Islamic Fintech: A Brief Description

Shariah compliant Fintech solutions are coined as Islamic Fintech. Islam allows any kind of financial and technological innovations as long as it is Shariah compliant; for example, usury (riba) and alcohol are prohibited in Islam. Though Islamic Fintech is still in its infancy, the global potential market is very promising. This is because according to EY’s Fintech Adoption Index 2017, Fintech adoption globally has grown from 16% in 2015 to 33% in 2017. Furthermore, 50% of consumers use Fintech money transfers and payment services and 64% of Fintech users prefer digital channels to manage all aspects of their lives.

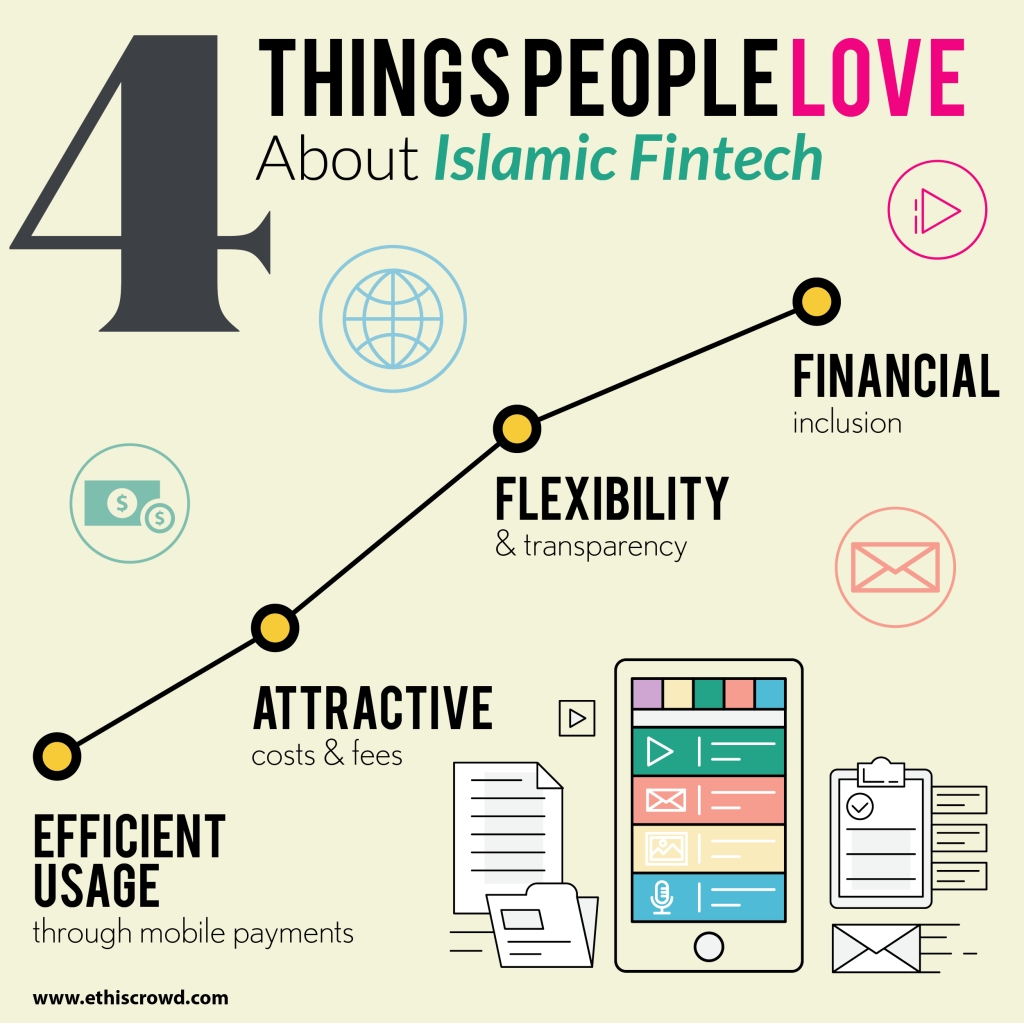

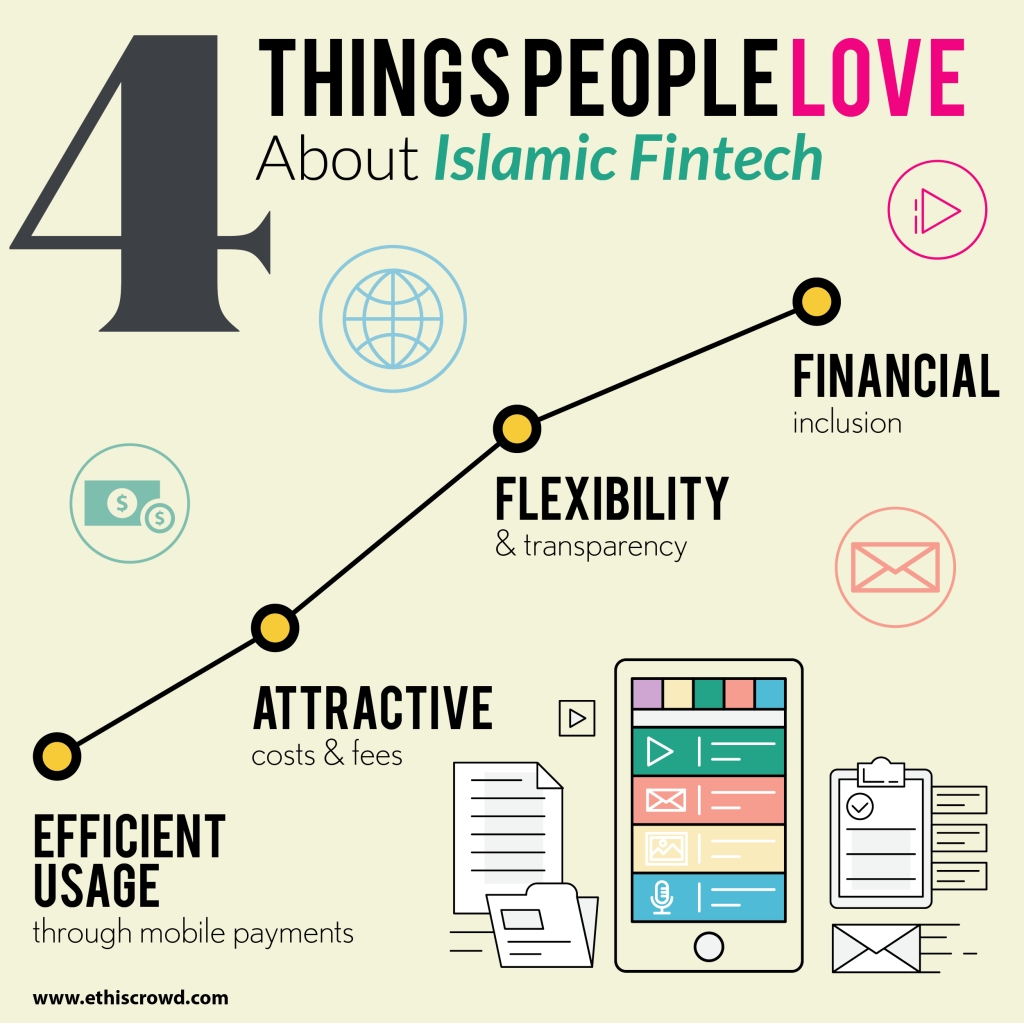

Effective usage thrives as the preliminary advantage of Islamic Fintech. The inculcation of technology into finance has made it more convenient for customers in handling their day to day financial transactions. It is also noteworthy to highlight that with the virtualized financial system, payments and remittances are becoming more transparent now. Also, as more companies are getting onboard the Fintech wave, new levels of competitive prices are being offered to customers. Automated processes offered through Fintech has multiple advantages: lowered costs, efficient customer care, and uncomplicated and accessible data. Below are some of the main reasons why people love Islamic Fintech.

4 Things People Love About Islamic Fintech

- Efficient Usage through Mobile Payments

We are now in a tech-savvy society where usage of mobile phones have increased remarkably over the past few years. For example, Indonesia, the country with the largest Muslim population is a fast growing market for mobile technologies. In 2014, 87% of households in Indonesia had a mobile phone and smartphone ownership rose from 32.6% in 2014 to 43.2% in 2017. By 2021, the smartphone users in Indonesia is estimated to grow as high as 96.2 million.

Users prefer handling their financial transactions on-the-go with a touch in their mobile phones, rather than tedious tasks of waiting at financial institutions. Therefore leveraging Fintech on smart phones has led to more user-friendly, efficient, and convenient financial transactions.

- Attractive Costs and Fees

Although Islamic Fintech is still at its infancy stage, the potential market is huge and robust. This serves as a catalyst in making Fintech competitive, thus leading to lowered costs and service fees. This will eventually lead to a higher customer experience. Additionally in Fintech, the need for an intermediary is reduced or even removed, and with a digitally integrated system there is an exponential cut-off of costs for both customers and providers. Therefore investors potentially have higher returns by investing directly into business ventures via virtualized financing markets.

