Ethis Global Pre-Series A Fundraising

Fintech, Crowdfunding

Kuala Lumpur, Malaysia

- Projected Return 10x

- Indicative Exit3 to 5 years

- Minimum GoalUS$3 million

- Maximum GoalUS$5 million

Today: An award-winning leader in impact investment and Islamic crowdfunding with licenses in Indonesia, Malaysia and Oman.

Tomorrow: Global Islamic Private Capital Market

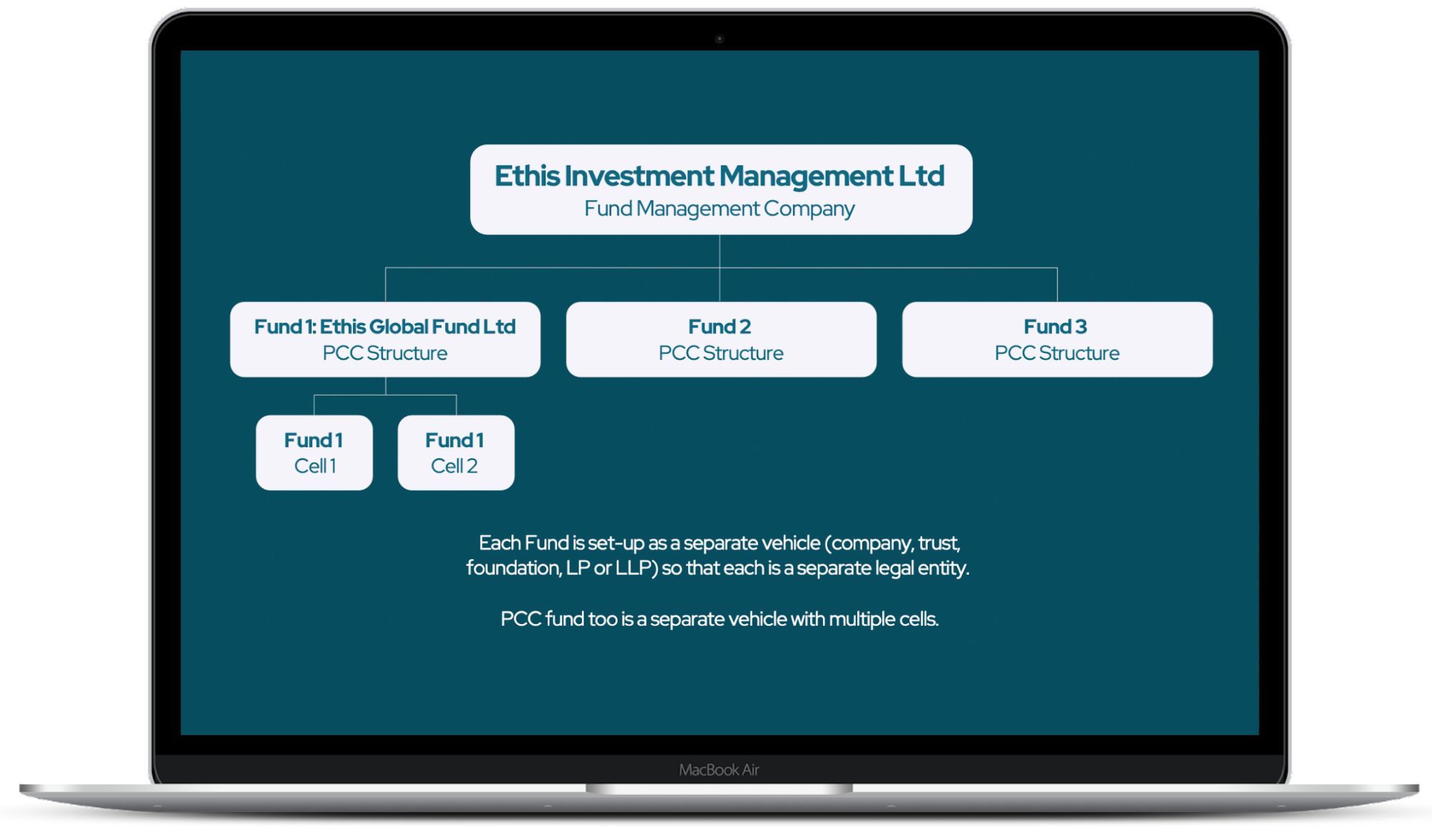

Group Structure

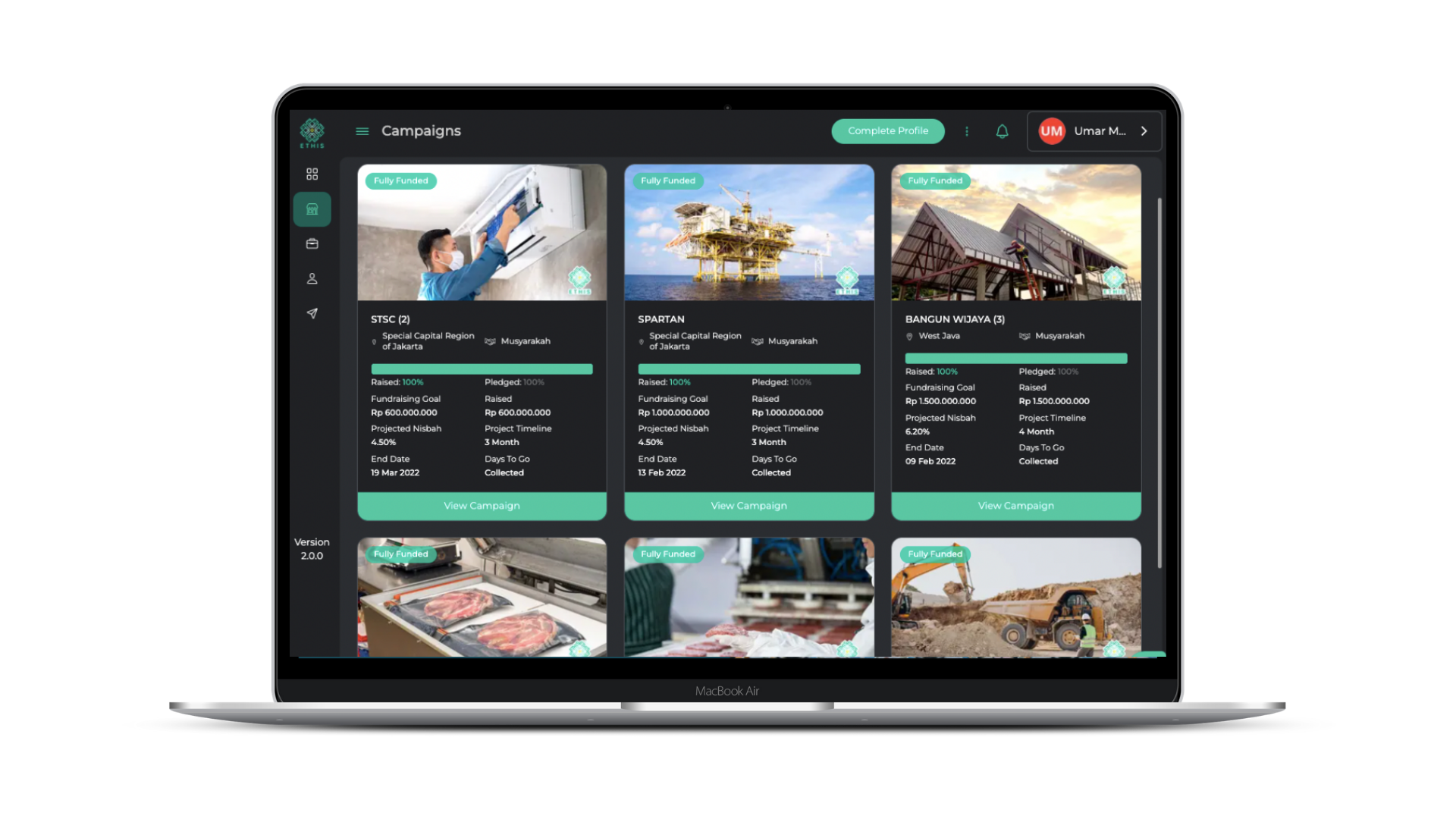

