By Noor Suhaida Kasri (PhD)

The Muslim World is at the crossroads of transitioning and reopening its economic and social sectors just after facing the challenging third wave of the COVID-19 outbreak. To cushion the devastating impact of the pandemic, countries like Malaysia have launched economic stimulus packages to facilitate the country’s recovery process.

Meeting current needs

Although various Muslim countries have adopted different initiatives to ensure the survival of the Islamic Banking and Finance Industry, the most successful seem to have been Malaysia. We will here dwell on how the country succeeded in getting over the crisis and why the Malaysian experience can be replicated in other Muslim states.

In Malaysia, we find that despite the prolonged pandemic and its devastating impact on the banking sector, the sector remained resilient and agile. This was no doubt due to the continuous support, effective coordination, and consistent policy response by the Government and its central bank, Bank Negara Malaysia (BNM).

For one thing, relief facilities and financing/loan repayment assistance continued to be offered to affected individuals, Micro SMEs and SMEs. For instance, the re-imposition of stricter nationwide containment measures that took place in mid this year saw another round of automatic moratorium proffered to all individuals, microenterprises, and SMEs. In addition, banks’ financing facilities to SMEs were also expanded, supported by the additional capacity provided through the BNM Fund and credit guarantee schemes.

Since the start of the pandemic, a total of RM18 billion was allocated under the BNM Fund to augment financing by the banking system to SMEs. In fact, for the first half of 2021, a total of RM154 billion was disbursed under bank financing to SMEs which was 4% higher than the pre-pandemic level. Loans/financings outstanding for the SME segment increased by 6% over the same period last year.

Efforts are also underway to develop alternative debt-equity and blended financing initiatives to enable SMEs to have access to a wider range of financing options across their growth cycle. All this demonstrates the high level of strength and stability of the banking sector as well as its ability to step up when the country needed it the most.

Shariah Advisory Council’s key support

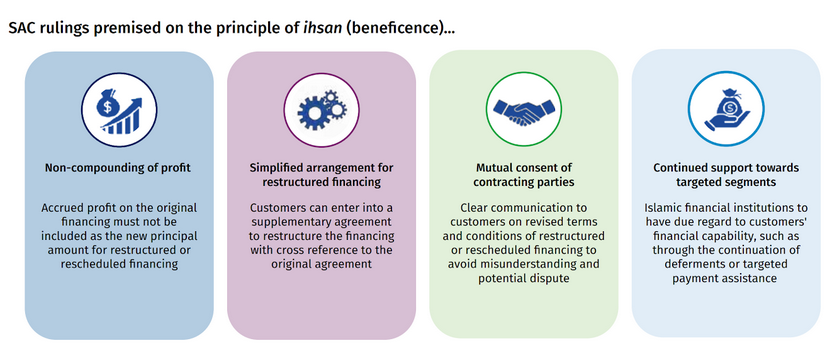

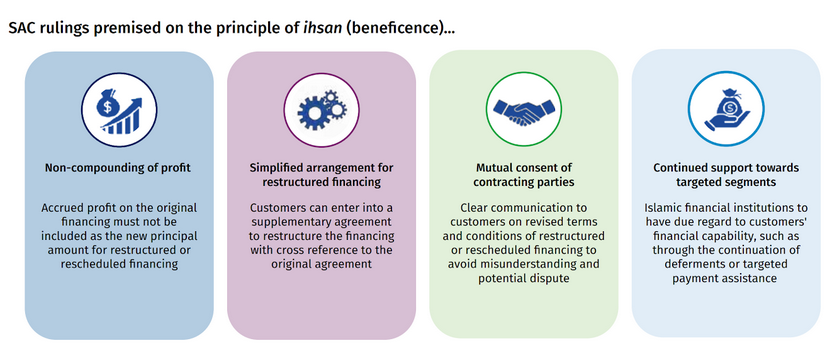

Another driver that drove Islamic banks to persevere in facilitating their pandemic-affected customers was the active support of the Shariah Advisory Council of Bank Negara Malaysia (SAC). In the wake of the pandemic, the SAC issued key rulings that guided the Islamic banking industry in implementing assistance measures to ensure that they were in line with shariah principles.