- Flexibility and Transparency

Islamic Fintech has paved ways for finance management. With the system integrated virtually and automated process on the back-end, this creates flexibility and convenience for users as they can now access their data from anywhere and at any time. E-invoice management portals also allows an organized and transparent finance management virtually. Additionally, online payment through Fintech also creates a lot of flexibility for customers as they can make payment at anytime and anywhere.

Also, Fintech services can be tailored according to the requirements of small-medium enterprises (SMEs) and individuals. It provides them with P2P lending or investment crowdfunding, secure and steady funding, and a better cash flow compared to opportunities provided by local banks. Financial data from various sources can be aggregated and bank accounts can be integrated from various financial institutions into one simple smartphone in hand – thus creating a lot of flexibility.

The virtual inculcation of information has also made transactions very transparent. Transparency is important to ensure that relationships, roles and expectations are clear, which prevents Gharar or excessive uncertainty, which is a key focus for Islamic finance. Transparent information flow and dealings are in-line with the Maqasid Al-Shariah (objectives of Islamic Law) by ensuring justice and fairness. Furthermore, information on financial processes are available just a click away – with the emergence of Islamic Fintech.

- Financial Inclusion

Globally in 2015, approximately 2 billion adults are unbanked. In South East Asia in 2016, 438 million are unbanked. According to the World Bank with the presence of Fintech, those adults who are currently unbanked will now have access to financial solutions. This is evident when in the last 5 years, 700 million adults who were unbanked now have access to financial solutions, leading to financial inclusion.

Islamic Fintech inherently supports financial inclusion. Wealth and money are not meant to be available or benefit small segments of society – rather these are blessings from Allah swt that are meant for human-kind. Islamic Fintech brings us closer to this ideal.

Conclusion

Overall, the Islamic financial industry is bright and promising. Nevertheless, further inclusion of Fintech can serves as a huge catalyst, allowing the industry to soar to greater heights. This is because generally fintech provides cost-effective and efficient solutions globally. Finally, this short article cannot fully appreciate the nuances found in Islamic Fintech; however it attempts to mainly highlight the main reasons why people are loving Islamic Fintech.

Read more on the Sustainable Development of an Islamic Financial System

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You