P2P Lending in Indonesia

Scaling-up

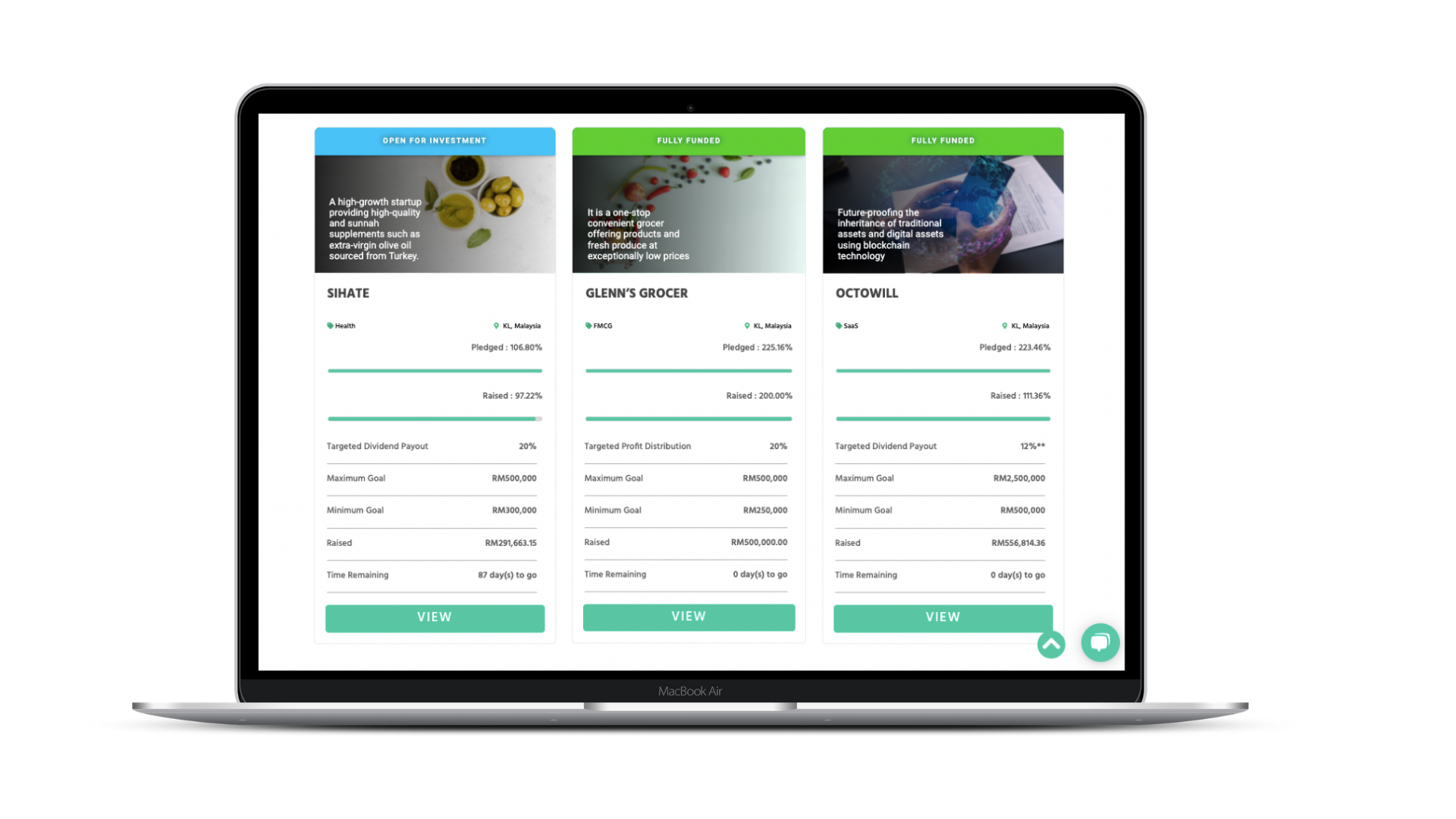

Equity Crowdfunding in Malaysia

Preparing to Scale Up

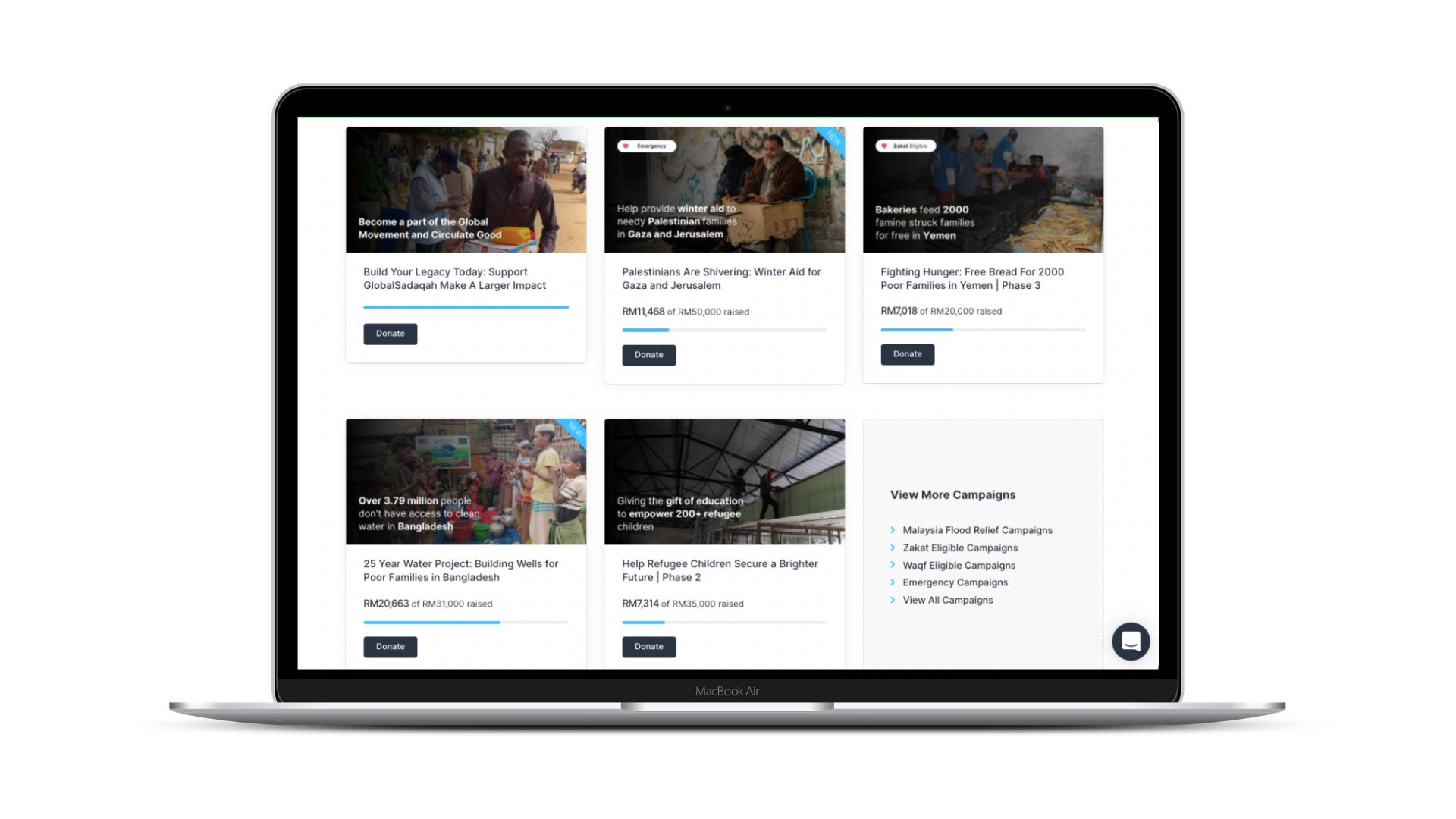

Islamic Social Finance Globally

Early Growth

Equity, P2P, SPV Globally

Launch 1H 2022

VC Fund and Micro-funds

Launch Q4 2022

Country Profile:

Established:

License:

Scope:

Status:

Country Profile:

Established:

License:

First Islamic Equity Crowdfunding platform licensed by Securities Commission Malaysia. Conditional license in April 2019 and go-live approval in July 2020

Scope:

Status:

Strong curated pipeline of companies that graduated from our internal accelerator program IFAT (Impact Fundraising Accelerator Track). Planned rollout of secondary market in 2023

Established:

License:

Scope:

Status:

Established:

License:

Scope:

Group Synergy:

Status:

Established:

May 2021

License:

Scope:

Group Synergy:

Alternative lending ‘Crowdfunding Micro-Fund’ to manage funds from existing large investors from our community, to be deployed alongside Ethis Indonesia P2P. VC fund co-managed with a top-tier VC to support ECF activity and build relevant networks for group expansion.

Status:

Launching in Q4 2022

Strategic Partner

Founded by Mufti Yousuf Sultan, the former Head of Shariah and previous COO of Ethis Group in October 2021. Adl is an independent boutique advisory and consulting firm of highly qualified individuals with unique expertise and exposure to fintech and the halal economy. See AdlAdvisory.co.

Startup, Scaleup, Global Expansion

Phase 1:

2016 to 2021

1. Licenses in Southeast Asia

2. Islamic economy relationships

3. Product-market fit

Phase 2:

2022

1. Scale up Licensed Markets

2. Secure a Global License and start Global business

3. Close pre-Series A round

Phase 3:

