In this article, we will be explaining the concept of Mudharabah and the advantages of using profit-sharing arrangements.

What is Mudharabah?

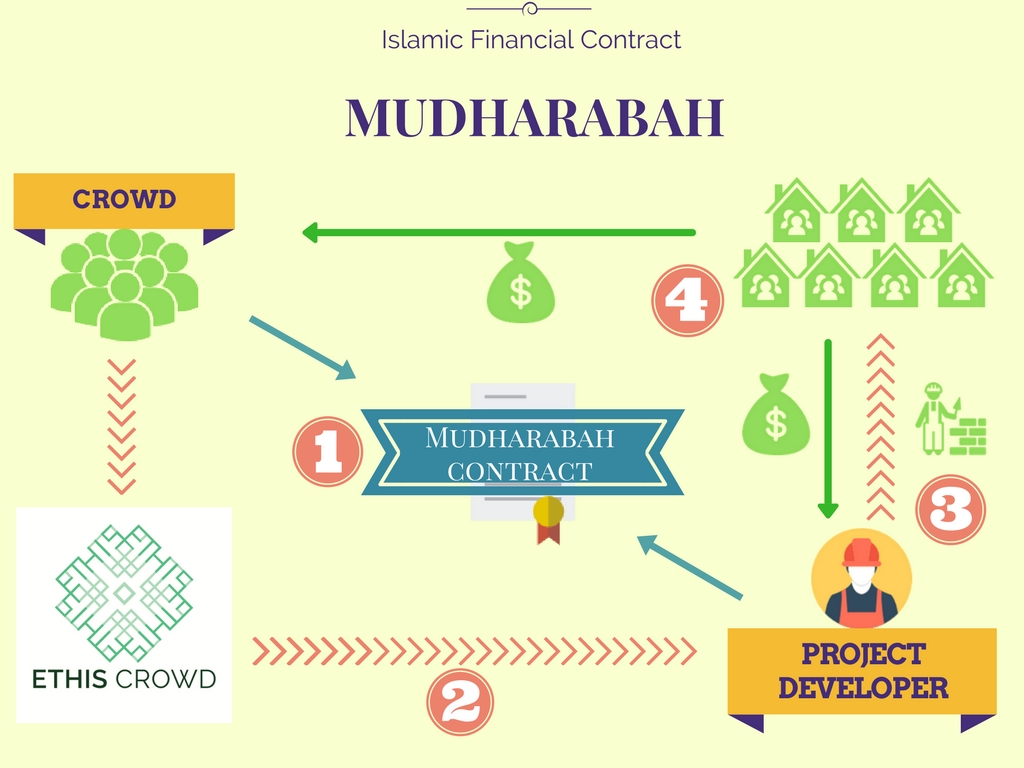

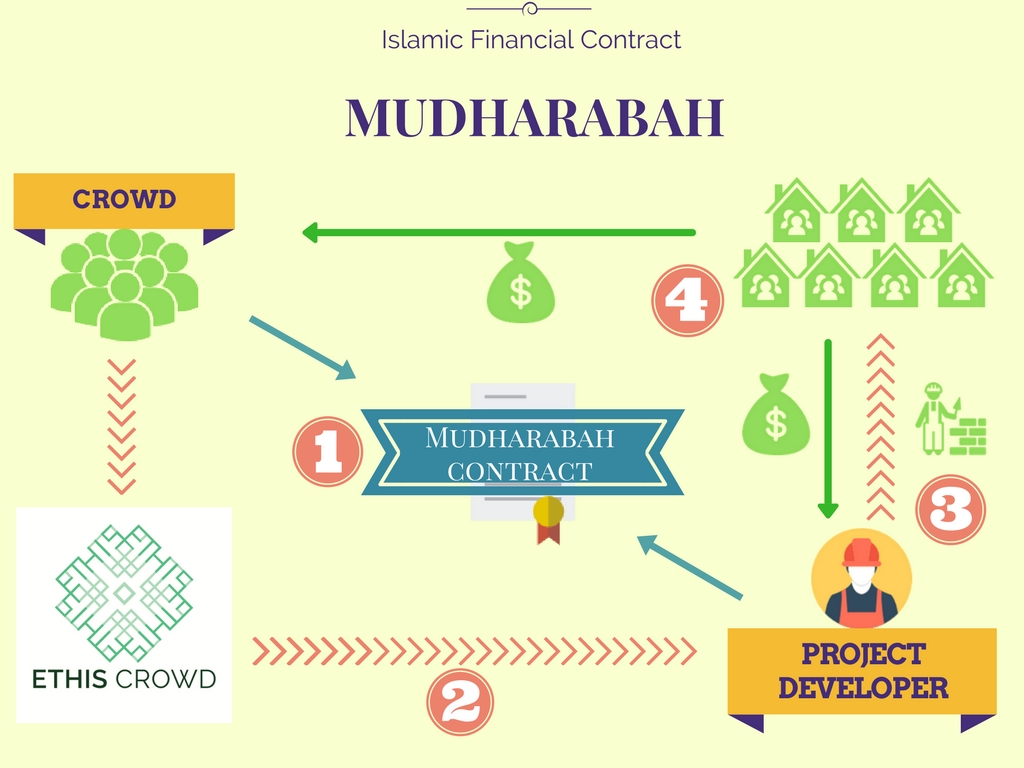

Mudharabah is essentially an Islamic term for a profit-sharing arrangement. In a Mudharabah contract, the investor (called Rabbul Mal) provides the capital while the entrepreneur (Mudarib) provides the expertise and specialization. Profits from the venture are shared according to the profit-sharing ratio, decided at the outset of the contract. In the event of losses, the investor will bear the financial losses while the entrepreneur loses the effort, credibility and resources vested into the venture. Mudharabah is one of the most popular contracts used in Islamic finance transactions. (See also: Can Islamic Finance Serve 2 billion Muslims?)

Can the Entrepreneur Guarantee Investors’ Capital or Profit?

In a Mudharabah contract, the entrepreneur cannot guarantee investors capital or profit since all parties share in the risks. Guaranteeing capital and profits is akin to a fixed-interest debt security, which is what the profit-sharing arrangement aims to avoid in the first place. However, what can be fixed is the profit-sharing ratio that is agreed at the outset of the contract. For example, if the agreement states that the profit-sharing ratio is 50:50 between the investor and entrepreneur, each party will receive an equal amount of generated profits at the end.

In order to understand how Mudharabah works, we can refer to a standard profit-sharing arrangement used in Ethis

Process:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Importance of Risk Management