Almost half of the SAC meetings in 2020 were dedicated to discussing shariah matters related to COVID-19 relief measures. The SAC rulings effectively reduced financial hardships experienced by customers during the pandemic in addition to the relief measures afforded to these customers by the GoM and BNM. The diagram below illustrates the SAC rulings on practices and conduct of Islamic banks in attending to the impact of the pandemic.

Marching ahead

Next year, the resilience and growth of the banking sector will continue to be tested amid the uncertainty surrounding the pandemic trajectory. Nonetheless, the pre-existing prudent provisioning practices of banks and adjustments made during the pandemic to account for the heightened level of uncertainty are expected to support the resilience of banks and provide an adequate buffer. This will ensure that banks are reasonably well-positioned to withstand higher-than-expected credit losses in the event of more adverse credit developments.

In this regard, Islamic banking institutions are expected to play a bigger and proactive role in facilitating the recovery process through their ongoing Value-based Intermediation (VBI) initiatives.

As a matter of fact, sustainability and inclusivity are already part and parcel of the Islamic banking system. Recognising its key contribution to the country’s economic resetting post-pandemic, the following are some key factors worthy of the industry’s consideration:

| Capacity Building | To strengthen its role in supporting the economy during this challenging time, Islamic banking institutions need to continue building the required capacity to enable continuous financial support to customers in a timely and efficient manner. The gradual reopening of the economy and the acceleration of the COVID-19 vaccination warrant new financing be extended as more businesses are allowed to resume operations. |

| Greater Focus on integrating Sustainability & Value-Based Intermediation | To cater to the emerging needs and the national sustainability agenda, Islamic financial institutions need to give greater focus on the continuous integration of sustainability and VBI into their business strategies, driving business decisions based on true costs and benefits to business and stakeholders. This includes prioritising responsible banking by identifying the best way to optimise positive social and environmental impact in their products offerings, services, operations, and activities. |

| Alternative Financing Initiatives | Overreliance on a debt-based recovery will lead to significant financial stability risks. In this regard, more focus must be given to innovative alternative financial initiatives. Hence alternative debt-equity and blended financing initiatives be further developed and scaled-up to enable Micro-SMEs and SMEs to access a diverse range of appropriate financing options across their growth cycle. This will lower the leverage and strengthen the long-term resilience and capacity of Micro-SMEs and SMEs thus increasing their contribution to the economy. |

| Inclusive Circular Economy | Islamic banking institutions can play a greater role in supporting the transition to inclusive circular (including green) economy solutions and business models through this segment is still considered a high-risk venture for banks. By working closely with the relevant stakeholders, including policymakers, the Islamic banking industry can better develop new and innovative financial instruments that de-risk circular economy investments while ensuring that the right incentives are in place for effective public-private partnerships. |

| Mass Adoption & Acceleration of Digital and Technology | The acceleration and mass adoption of the digital and technology system have proven their viability and agility to the banking sector. They offered a host of opportunities, including lowering the costs of banking services, enabling more tailored and convenient banking offerings, and a greater ability to reach underserved and unserved segments. With the progress of the data ecosystem, the Islamic banking sector could make the most of this novel system to further advance financial inclusion, empower consumers to make informed banking decisions, and further develop innovative banking solutions that benefit the community as a whole. |

| Sustainability & Value-Based Intermediation Awareness | Forging better understanding among the industry players and their stakeholders (including Islamic banks’ employees) of VBI, sustainability, their opportunities and related risks. This will inculcate interest in the industry players to participate, support and adopt sustainability and VBI agenda in their institutional strategy, operations and activities. The increased awareness will also drive employees to be on board with their employer’s sustainable agenda thus support the employer in promoting sustainability. While customers would be more confident and encouraged to make the transition by adopting more sustainable practices in their businesses. |

Bottom Line

In sum, Malaysia’s Islamic banking industry has risen to the challenge through its VBI responses to the pandemic. Notwithstanding the long-lasting effects of the pandemic which includes the potential ‘double whammy’ of reduced income and higher financing defaults by individuals and businesses, the industry must march forward. It must continue to further grow and enhance its contribution towards domestic socio-economic growth and development post-pandemic, an opportunity for Islamic banking and VBI sector to mainstream and lead the country’s banking industry.

Malaysia’s success story in this regard shows that with timely and well thought of initiatives, the Islamic Banking and Finance Sector can be revived, revitalised and rejuvenated. All it needs is the necessary political will and public support to take it forward.

Read more about How Shariah-Compliant is Islamic Banking?

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You