2023

1. Secure licenses in 3 key markets

2. Expand products, revenues

3. Close Series A round

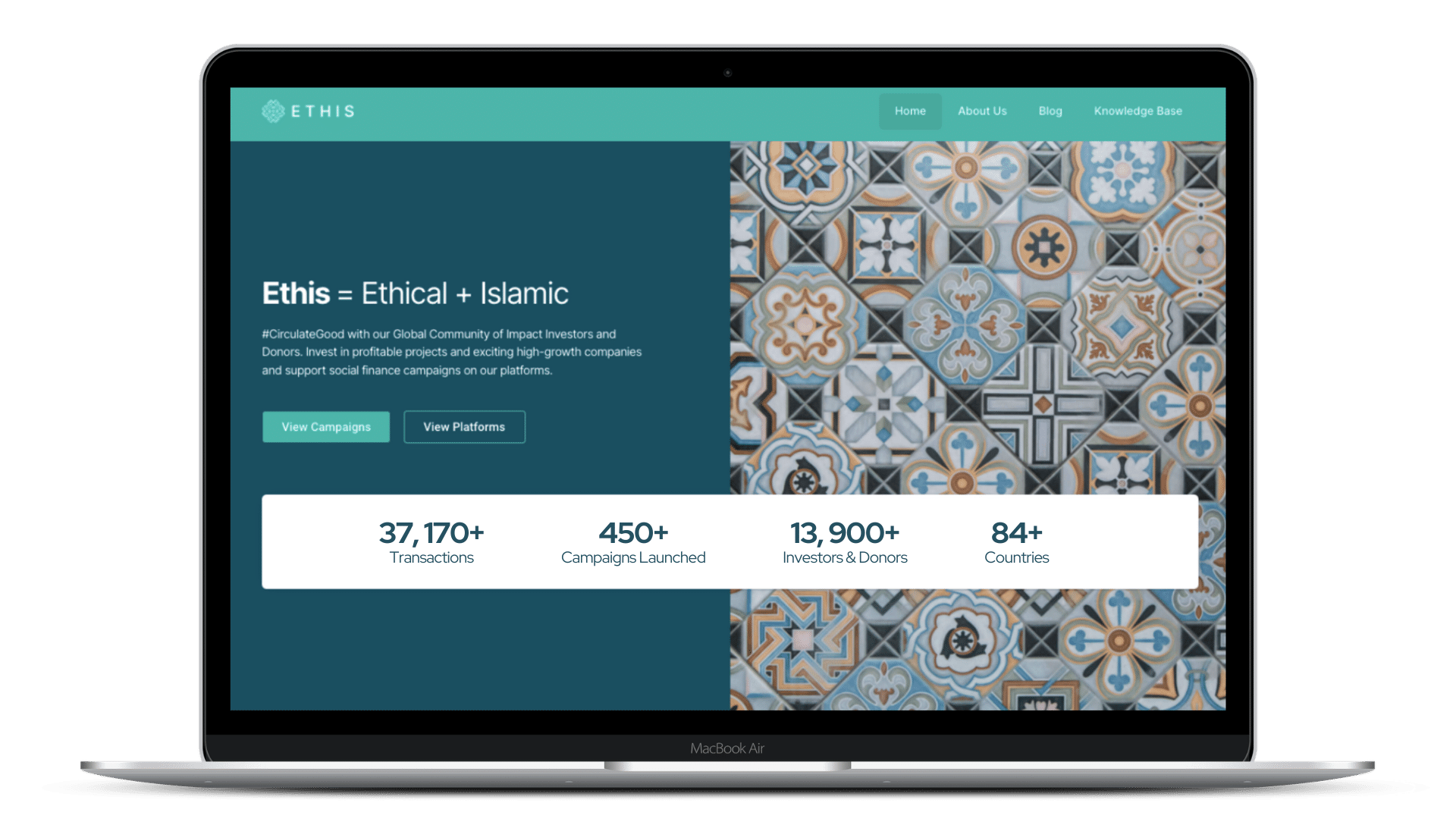