In a Mudharabah contract, effective risk management is pivotal in reducing all controllable risks to ensure the success of the venture and to protect investors. This is of utmost importance for a business such as Ethis. In order to manage those risks, Ethis engages in 4 vital processes:

- Performing intensive vetting on the viability of individual social-impact, real estate projects through our internal project screening mechanism

- Partnering with credible project developers that possess a near-perfect track record

- Fixed currency rates by a third-party entity for the whole tenure of the investment to hedge the volatility in currency rate risk

- Ethis local partner holds collateral of the land for every housing project as protection in the event of default by the project developer

What are the Advantages of Using a Profit-Sharing Contract?

Mudharabah represents a common form of partnership arrangement used in Islamic finance transactions. The utilization of a profit-sharing arrangement eliminates the presence of usury in a business or financial transaction. There are numerous benefits of using profit-sharing arrangements, which includes:

1. Avoiding the Destructive Nature of Interest

It is interesting to note that Islam, Christianity and Judaism are unanimous in prohibiting usury due to its harmful effects on society. Not only that, various studies by independent scholars and researchers have corroborated the negative effects of interest, as listed below:

-

Economic Exploitation

Interest-based transactions allow the lender to generate a fixed rate of return effortlessly, without expanding any effort, resource or time. This is the exact opposite of trade, whereby there is an exchange of real value. Essentially, the lender bears no risks due to the fixed-nature of loans. This imbalance leads to a greater concentration of wealth by the rich, who can then yield considerable economic and social power over the masses.

