Estet Sepakat (ES)

- Expected ROI

24%

- Maximum Goal

RM6,000,000

- Minimum Goal

RM1,400,000

- Maximum Equity offered

30%

- Minimum Equity offered

9%

- Raised

RM724,760.86

-

Time Remaining

0 day(s) to go

About the campaign creator

×Contact Info

Social Link

- 1. 2.5% valuation discount for all investors

- 2. 12.5% valuation discount for investments of at least RM100,000

- 3. 25% valuation discount for investments of at least RM200,000

- 4. 50% valuation discount for investments of at least RM400,000

Before any valuation discount applied–

Current company valuation: RM14million

Current number of shares: 1,866,667

Current price per share: RM7.50

Here’s an illustration of this discount:

2.5% valuation discount

If you invest RM10,000, you would have gotten 1,333.33 shares before the discount and 1,367.52 shares after the discount.

12.50% valuation discount

If you invest RM101,000, you would have gotten 13,466.67 shares before the discount and 15,390.48 shares after the discount

25% valuation discount

If you invest RM201,000, you would have gotten 26,800.00 shares before the discount and 35,733.33 shares after the discount.

50% valuation discount

If you invest RM401,000, you would have gotten 53,466.67 shares before the discount and 106,933.33 shares after the discount.

SPEAKER

Project Pitch

Join the live pitch session for this project

Join us for a conversation on this e-commerce investment opportunity with the team from Baloy and ETHIS

- 27th August, Friday

- 8:00 P.M. MYT (GMT+8)

Mr.Badardin Ahmad

Founder, Principal Advisor

Estet Sepakat (ES)

Sharren Sanny

Investment manager

ETHIS Malaysia

Mufti Yousuf Sultan

Head of ShariahETHIS Group

Khairul Hafiz

Head of Investment

ETHIS Malaysia

- High-growth market: The global ATaaS (Agriculture Technology-as-a-Service) market is expected to reach US$2.49 billion by 2024 with a CAGR of 21.75% as the demand to adopt agricultural technology increases and with greater retention of ATaaS providers due to the recurring nature of its services.

- A recession-proof investment: Rice is a traditional staple food and a defining feature in the culture of many countries especially those in Asia creating a recession proof demand for it. The world rice output is expected to reach 570 million tons by 2025.

- Robust socioeconomic impact: Improve the livelihoods and income of paddy farmers in Malaysia and later Indonesia and Thailand by improving their paddy yield and lower their cultivation costs. As an investor, you will also contribute to achieving the Malaysian government’s national rice production Self-SufficiencyLevel (SSL) target of 75%.