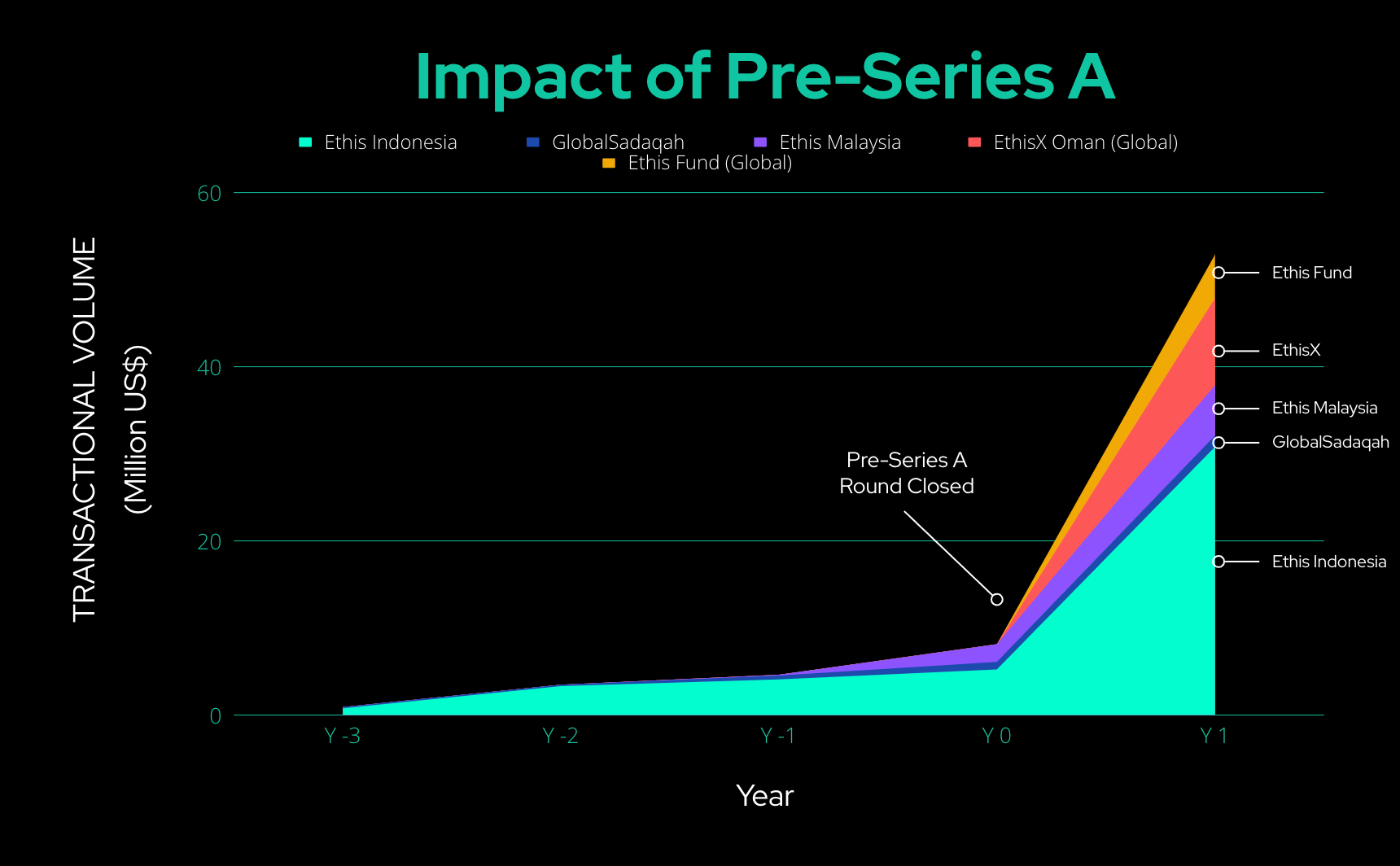

Phase 1 Traction

Combined Total (All Platforms)

37,170

Total Transactions

13,898

Paying Customers/ Users (Investors + Donors)