-

Increasing Indebtedness

It is a common trend for many to acquire a huge amount of debt to finance their lifestyle. It is enslaving for us to outstretch our financial capabilities and be sucked into a vicious cycle of debt. This is the reality for most who are simply scraping by to survive. Ironically, the fuel of our banking system (which represents the main pillar of our economy) is debt. Banks are incentivized to create more debt by lending money to the masses since it increases their profitability. The most recent example of the real consequences of debt was the 2008 global financial crisis. Millions of people lost their homes, wealth, assets and jobs due to acquiring an unsustainable level of debt.

-

Wealth Inequality

This refers to income distributed in an uneven manner throughout society. The disparity between the rich and the poor is getting wider with time, and this is a worrisome trend. Wealth inequality could lead to a host of negative consequences which includes an unacceptable degree of control by the wealthy. This could, therefore, lead to undermining the integrity of political institutions and the economic system.

These justifications serve as a reminder of the need for an alternative mechanism that is free from the clutches of usury.

Fundamentally, the amount of profit should be proportionate to the amount of risk assumed in any transaction. This will therefore align the interests of all stakeholders to a singular focal point in ensuring the success of the venture. This will ultimately benefit all parties economically and socially.

2. Potential for High Returns

Traditionally, access to investments that generate a high rate of returns is only available to accredited investors, who are normally categorized as wealthy high net worth individuals. It is, therefore, an exclusive investment option that the average person has no access to. Profit-sharing arrangements is a great way for any individual to get in the action of high-return investments. Since profit-sharing entails assuming risks by investors, they are entitled to receive a portion of the profits from the venture. These returns are almost always favourable to the investors. For instance, Ethis is a real estate crowdfunding platform that offers average returns of up to 15%! In addition, the Financial Technology (FinTech) revolution has contributed to leveling the playing field in terms of offering a diverse array of investment alternatives, including crowdfunding. (See also: Crowdfunding: A New Way to Grow Your Wealth)

3. Efficient Resource Management

Since the expected profits depend directly on the performance of the venture, the entrepreneur has to present a viable plan to potential investors in ensuring its success. This provides a naturally strong incentive for the entrepreneur to perform a thorough analysis to reduce risks and allocate resources more efficiently. This is thus a symbiotic relationship whereby both parties leverage on the competence of the other; the investor provides the resources (i.e. funds) while the entrepreneur provides the necessary skills and expertise. Hence, there is an implicit trust that the entrepreneur would maximise resources efficiently to perform well.

4. Wealth Distribution

A profit-sharing contract is a great way of wealth distribution. It allows investors to potentially get a higher rate of returns since risks are shared. Especially so in a crowdfunding arrangement, where investors can partake in investments that offer a considerable rate of return for a relatively small investment amount. The accessibility of alternative investment options, such as Ethis, allows for greater financial inclusion since anyone can invest for as low as SGD250. A greater degree of financial inclusion would enrich the masses and potentially alleviate the growing issue of wealth inequality.

The universal principle of moral equality dictates that every individual matter in the same way, and it is our collective obligation to increase their well-being if we can.

For a more detailed explanation of Ethis’ model, please look at our video below:

For more information on the developments in Islamic finance, check out What is Islamic Crowdfunding?

Sources :

- The 4 Biggest Reasons Why Inequality is Bad for Society

- Profit and Loss Sharing: The Flagship of Islamic Banking and Finance by Abdul Karim Abdullah

Ethis is the world’s first Real Estate Islamic Crowdfunding Platform and is at the forefront of the Fintech revolution. Our international community of 20,000 private investors crowdfunds investments in entrepreneurial, business, trade, and Real Estate activities in Emerging Asia.

3 Replies to “Islamic Finance Contract: Mudharabah”

I’m truly enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Excellent work!

Hey! I could have sworn I’ve been to this website before but after reading through some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be bookmarking and checking back often!

I have been surfing online more than 3 hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my view, if all web owners and bloggers made good content as you did, the internet will be a lot more useful than ever before.

Top Posts

Islamic P2P Crowdfunding Explained

Halal Money Matters: How Muslims Can Balance Deen and Dunya with Smart Islamic Finance

Halal Investments for Singapore Muslims? It’s time for a shake-up in the Islamic Investments scene.

Smart investment for making Halal money

3 Reasons Why Property Crowdfunding is the Smart Investment for You