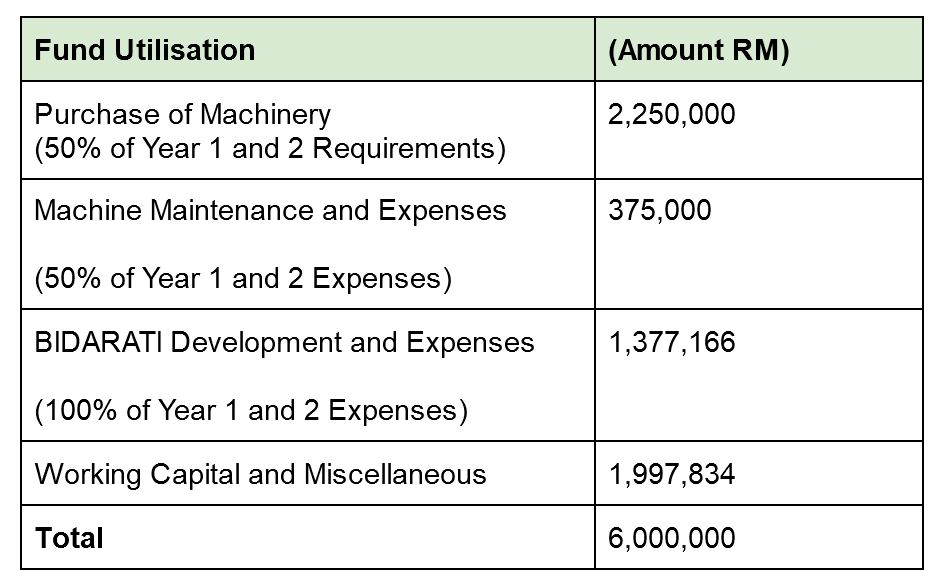

- Solid exit strategy and return on investment (ROI): ES projects an annualised ROI of 24% for an RM6 million investment over a 5 year period at the back of a cumulative revenue of RM146,836,326. As part of the ROI, Estet Sepakat is targeting to purchase the shares from investors in tranches over a 5 year period and distribute 40% of the net profits as dividends according to the type of shares owned by the investors. Out of the 40% distribution, Class M1 investors are targeted to receive 12%, and ordinary investors are targeted to receive 28%. ES is targeting to begin purchasing the shares back from investors at the end of year 2 on a first come first serve basis, giving investors a projected 16% yearly capital gain. Collectively and ideally, both the capital gain and the dividend will make up a projected annual ROI of 24% for investors. Investors may choose to sell their shares or hold on to their shares. If the investors choose not to sell, they will receive dividends** and may wait for the IPO to happen after year 5. Investors who stay on in the company for long term benefits will automatically be converted to ordinary shares. The conversion price is projected to be at a discount of not less than 30% of Equidam’s Independent Valuation Price at the time of conversion. Finally, the company may propose Investment Protection Plans to investors to safeguard them from total capital loss. Note: Please refer to the FAQ regarding M shares ** Investors will be entitled to ordinary shares dividend (if they do not accept the offer to sell back the Class M shares then their Class M shares will be automatically converted to ordinary shares.) Estet Sepakat will also present financial alternatives to investors on whether to accept the offer or allow it to be converted into ordinary shares.

- Strategic collaboration and partnerships: ES partnered up with non-profit technology think tank Malaysian Industry-Government Group For High Technology (MIGHT) which is an agency of the Ministry of Science, Technology and Innovation (MOSTI) and Koperasi Peserta-peserta FELCRA Seberang Perak Berhad (Koperasi FELCRA). This tripartite agreement further solidifies this strong partnership. In August 2021, ES signed a Strategic Partnership Agreement with Jiangsu World Agricultural Machinery, Jiangsu, China and Worldstar AM Sdn. Berhad for product development focusing on continuous enhancement of connecting data to machines for the paddy farming industry.

- Scalable business model: According to a report by Business Wire, the global agriculture industry is increasingly adopting smart technologies to support farming and increase food production globally. The ATaaS business model allows customers to procure their desired agriculture technologies by purchasing services under affordable pricing models versus acquiring them at a high capital outlay as a one-time purchase. The low cost, high accessibility, and integrated features of ATaaS are major plus points that make it scalable.

ES is an Agriculture Technology-as-a-Service (ATaaS) company that adopts efficient machine technology and data services to improve the income of paddy farmers.

ES’ goal is to build a community of paddy farmers that are tech-friendly and data-driven to help them create a sustainable long-term income to enable the small farmers to acquire the benefits of large paddy estates.

According to Khazanah Research Institute’s latest report on the paddy and rice industry, farmers in Malaysia earned a household income of RM2,527 a month. This figure is strikingly below the national average of RM6,958 a month and also below the average B40 (bottom 40) income level in Malaysia. This disparity has been attributed to paddy farmers’ being the smallest and most fragmented player in the industry.

Other pressing issues faced by Malaysian farmers include:

- Small land size

- Low yield

- Inclement weather such as floods and droughts

- Poor farm management knowledge and practices

ES intends to change this reality by improving the livelihoods of farmers in Malaysia and by building a community of farmers that are data-centric and agri-tech driven. In addition to helping farmers, ES also wants to improve the country’s food security by enhancing the national rice production level.

- ES executes an extensive Agriculture Technology-as-a-Service (ATaaS) strategy that includes the acquisition of efficient machinery services starting with mini harvesting machines before expanding to tractors, including driverless tractors, transplanters and drones. This will make ES the only full-service ATaaS company in the country.

- Through its wholly-owned subsidiary Data Clarity Sdn. Bhd. (DC), ES will develop an end-to-end solutions platform called BIDARATI which will provide services that include but are not limited to the purchase of seeds, farm management, fleet and equipment management, harvesting and an e-marketplace for purchases of cultivation inputs and services.

BIDARATI’s key features include:

- Microfinance and payments distributed through an e-wallet

- Fleet management and e-marketplace

- Tracking and traceability

- Mobile app with farm management services

- Efficient machinery services

- Financial intermediaries and Crop Takaful

- Adopts a pay-per-use and subscription-based revenue model

Through these solutions, ES hopes to achieve the following:

- Increase paddy farmers’ income from RM2,500 to RM5,000 per month by reducing cultivation cost by 15%, improving paddy yield by 2 tons per ha per season and increasing farm sizes to 6.5 ha per farmer through its Agroland Exchange component of BIDARATI.

