based on a pre-agreed Profit-Sharing Ratio (PSR) and bear loss proportional to their contribution in the capital of the partnership. The returns will depend on the amount invested. Generally, the more money you invest, the higher the returns.

At Ethis Indonesia, we have an issuer that paid up to 15.3% actual return on their project within a campaign period of two months. However, please bear in mind that past performance is no guarantee of future results.

2) Build your own investment portfolio

P2P lending allows you full control over your investment portfolio. Whether to invest in property-related projects, industrial petrol trading, IT procurement projects, or not to, it’s your call.

At Ethis Indonesia, our projects range from property, supply chain, microfinance, and other exciting impact-driven projects supported by reputable local and international partners.

3) You don’t have to fund the entire project

The beauty of crowdfunding platforms is that the funding does not come from a single source but the crowd. In this case, there will be a pool of P2P investors funding the same project to hit the funding target. So you don’t have to worry about the high investment threshold that the project would require as you can invest only the minimum amount that you can afford to lose.

The risks of Shariah compliant P2P lending to investors

Now that we have laid out the rewards, let’s dissect the risks that come with the opportunity to earn higher-than-average returns on your investment.

1) Delayed payment

There is a likelihood that some project payout may get delayed due to the delay in the completion of the project as a result of unavoidable circumstances such as the COVID-19 lockdown, supply chain disruptions, etc. This is a risk that you will need to consider.

2) Your capital is not guaranteed

You could lose a portion of, or your entire principal invested if the borrower defaults on their payments. Some platforms have safeguards in place to mitigate the risks, may take legal action against default borrowers or work with them to propose alternative repayment solutions. Nevertheless, your repayments are not guaranteed as you are an unsecured creditor.

3) Limited liquidity

Unlike stocks where you can just sell off any time and the market is open even at a loss, P2P investing is a buy-and-hold type of investment. It’s illiquid. Investors can only exit once the issuer has cleared the repayment to the platform for disbursement to the investors.

Related: Investing through Equity Crowdfunding (ECF): The Pros and Cons

To mitigate these risks, it’s advisable to diversify your investments and spread out your capital across multiple investment options. Though the goal of investing is to grow your money over time, remember to only invest an amount that you can afford to lose.

Learn more about P2P lending campaigns on Ethis Indonesia at ethis.co/id.

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You