$21.3mn

Volume of Funds Raised

Our People

86

Talents Employed

457

Campaigns Funded

137

Businesses Funded

85

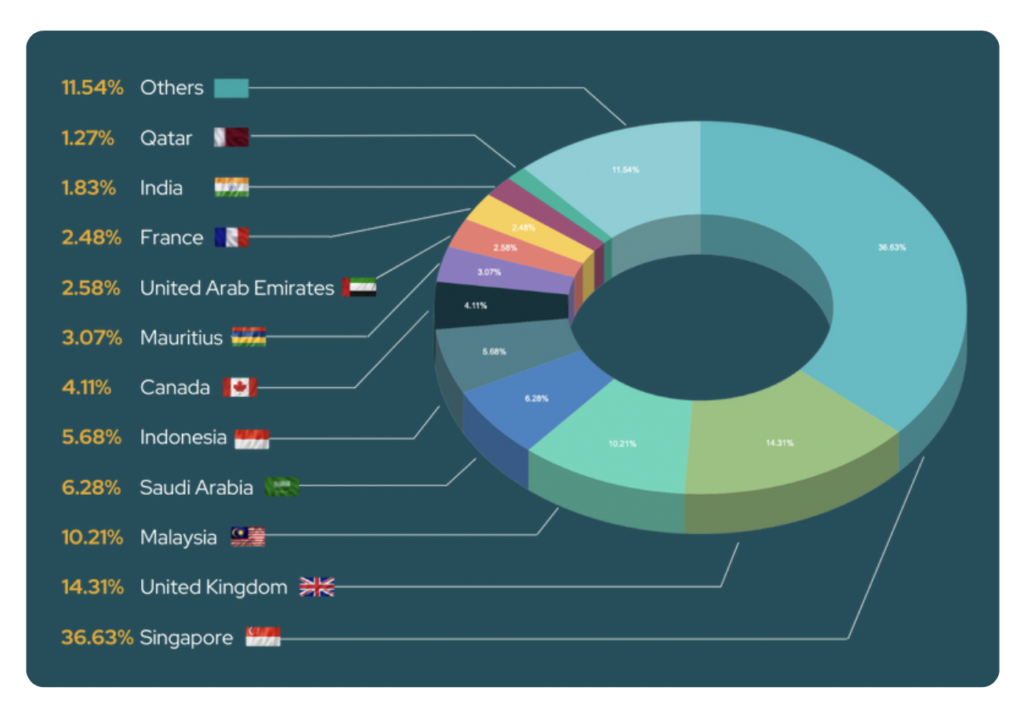

Countries

13

Nationalities

Senior Leadership

Wisdom and Relationships

Former CEO of Islamic Banks and President-CEO of INCEIF (Malaysia)

Corporate Transformation Leader. Former Group MD, SME Bank Malaysia

Former CEO of Islamic Investment Banks and Fund Managers including SBI Brunei

Property and Waqf development expert. Former CEO of Warees Investments Singapore

Corporate Venture Building. Former Managing Director, KAMCO Investment (Kuwait)

Institutional and Family Office Investors. Managing Director and Head of Client Coverage at Shuaa Capital (UAE)

Social Finance Expert. Director and CEO, PERGAS Investment Holdings (Singapore)

Islamic Investment, Legal, Compliance and Shariah Expert. Executive Board, Indonesia Haj Financial Management Agency (BPKH)

Chief Executives

Passion and Ambition

Social Entrepreneur for 20 years, Chair of the Islamic Fintech Alliance founder’s group

Social Entrepreneur for 15 years. President of Indonesia Fintech Shariah Association, a sub-regulatory body

Experienced management consultant and director of an investment company in GCC

A corporate lawyer with wide regional experience in top-tier law firms in the GCC

Former COO of a Top 5 global management consultancy firm and various financial institutions in Indonesia for over 2 decades

Experienced senior executive in significant Islamic finance and economy institutions

Founded a Venture Builder, former Innovation Lead at a Big-4 consultancy firm

Country Manager for a Global Islamic NGO, various roles in Islamic finance institutions

AAOIFI Shariah Auditor and Master Trainer, Shariah Advisor registered with Securities Commission Malaysia

Awards

The Ethis Advantage

Multiple award-winning pioneer in fintech for Shariah-compliant and impact-driven investments

Deep experience in Indonesia and Malaysia in P2P Financing and Equity Crowdfunding respectively

Deep, relevant relationships in the global Halal and Islamic economy with a healthy pipeline of deals

A diverse and active growing community including retail, HNWI, family offices and institutional investors

Replicate local success in new markets building on our unique experience and expertise

Media & Features

Double the Value in Series A

We are now raising US$5mn at the Ethis Global Group level ahead of our Series A in Q3 2022.

We are raising US$5mn at the Ethis Global Group level ahead of our Series A. We aim for US$100mn valuation in Series A based on these milestones:

- Global Business: launch of EthisX Global Platform and close of our first micro-fund

- Scale Up: Ethis Indonesia records significant growth with the deployment of local institutional funds

- Secure a significant M&A transaction that will add immediate and huge value to Ethis