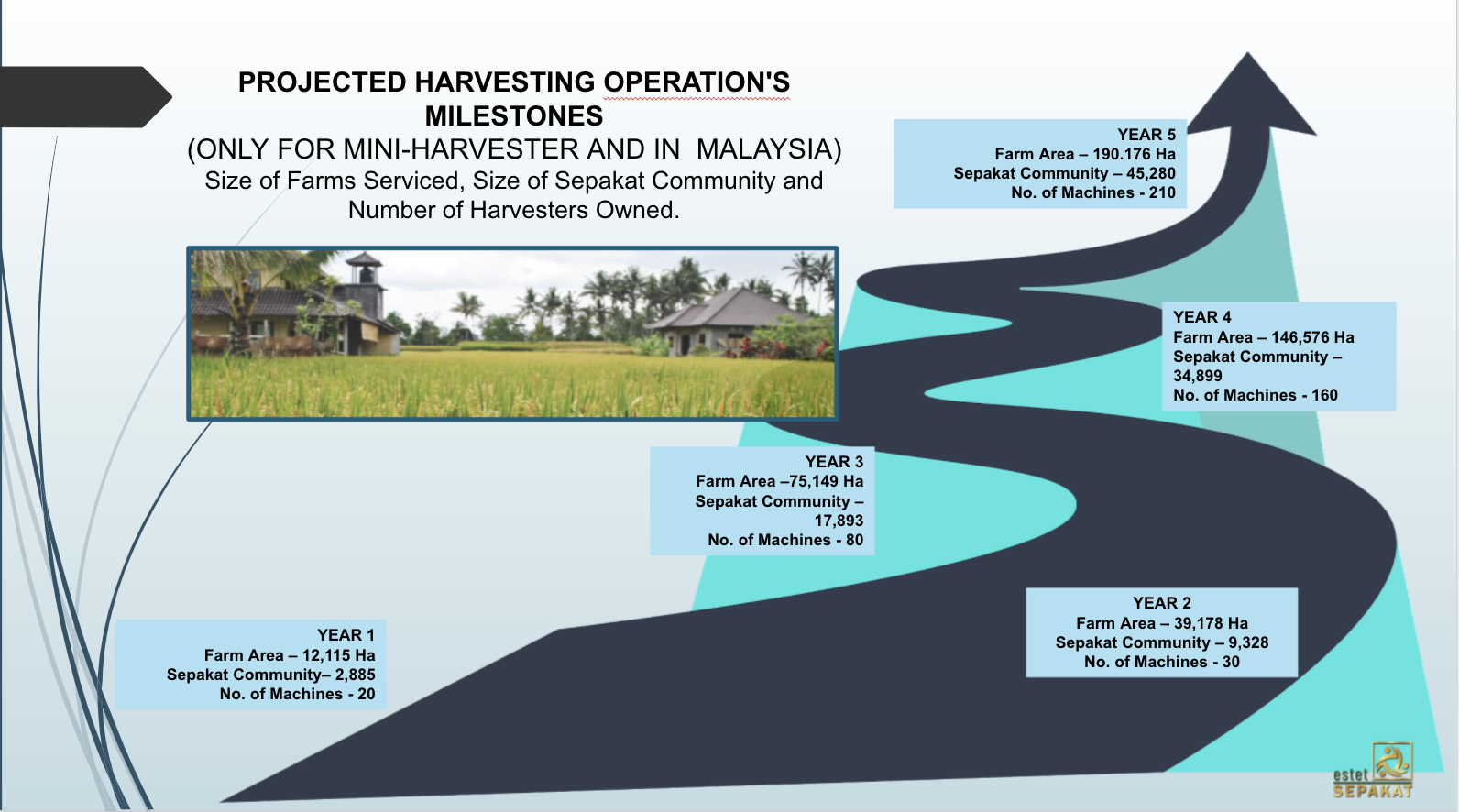

- Increase the company’s revenue multi-fold through the expansion of harvesting areas and increasing revenue per ha. The harvesting area will grow at a projection of about 12,000 ha in year one to about 190,000 ha in year five in Malaysia.

- Increase the national paddy production by an additional 400,000 tonnes by Year 5; Malaysia currently produces 4.5 million tonnes of paddy nationally. This goal is in line with the government’s aim to raise paddy production by up to 75% of the national consumption.

- Serve a larger farmer population and land area through BIDARATI’s fleet optimisation and farm management software.

Through a comprehensive five year plan, ES’ growth will be supported by an increase in the number of machines, the number of farmers involved and the farmland area.

The global Agriculture Technology-as-a-Service (ATaaS) market is expected to reach US$2.49 billion by 2024, at a CAGR of 21.75% during the forecast period from 2019 to 2024. Estet Sepakat’s estimated Serviceable Available Market (SAM) in year 5 is RM82 billion covering Malaysia, Indonesia and Thailand.

Badardin Ahmad

Founder, Principal Advisor

MBA, University of Chicago, USA and B.Sc. in Nuclear Physics, UKM.

More than 30 years of experience in corporate turnaround, performance improvement and restructuring, mergers and acquisitions and project initiation and implementation in various industries: financial services, agriculture, distribution, logistics and ICT. Currently, Badardin focuses on technology applications to improve community livelihood.

Amiruddin Ahmad Tajuddin

Founder/Executive Director, Head of Operations

B.Sc. (Hons) UKM, Dip. in International Trade, IIFT, New Delhi, India and MBA, UM.

More than 35 years in the paddy cultivation and production industries, managing local paddy production in Malaysia and West Africa. An all-around experience in paddy seeds production, paddy estate management, small paddy farm management, harvesting and post-harvesting operations, rice mill operations and rice distribution. Had a long and successful stint at Bernas, or Padiberas Nasional Berhad, the nation’s partner in the paddy and rice industry.

Ishafizan Ishak

Founder, Executive Director, Chief Data Architect

B.Sc. Electrical/Electronic Engineering, Birmingham University and Masters in Systems Engineering, Cardiff University, Wales

Vastly experienced IT expert in analytics, software architecture and development. Was with SIRIM Malaysia, MIMOS Berhad, Andersen Consulting, and Resonate Digital Sdn Bhd. Won multiple national and international awards for his data systems-related projects.

Lee Ban Lye

More than 40 years in servicing and distribution of farm equipment for the paddy industry. Worked closely with farmers and farm managers. Engineering and design expert for machines customised for Malaysia’s paddy industry.

Emir Imran Badardin

B.A (Honours) Accounting and Finance, Taylor’s University

Entrepreneur specialising in digital and physical marketing of motor vehicles and machines. Social and digital entrepreneur in the paddy production ecosystem.

Mohd Johari Othman

B.Sc. (Hons) Computer Science and Mathematics, USM

Led deployment, automation, maintaining and managing AWS cloud-based, hardware architecture and process improvements, and open-source evaluation deployment teams. Also into Big Data development.

S. Yogesh Papiya

CA (M) ASA (AUS), B. Acct (Hons) – Accounts and Finance

Certified Chartered accountant in Malaysia with 12 years of experience in audit, accounting and taxation.

ES is an Agriculture Technology-as-a-Service (ATaaS) company that adopts efficient machine technology and data to improve farming. ES’ goal is to build a community of paddy farmers that are tech-savvy and data-driven to help them create a sustainable long-term income.

ES wants to improve the income level of thousands of farmers in Malaysia as well as contribute to the increase in the national paddy production level. ES projected that it will be operating in Malaysia, Indonesia and Thailand by that time. To create even more impact and scale further, ES hopes to explore an IPO as a way to continue to sustain its growth.

ES believes that the livelihood of paddy farmers can be improved. With the right strategies, particularly through the development and implementation of data insights and technology-based ecosystems, the income level of farmers can be improved to be beyond its required sustainability.

As part of the first phase, ES aims to help its community of farmers increase their income from RM2,500 to RM5,000 per month. Despite its clear social objectives, ES is cognizant that the project still needs to be implemented with commercial viability as its prime consideration. This will be achieved by providing services that are currently consumed by the farmers packaged in an attractive offer. ES anticipates a huge SAM of RM82 billion in 5 years and they intend to be the key player.

From year one to year five, ES will generate revenue by providing harvesting services; other paddy cultivation related machinery services and farm management services driven by data collection and insights. In addition, its BIDARATI platform will be able to generate revenue through transaction fees of trading and provision of services on the platform.

The BIDARATI platform was named after big data, analytics and artificial intelligence (AI), and it is the brain of their data-driven initiatives. The BIDARATI platform will be created through multiple collaborations with established, mature and proven systems and organisations.

The platform has nine components and will be developed in stages. At the start, BIDARATI will utilize the AGRIVI fleet management system and subsequently AGRIVI’s farm management system through a white label program. To date, AGRIVI has positively impacted farmers in 150 countries and has been voted as the best Farm Management Software in the world.

The platform also comes with an e-wallet component. This will be driven by the Berrypay platform which is already in use locally as well as in other countries (Indonesia, Singapore and UAE). Berrypay boasts a membership of more than 3 million.

ES is also going to work closely with FSX—a Singapore based AI outfit focusing on food security to execute the big data and AI components of the platform.

The BIDARATI platform operates as follows:

- Coordinates the data flow between the components

- Controls the transactions on the e-wallet, e-Marketplace and fleet management of machines used

- Relays required data from various components to relevant data users—farmer, farm manager, fleet supervisor and logistic managers

- Driven by big data analytics, AI and machine learning

- Blockchain for the authenticity of transactions

Farmers in Malaysia face a lot of issues and most of them are related to cultivation costs and timing of getting seeds and fertilisers. These challenges impacted their production yield and hence their income. From what Estet Sepakat has observed, farmers generally do not have a holistic picture of how various dynamics of the industry affects their income level. Providing them with the services that improve their yield and lower their cultivation costs will have an immediate and clear impact on their income and will be immediately noticed.

ES believes its approach of delivering services could help these farmers. For example, it plans to supply harvesters that are below the market price—generally, the market price is about RM55 to RM60 per ton harvested. Instead of cutting prices, which will create unhealthy competition, ES translates it into discounts for other services which will then encourage the farmers to use its other services. As ES will be the company with the most comprehensive services, it can easily translate this strategy into its business activities and revenue.

Its first goal is to help the farmers tackle their main and immediate issues and problems so this would give them relief over a short time and encourage them to further use their other services.

Similarly, ES also works with brokers and appoints them as their representatives, and they become sales channels of the company. The brokers normally have between 50-200 farmers each using their service.

Finally, ES’s partner, Koperasi FELCRA, who manages the farmers, has a credible reputation in the paddy farming industry. They are a five-time winner of the Best Rural Cooperative in Malaysia award and have vast experience in managing large scopes of land and farmers that currently cover approximately 4,378.87 Ha of paddy farms and 1,554 members. Working with Koperasi Felcra will provide the endorsement that other farmers want to see.

- Class M shares embody the spirit of Musharakah.

- This Issuance of Class M shares is the first Issuance of its kind, and is specifically called Class M1 shares. There could be future Issuance for which it will be called Class M2, M3 etc.

- All investors get to share profits as well as cash generated from the operation. If the company records losses for the year, no profit sharing or dividends will be paid.

- The Class M shares offer limited voting rights at a General Meeting focusing on the variations of the features specific to the Class M shares.

- Class M shares also provide an opportunity for investors to convert into ordinary shares in the company through an option to convert as well as through non-acceptance of the sell-back offer to the company of the Class M1 shares. The sell-back is projected to start at the end of year 2 and is expected to be done in a step-up manner with the highest portion of the sell-back to be done at the end of year 5.

- Profit-Sharing will only be paid in the event the company records a positive Profit After Tax.

- Investors will be offered to sell the shares back to the company on a progressive basis starting at the end of year 2 at a projected premium of 16% escalation every 12 months. Class M1 shares not sold back will automatically be converted to ordinary shares.

- The conversion rate will be offered at the company’s valuation of not less than a 30% discount to Equidam’s Independent Valuation at the time of conversion.

- All Class M1 shares would be included in the Investment Protection Plan.

- The Class M1 shares are projected to provide an annualised return of investment of 24% per annum over the investment tenure of 5 years.

2021: RM 2,359,476

2022: RM 11,423,353

2023: RM 21,822,538

2024: RM 45,846,275

2025: RM 65,384,684

Its team consists of a group of highly experienced, passionate and dedicated individuals. Its founders studied at the University of Chicago, Universiti Kebangsaan Malaysia, Birmingham University and more, and have collectively, more than 80 years of working experience in various industries, including related industries such as agriculture, paddy cultivation and production, and software architecture and development. With the right blend of paddy cultivation and data architects and experts, ES is the most qualified company in the industry to implement this project and to improve the livelihood of farmers through machinery and technology.

ES anticipates its first years of operations to focus on organic growth, revenue stabilisation, and achieving breakeven. As part of its exit strategy, the company targeting to offer to purchase shares from investors with a value that will increase by a projected 16% after every 12 months.

Retail InvestorsBecome a retail investor by investing between SGD 3,000 and SGD 20,000 |

Silver InvestorEarn a 1% higher projected returns by investing between SGD 20,000 and SGD 100,000 |

Gold InvestorsEarn higher returns on your investment by investing between SGD 100,000 and SGD 350,000 |

Platinum InvestorsGet exclusive returns on your investment by investing amounts greater than SGD 350,000 |